Estate Tax: How Will My Assets Be Taxed When I Die?

Key Points – Estate Tax: How Will My Assets Be Taxed When I Die?:

- The IRS’s Definition

- Who Is Impacted?

- The Estate Tax Exemption for 2023

- What Will Happen with Estate Tax When the Tax Cuts and Jobs Act Sunsets in 2026?

- 4 Minutes to Read

How Do You Incur an Estate Tax?

During our newly-released podcast, Family Financial Planning, Matt Kasper, CFP® and Dean Barber highlighted how the four main components of financial planning work together in many different ways. Those main components are risk management, taxes, estate planning, and investments. They explained why it’s important for you and your loved ones to know how those components are intertwined.

About halfway through the podcast, Matt and Dean briefly touched on was something called an estate tax. The IRS defines estate tax as a tax on your right to transfer property at your death. It applies when the estate’s value is more than a set estate tax exclusion limit that is determined by the government. Should the estate’s value exceed the exclusion limit, the difference of the estate’s value and the threshold is subject to be taxed. Make sure to note that the estate tax correlates with the estate’s fair market value, not what the deceased first paid for their assets.

The Estate Tax Exemption for 2023

Everyone has an estate tax exemption, which is also known as a unified credit. It’s the amount of money that you can pass to the next generation—while you’re alive or after you’ve passed—without having to incur an estate tax or gift tax.

