4 Retirement Risks That Are Out of Your Control

Key Points – 4 Retirement Risks That Are Out of Your Control

- Controlling What You Can Control

- The Biggest Retirement Risk Is Outliving Your Money, But It’s a Controllable Retirement Risk

- The Role Fear and Greed Can Play in Your Retirement

- What Can We Expect Next from the Fed?

- 20 Minutes to Read | 38 Minutes to Listen

A huge factor of financial planning is controlling what you can control. It’s pivotal to understand that as you’re determining if you have enough money to get to and through retirement. The fear of outliving your money is a retirement risk that’s big concern for a lot of people. However, with a financial plan, it’s a controllable retirement risk. In this episode of America’s Wealth Management Show, Dean Barber and Bud Kasper discuss four retirement risks that you can plan for but are out of your control.

Show Resources:

Find links to the resources Dean and Bud mentioned on this episode below.

- Schedule: 20-Minute “Ask Anything” Session

- Download: Retirement Plan Checklist

- Education Center: Articles, Videos, Podcasts, and More

The No. 1 Concern When It Comes to Retirement

Dean Barber: Thanks so much to those who join us on America’s Wealth Management Show. I’m your host, Dean Barber, along with Bud Kasper. Bud had a much-needed vacation last week. Welcome back.

Bud Kasper: Thanks. It felt good.

Dean Barber: What we’re going to talk about today is what I think is the number one thing that is on people’s minds as they go into their 50s, 60s, and even early 70s. People ask themselves, “Am I going to be OK? Do I have enough money to do all the things that I want to do without being fearful of running out of money?”

Bud and I have done a ton of research and there’s been a lot of research done throughout the industry. People can be petrified of outliving their money. One of the things that Bud and I have dedicated our careers to working with people who are nearing retirement or who are already retired. We’re focused on that because the rules drastically change from all sorts of different perspectives, including planning, investing, taxes, and risk management. All those rules that you follow during the accumulation phase change as you near retirement and begin retirement.

Your Investments Are Just One Component of Your Financial Plan

Bud Kasper: Absolutely. I think the problem is semantics because there are so many people who think their investment plan is their financial plan. That’s so wrong. For example, I recently met with a couple who just became our clients about three weeks ago. We sat down and talked about planning. They said that they had never gone through anything like that before. That’s why you work with a CFP® Professional is to get to the finish line in a manner that is agreeable to you.

When I looked at their investments, which is just one aspect of the plan, no adjustments had been made. They were down approximately 19.5%. I asked them why they were exposed in that way, and they said it was the way it worked out in their plan. I told them that was just the investments part of the plan and that they needed to have a course correction. If they don’t go in and protect those assets more than what we’re currently doing, it may cause a bigger issue in the overarching plan.

Dean Barber: That’s interesting. Your investments are something that you have control over. However, there are also retirement risks that are out of your control. Your investments coincide with market volatility, which is one of those uncontrollable retirement risks. We’re going to go over market volatility and three other big retirement risks that are out of your control, but also want to highlight several things that are in your control as well to attain financial independence or retirement. You don’t have to be fearful of the retirement risk of outliving your money.

1. Retirement Risks That Are Out of Your Control – Market Volatility

Along with market volatility, a few other big retirement risks that are out of our control include interest rates, inflation, and tax rate hikes. We’ll review those other three shortly, but I want to begin with market volatility.

One of our CERTIFIED FINANCIAL PLANNER™ Professionals and I met with a couple in December, and they wanted to know if they could retire in 2022. We went through the whole process, built their plan, and looked at the tax perspectives, investments, and everything else. We discovered from an asset allocation standpoint that 90% of this couple’s savings was in their 401(k) plans. And 100% of the money that was in the 401(k) plan was in the S&P 500 index fund.

Asset Allocation Can Make a Huge Difference

We took a step back to explain to them why that asset allocation wasn’t in their best interest. One of the things that our financial planning tool can do is to show the probability of success with that asset allocation compared to other asset allocations. They could take 30% of the money they had in the S&P 500 and keep it there. But with the balance of that, we put it in the fixed income portion of their 401(k) because we didn’t know what would happen with interest rates. Again, interest rates are one of those uncontrollable retirement risks that we’ll discuss more momentarily.

When we met with them again this last week, they were so glad that we showed them that we didn’t have to take on that much risk. They would have been down so much more money and said they probably would feel uncomfortable with their ability to retire.

Taking the Least Amount of Risk to Accomplish Your Long-Term Objectives

While you can’t control market volatility, you can control taking the least amount of risk in your investments and still accomplish all your long-term objectives. That’s a unique way to think about it as opposed to, “What’s my risk tolerance?” I think that’s a crazy way to look at it.

In this case, 30% equity exposure gave them a better probability of success than 100% equity exposure. Why? Is it because it’s going to outperform over the long term? Absolutely not. It’s because it’s going to prevent massive drawdowns. When you’re retired, you need to start asking that money to work for you. You need to take systematic withdrawals from it to get your income into your checking account to go spend. There are answers to all the things that we do. And those answers are always found in the process of financial planning.

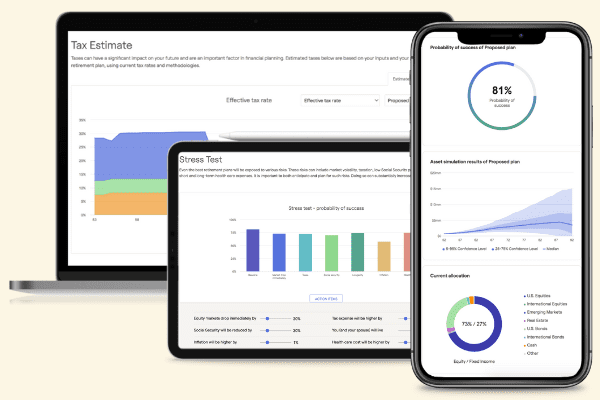

As I mentioned earlier, we use a financial planning tool to put together financial plans and to determine their probability of success. Well, we’re now providing people the opportunity to utilize that tool free of charge from the comfort of your own home. That way you can find out where you’re at in your progress toward financial success. Can you reduce some of the retirement risk in your portfolio so that you can sleep better at night, still know that you’re going to accomplish your long-term objectives, and not going to outlive your money? Again, the fear of outliving your money is typically people’s No. 1 concern when it comes to retirement risks.

Another Reason Why Fear Can Be One of Your Biggest Emotions When It Comes to Your Investments

Oftentimes, people are very fearful of future unknowns. People can be fearful of the fact that their ability to earn a paycheck is gone and they’re relying on the investments that they have to support their lifestyle. They don’t have the clarity that they need to know what a safe amount to spend might be, so they end up doing something just as bad as outliving their money. And that is, dying with a mattress stuffed full of money that you could have enjoyed.

Bud Kasper: That’s true. There’s nothing that is worse from a retiree’s point of view than to start questioning whether they have taken too much money out or that they’re not going to have enough to live. Talk about high anxiety.

You Don’t Know What You Don’t Know

Dean Barber: The anxiety comes from uncertainty.

Bud Kasper: It does. How do we calm that? Through a financial plan, with a CFP® Professional.

Dean Barber: Yeah. You need to have that financial plan. There is a huge need for people to get that clarity so that they can get rid of that anxiety and not worry about running out of money.

Bud Kasper: One of your favorite statements is, “You don’t know what you don’t know.”

Dean Barber: Yeah. That’s right.

Bud Kasper: Yeah. And trust me, you don’t know. And I don’t mean that to be derogatory or mean. I’m just saying that I have never met with a prospective client for the first time who has had everything buttoned down with their financial plan.

Dean Barber: I’ve had that happen a couple of times in the last 35 years, but it’s very rare. For the people who have, it’s like, “Congratulations, you’ve done it.”

Bud Kasper: Right. Exactly.

2. Retirement Risks That Are Out of Your Control – Inflation

Dean Barber: Moving on to another retirement risk that’s out of your control and is also very pertinent, let’s talk about inflation. Inflation is all over the news right now. The latest number was 9.1%. There’s speculation that inflation maybe starting to cool a little bit, but time is going to be the only thing that’s going to tell us what’s happening with inflation.

If you think about inflation talks a year ago, Jerome Powell was saying whatever inflation we would have would be transitory. He said it wouldn’t be here long term and that it wouldn’t be a big deal. They weren’t planning on raising interest rates.