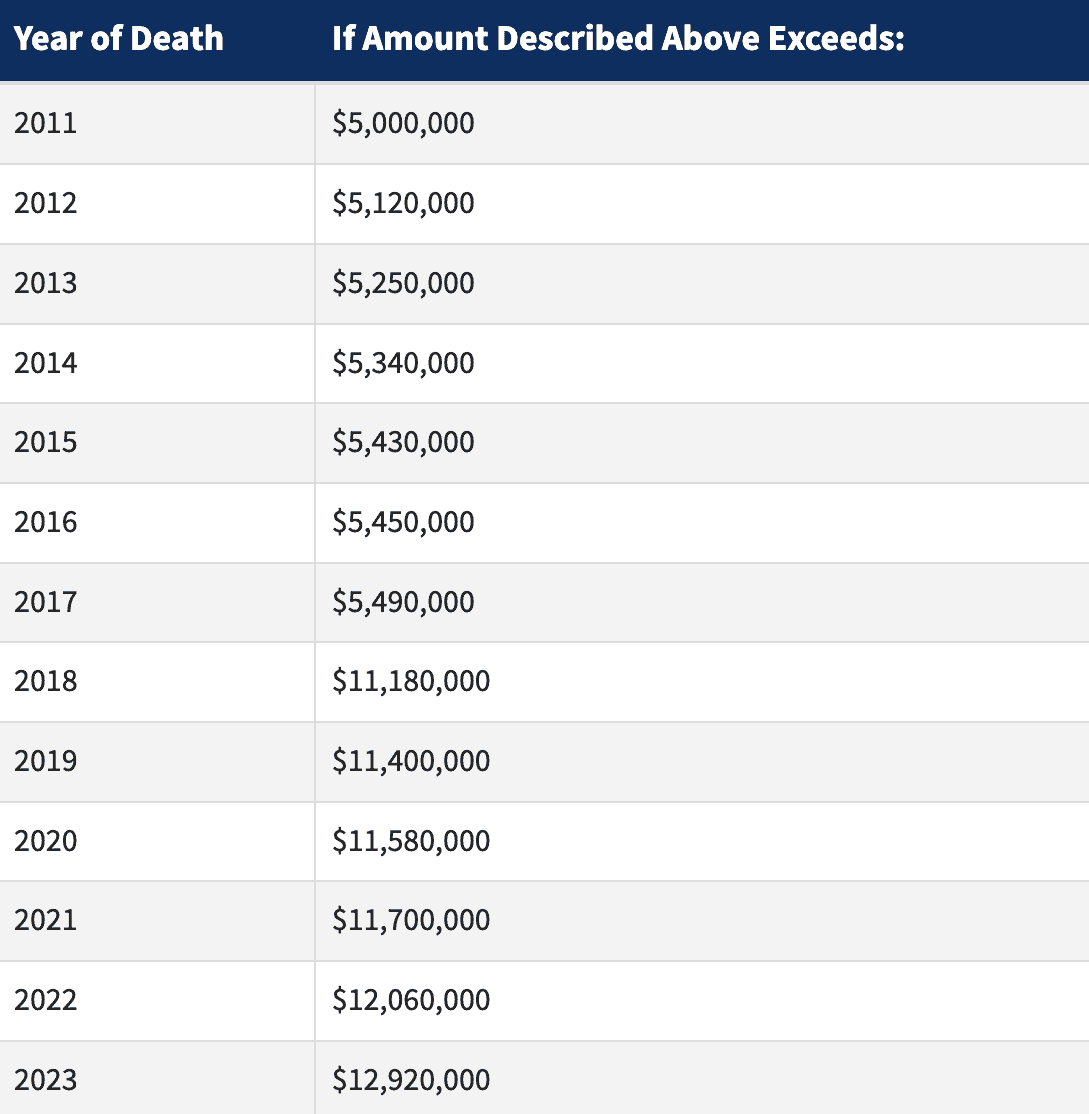

That unified credit can be used up while you’re alive or after you’ve passed. For 2023, that exclusion limit is $12.92 million ($25.84 million if you’re married). That’s up from about $12.06 million in 2022. Here’s a look at how much the estate tax filing threshold has increased since 2011.

FIGURE 1 – Filing Threshold for Year of Death – IRS

Projecting Future Exemption Levels

You probably noticed that there was a sharp increase in the exemption level in 2018. Why was that? Well, that was right after the Tax Cuts and Jobs Act went into effect. We’ve been trying to make people aware that the Tax Cuts and Jobs Act will be sunsetting in 2026 and how that will impact people in a big way. As Dean and Matt explained in the Family Financial Planning podcast, one of the things that will happen when the Tax Cuts and Jobs Act sunsets is that the exemption will be cut in half.

What Is the Tax Rate of an Estate Tax?