Suddenly, they couldn’t raise rates fast enough. And it’s wreaking havoc on people’s monthly expenses. Inflation is causing people, especially people who don’t have a plan and don’t have the clarity, to begin cutting back on some of the things that we would consider to be discretionary spending items.

How Inflation Can Make You Fearful While Trying to Live Your One Best Financial Life

I can give a perfect example of that that recently occurred with a client of mine. She was widowed a few years back and has two adult children. She brought them in with her to visit with me late last year while we were updating her plan. Everything was in good shape.

Once my client heard that, she said, “Dean, I want do something for my family. I would love to take my entire family on a vacation.” So, I asked her what kind of vacation she had in mind and she wanted to take them to Colorado over the holidays to go skiing. She wasn’t planning on skiing herself, but wanted to find a place big enough to rent for her, her kids, and her grandkids to stay. After hearing that, it was time to do some research to see what it was going to cost.

She came back a few days later and told me that she thought it was going to be about $30,000 for it to be the full experience she wanted everyone to have. I plugged that into her plan and it didn’t move the needle. I said, “You’re fine. Go do it.”

Well, she called me two months ago and was nervous because of how much more expensive things had gotten. She mentioned how uncooperative the markets have been and that even bonds were down a little bit. And she asked me if she was still okay to take the trip or cancel it and just lose her deposit. So, I updated her plan and the needle still didn’t move. I told her to take the trip. She said, “Really? Oh my gosh. Thank you so much. This is a really big deal to us.”

The Clarity that Can Come from a Financial Plan

Had she not had that clarity from her financial plan, her anxiety about the uncertainty of what’s happening in the economy and markets and everything that’s going on with interest rates, inflation, and all those things may have caused her to cancel that trip. We only have one life. One of the things that I believe that financial planning does is give you the clarity to live that one life that you have to the fullest without the number one retirement risk—the fear of running out of money—coming into play.

That Clarity Can Deliver Good or Bad News, but It’s Still Critical

Bud Kasper: I agree, but I want to talk about the other side of this as well. There can be times where the needle that Dean is talking about will go into the negative and give you bad news.

Dean Barber: Absolutely. But you’re still receiving clarity in a different sense that you need to make adjustments to get back to where you want to be.

Bud Kasper: Well, that’s my point. Not everything works out the way we want it to. But you need to have an independent resource to utilize and find out whether it will work out. And that was the point of where the needle is.

Dean Barber: Sometimes it’s a matter of trade-offs.

Bud Kasper: Yes, it is.

Dean Barber: So, if we go ahead and do something, is it more important than getting a new vehicle in two years? Which one is more important to you?

Bud Kasper: And the coordination of those events with money events, such as Social Security. There are so many moving parts associated with this that you need to recognize, identify, and define so that you know how to maximize the result that we’ve been talking about. And that result we want to maximize is to have all the money you need for the rest of your life.

Inflation Is Insidious

Dean Barber: And inflation is one of those things that is insidious. We call it the silent killer. Typically, inflation won’t cause a person to go broke. It won’t cause a person to outlive their money. But inflation will cause them to live like they’re broke. It will cause them to forego things or cut back in certain areas where they may not need to.

Accounting for Inflation in Your Financial Plan

As a perfect example, we know that health care costs have been rising at a much more rapid pace than normal inflation. So, go over the last two to three decades where inflation has been running in the 2% to 2.5% range. We’ve always said that we’re not going to build a plan with that 2% to 2.5% inflation, though, because we don’t think that’s sustainable.

Let’s put a 4% to 4.25% inflation in there. Let’s inflate health care at 6.5%. If your plan can survive that type of inflation, we know that if we have a year or two like what we’re experiencing right now that we average it out over time. Even though inflation is a retirement risk that you can’t control, you can still say, “If we do average that high of inflation over a long period, I’m going to be OK.”

Bud Kasper: Yeah. As a CFP® Professional, I’d rather put more pressure on the plan than it probably will have.

Dean Barber: By having a higher inflation rate.

Things Like Health Care Are Going to Have a Higher Inflation Right Than Other Aspects of Your Plan

Bud Kasper: That’s right. And things inflate differently. Health care is part of the consideration. We inflate that at almost 3%, 3.25% more than what we have as the overall inflation rate. These things need to be accounted for. Rarely do I ever meet up with a couple for the first time that already has a plan, but if they do, the first thing we look at is their assumptions on inflation.

Dean Barber: Right. And we’ve seen people accounting for 1.5% to 2.5% inflation over the last several years.

Bud Kasper: Which is ridiculous.

Dean Barber: It’s crazy.

Bud Kasper: Yeah. There’s no plan around that number.

Dean Barber: It gives a false sense of security.

Bud Kasper: It does. And then you need to ask why was that even brought into play? There was probably a motivating factor on the side of the person who might be a salesman instead of a planner.

Dean Barber: That’s rampant in our industry, for sure. But here’s the thing, everybody can gain the clarity that they need to roll into retirement without the fear of running out of money. You do that by building a financial plan.

Again, we’re giving everyone the ability to utilize the same financial planning tool that we use for our own clients, right from the comfort of your own home. If you get in there, get stuck, and don’t understand the terms or how something fits, that’s fine. It’s fine because you can reach out to us and we’ll set up a meeting with you and one of our CFP® Professionals and we’ll walk you through the ins and outs. We’ll make sure that you get the data into our financial planning tool so that you get accurate answers. Get that clarity that you want.

The Art of Financial Planning

There’s an art to this. It’s not just the financial planning tool itself because there’s an art that a good CERTIFIED FINANCIAL PLANNER™ Professional can put around your personal financial situation. That art is what gives you the clarity that you need. Sometimes you can do even more than what you thought you could. And sometimes you’re going to have to have some trade-offs. It’s good to know that those things are out there.

We also have clarity when we’re working. We know how much we make, how much is going into our 401(k), how much is being deducted for health care costs and all the other things that come out of our paycheck. And we know what our net paycheck is every other week in most cases. Or sometimes it’s once a month or weekly, but we know what that net paycheck is. So, we can make a plan.

It’s easy while you’re working because you have clarity of exactly what that cash flow is. You can know what kind of raises you can count on and those types of things. Well, when you head into retirement, that consistent paycheck that you’re so used to goes away. That’s where a lot of the anxiety comes from, which is caused by the uncertainty, which is caused by the lack of a plan.

Going Back to the Question of the Day: Do I Have Enough?

Bud Kasper: Yeah. And that brings up the question we hear all the time. Do I have enough? But let’s even dive in a little bit deeper than that. The question for retirees right now is, “How much money do you have set aside that is not in any form of risk that will support the income that you’re going to need? And that’s not for just the next six months, but for the next year, two to three years, whatever the case may be. You might say, “Well, how much do you need to set aside?” My reply would be, “It depends.”

Dean Barber: It depends on the plan.

Bud Kasper: Yeah. That’s why it needs to be individualized. It’s not one size fits all. When you’re going through the difficulties that we’re having with today’s market, we also know that there is a sunshine at the end of the road. We can calculate what we need to do to regrow that money in time while we’re still supplying the income need in the process of occasional market volatility.

3. Retirement Risks That Are Out of Your Control – Interest Rates

Dean Barber: I think it’s more critical than ever that you take that approach because of the rapidly rising interest rates. Interest rates and what the Fed decides to do with them is No. 3 on our list of retirement risks that are out of your control.

The interest rates on CDs, 10-year treasury, or whatever instrument it is are out of your control. But those things can have a dramatic impact. When we get into times of uncertainty like this, the last thing that you want to be forced to do while you’re in retirement is to sell or liquidate an asset that is depressed in value in order to give you the income that you need for that month, six months, year, two years, etc.

It’s always a great idea to have a buffer of somewhere between 18 and 24 months of needed income that’s set aside for times like this. Some people might want to go as far as 30 to 36 months of needed income or needed distribution from your underlying investments.

You have other parts of your portfolio where you’re still trying to do more of a moderate or longer-term growth investment strategy. In years where you get some outperformance in bucket two and bucket three, you can scrape those winnings off and put it back into bucket one until you get to a point where you’re comfortable.

Those Winnings from 2020 and 2021 Could Be Very Useful Right Now If You Set Some of Them Aside

Let’s just take 2020 and 2021 for an example. We had some amazing years. So, let’s scrape off some of those winnings. We could generate three years of income in a single year when we get returns like we had in 2021. Take the winnings, don’t get greedy, and set them aside. That way you could get to have that longer-term approach again.