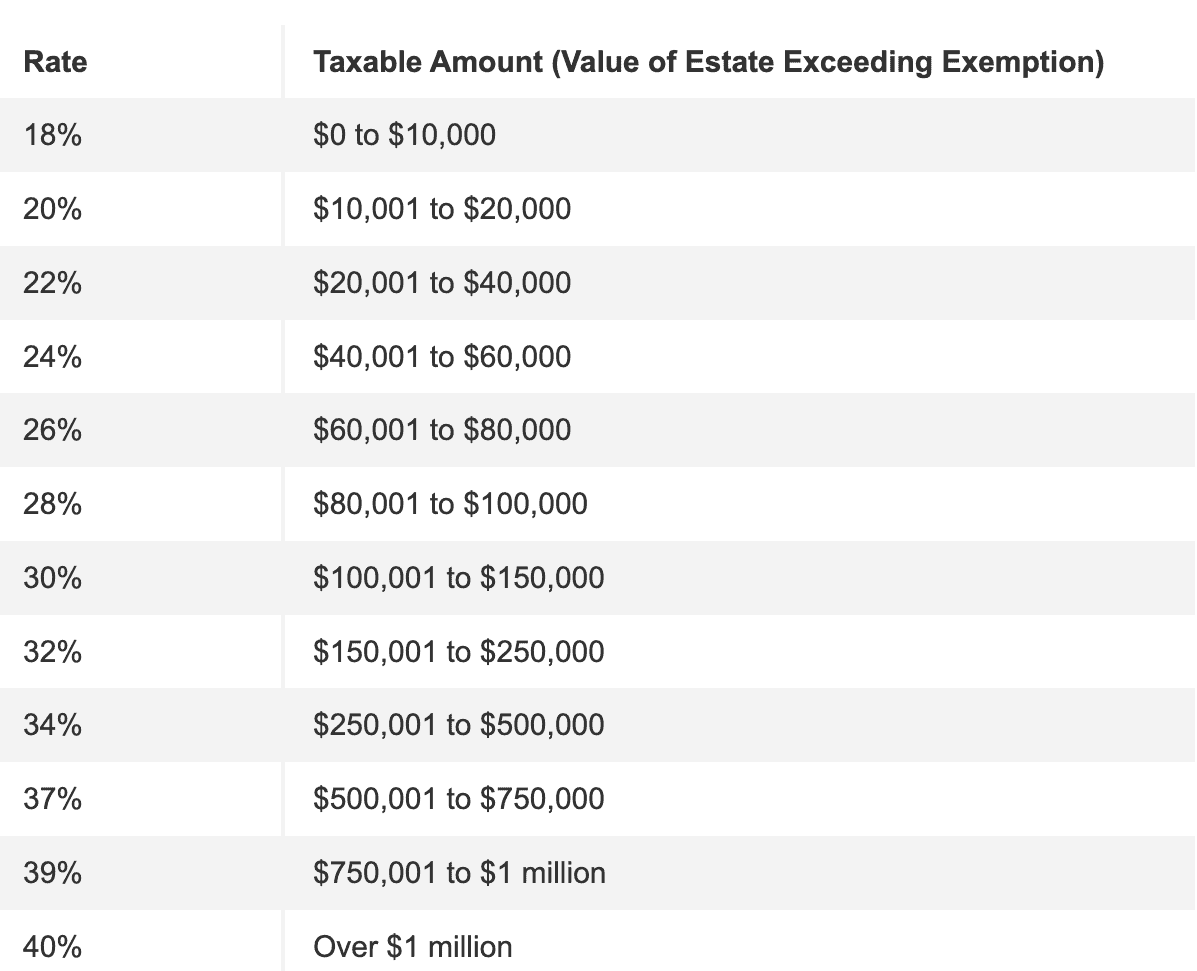

While there aren’t very many people who have an estate of $12.92 million (or even half that), those that do need to be aware of the estate tax rates. Most people that have trusts that are going to go on beyond their life may not realize the high taxation that happens to their wealth at that stage. You can see below that the majority of the estate is taxed at 40%.

FIGURE 2 – Estate Tax Rate – Kiplinger

If you know that you are subject to estate tax or think you will be in the future, check out Form 706 on your tax return.

The Unlimited Marital Deduction

Fortunately, the IRS is showing some grace when it comes to estate tax and surviving spouses. Thanks to the unlimited marital deduction, any estate tax that is inherited by surviving spouses is nullified. But that’s as far as the IRS’s grace goes. Because when the surviving spouse passes away, the next beneficiaries can be subject to estate tax if the estate’s value is more than the exclusion limit.

That’s a pretty cut and dry stance from the IRS, but it can get hairy if you’re not careful. Let’s say that someone got divorced and remarried, but they forgot to update their beneficiaries. Your ex-spouse inherits your estate and reaps the rewards of the unlimited marital deduction. Meanwhile, your widow is left with nothing.

A Benefit of Roth IRAs

Next, let’s look at estate taxes and how they can be avoided with Roth IRAs. If you have a Roth IRA, you can sidestep them by naming heirs as a beneficiary under the Roth IRA instead of passing it through your will. By doing this, the beneficiary can take over the Roth IRA account instead of inheriting—therefore eluding estate taxes. We could go on and on about the benefits of the Roth for you and your beneficiaries. The point we want to make here is how important it is to properly title your estate and beneficiary designations.

Most People Won’t Have to Worry About Estate Tax, But It Never Hurts to Be Educated About It