Look at what’s happening right now with Jerome Powell and the Federal Reserve raising rates as rapidly as they are. It’s causing havoc in the bond market and stock market. If you set aside gains from 2021, maybe you don’t have to worry about that. And remember, markets have cycles.

We said this earlier, but the rules change when you get near retirement or in retirement. You don’t want to allow the market volatility that we talked about earlier, which has been caused by the rising interest rates, to cause you to have to sell things at discounted prices to fund your retirement.

Bud Kasper: Yeah. I agree. De-risking portfolios at certain times of market cycles also makes a heck of a lot of sense. We’ve been experiencing that since the first of the year.

Dean Barber: It’s not a set-it-and-forget-it scenario.

What Can We Expect Next from the Fed?

Bud Kasper: Exactly. Also, remember that the Federal Open Market Committee is going to announce possible interest rate increases in the coming week. In any business, there’s a certain amount handicapping that goes on. They’re going to be asking exactly how much rates are going to increase.

I saw that there’s a 66% probability that we were going to see a 75 basis points increase. We also just had a 75 basis points increase last month. It caused a dislocation in the stock market as a reaction to the Federal Reserve raising rates again. The question we have now is whether that can of increase again is already baked into the market’s numbers? I think it is to a certain extent, but to the full extent, I’m not sure.

There is a smaller probability that it could be a 100 basis points increase. Then, we would have a different game. You’re going to get a different reaction out of the market if it’s a full 1% hike. However, remember what happens after that. August is a month off for the FOMC. They then meet in September, November, and December to round out the year.

I hope they do a 75 basis points hike next week to show that they’re committed to driving down inflation. Once we start to see those inflation numbers start to come down, opportunity is going to be born. And so again, we go into the plan and say, “If we start to see better numbers and a better market in front of us, how do we prepare for that?”

The Fed’s Main Goal Is to Slow Down Inflation

Dean Barber: There’s a great deal of uncertainty in today’s economic conditions. In the last 15 years, the stock market and the economy have been dependent on the Federal Reserve cushioning the blow from unwanted economic cycles.

It’s almost like a heroin addict. Every time you kind of start to come off that little buzz, you get another shot. And at this point, the Fed can’t do that because inflation is harming the average American far more than volatile stock markets and bond markets are harming the wealthy Americans. They have the responsibility of stopping inflation.

The Fed is not here now to stop a market cycle from declining or stop a recession. And we could already be in a recession. We don’t know the answer to that yet, but that’s not the Fed’s chief concern at this point. The Fed’s chief concern is stopping inflation in its tracks. So, they’ll get very aggressive. That illustrates how interest rates are a retirement risk that is out of your control.

But you know what? You can stress test your plan through a period of rising interest rates. We do it all the time for our clients. It’s another thing that you can do with our financial planning tool.

4. Retirement Risks That Are Out of Your Control – Tax Rate Hikes

Bud Kasper: As we wrap up discussing retirement risks that are out of your control, let’s talk about tax rate hikes. We have something that’s coming up in 2025 that people need to know about. At the end of 2025, the Trump tax proposal or plan ends. What’s going to happen at that time is going to be critical. And of course, that’s going to have a bearing on the presidential election coming up in two and a half years as well.

Dean Barber: All the tax cuts that came out of the Tax Cuts and Jobs Act will sunset, so we’ll go back to the same tax code that we had prior to that.

Bud Kasper: Which will raise rates.

Taxes Are at the Heart of the Financial Plan

Dean Barber: It’ll raise rates, and it’s fairly significant. If you’re doing proper financial planning, taxes are at the heart of a financial plan. There’s almost no financial decision that an individual or a couple makes that won’t, at some point, come back to the tax return.

If you don’t understand that different types of income during retirement are taxed at different rates and they don’t play well together, you can pull money out of the wrong account and it can cause unwanted tax consequences. And it’s not like the IRS is going to go, “Oh, you didn’t mean to take it out of that account. Sorry, go ahead and put it back in. Then, we’ll let you take it out of another account.” That doesn’t happen. Once the genie is out of the bottle, it’s not going back in.

Bud Kasper: Right. So, wouldn’t you like to know now what your tax obligation would be after the Trump tax plan sunsets at the end of 2025 and starts in 2026? Well, we can do that.