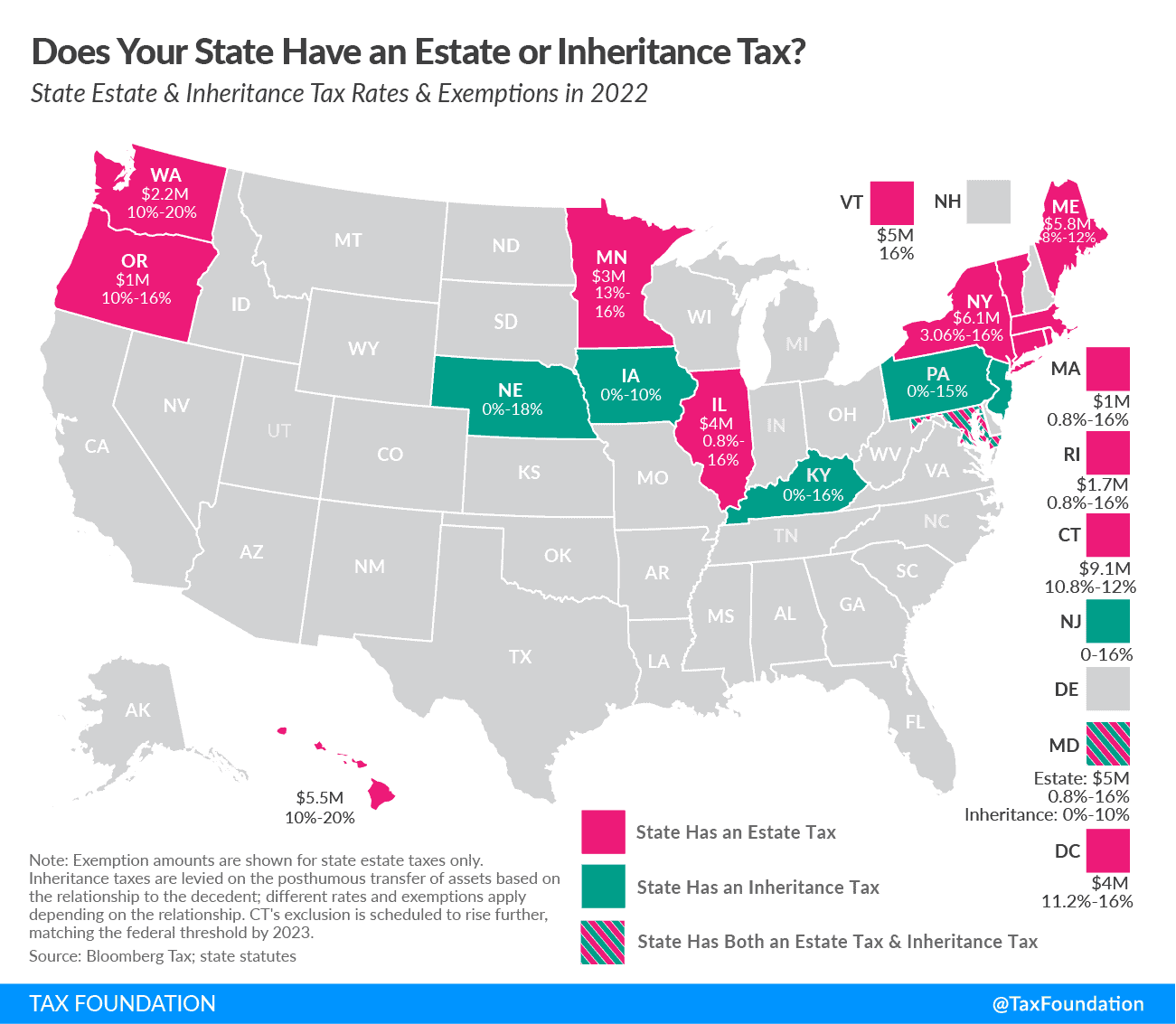

Currently, most of you won’t need to worry about estate tax, as it’s only imposed in 12 states. Still, even if you don’t live in one of those states, this is good information to be aware of.

FIGURE 3 – Does Your State Have an Estate or Inheritance Tax? – Tax Foundation

How to Avoid Estate Tax

At Modern Wealth Management, we spend a lot of time trying to help people pay as little tax as possible. That’s not only for one year, but over your lifetime. So, how does one go about avoiding estate tax? We’re glad you asked.

Estate taxes are enforced following the estate owner’s death. Therefore, the best way to avoid them is by gifting your assets while you’re still living. A federal gift tax is still enforced on assets that are gifted within certain limits while you’re still alive, but there is a sizable annual exclusion of $17,000 for 2023. And that’s $17,000 per person, too. That’s up from $16,000 in 2022.

If you still wanted to gift more than $17,000 in 2023, the excess would just come off the $12.92 million (single)/$25.84 million (married) exemption. That excess amount will just need to be reported on a Form 709 gift tax return. And just remember that exemption is going to be cut in half in 2026.

Do You Have Questions?

Even though many of you won’t be subject to estate tax, hopefully this article has helped you and your loved ones realize how to avoid it or at least prepare for it. The first step to avoiding it is to have a financial plan that gives you clarity and confidence about your financial life. To see the bigger picture of your retirement, legacy planning, and much more, begin building your plan by clicking the “Start Planning” button below. It’s the same tool that our CFP® Professionals use with our clients, and you can use it at no cost or obligation.

Anything involving tax can be complicated, so it’s always best to consult financial professionals if you’re the least bit unsure about something. You can schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals and ask about legacy planning or other financial matters on your mind. We can meet with you in person, virtually, or by phone—whatever works best for you.

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.