Looking at Your Taxes Before and After the Tax Cuts and Jobs Act Sunsets

Dean Barber: Yeah. That’s all part of the financial planning tool that we use. There is an amazing tax module on it. It will fill out your tax return for you, but this is not a tax return you file. It’s just to use for a financial planning perspective. You need to understand what taxes are going to do. You can pull up your 2026 tax return based on the information that you put into the plan and what your current strategy is. It’ll show you the difference between what you would pay in 2025 in taxes versus 2026 in taxes.

The financial planning tool will calculate your Required Minimum Distributions and do all those amazing things to give you clarity. A lot of people don’t understand that the effect of taxes in retirement is out of your control. If you are a married filing jointly taxpayer and then your spouse passes away, suddenly you’re a single filer. And guess what? On the same income, your taxes are enormously higher than if you were married.

Bud Kasper: It’s terrible. You’re so right there. As I was initiating this, I asked myself, “What are smart people doing?” Smart people are looking to 2026 and wanting to know what taxes are going to be versus what they’re paying in 2025. But for what purpose?

Dean Barber: So you can plan.

Bud Kasper: That’s exactly right. We can go into your plan mitigate as much of Uncle Sam out of your life as possible leading up to January 1, 2026. That is planning. That is the beauty of working with a firm and professionals who focus on the plan as a major part of the relationship that they have.

CFP® Professionals and CPAs Working Together

Dean Barber: Not only that but having CPAs in house that can work alongside our CERTIFIED FINANCIAL PLANNER™ Professionals and our clients so that everyone is on the same page. That way everyone is looking at the same objectives.

A good CERTIFIED FINANCIAL PLANNER™ Professional always takes taxes into consideration, but they’re not CPAs. It’s a great addition to have a CPA who looks at that financial plan purely from a tax perspective. They’ll see things and bring things to light that the CFP® Professional may miss and the client may miss it 99% of the time.

Tax Rates Are Subject to Change at Any Time

As long as you live in the United States and either have money or make money, taxes are going to be a factor of your life. If you understand that and the tax code, what you start doing is putting together a longer-term forward-looking plan. You need to remember that tax rates are subject to change at any time.

And it could be that there’s a change in the tax code prior to 2025. But we know that at the end of 2025, we’re going to have a change. We should be making plans right now to mitigate the effects of that increase in taxes that we know is coming in 2026.

Voting Is Something That Is in Your Control

Bud Kasper: And the only thing that’s going to change any of that is voting. Figure out where your best interests are going to lie because in the future.

Dean Barber: Right. And of course, your votes are what’s going to shape the representation that we have in the Senate and in the House. From a personal perspective, people should be putting together a rock-solid distribution strategy. With what we know of taxes today, put that distribution strategy together so that you know that the accounts that you’re pulling from are giving you the most income with the least amount of taxes. And that’s not just a distribution strategy over one year, but over a lifetime and based on current tax code.

Your Distribution Strategy Matters

If the tax code changes, we then go back and we adjust that distribution strategy, attempting to do the exact same thing, which is to give you the income that you need into your checking account to go live the life that you want to live with clarity with the least amount of taxes possible.

And that can be done. It’s all done. We do it all the time. But you need to have the professional financial planning tool to begin that process. It’s not the end all be all because you still need to have the CPA come in and put the finishing touches on it. But you can start building that plan out to understand the longer-term impacts of a tax plan.

Again, you can use our financial planning tool from the comfort of your own home with no cost or obligations. Just click the “Start Planning” button below.

As I said before, if you have trouble, aren’t sure you’re entering the right data, or not sure what it means, you can schedule a 20-minute “ask anything” session or a complimentary consultation with one of our CERTIFIED FINANCIAL PLANNER™ Professionals. We can meet with you in person or set up a virtual meeting or phone call with you to help you make sure that the data’s being put in correctly.

Don’t Forget About Tax-Free Income from Municipal Bonds

Bud Kasper: If the tax brackets do increase, one of the things that people need to start thinking about now is the value of tax-free income from municipal bonds. Do you think that asset might go up in value?

Dean Barber: It could with higher tax rates, for sure. Well, Bud and I hope you’ve enjoyed us talking about retirement risks that are and aren’t in your control and how you can get certainty and get clarity so that you don’t have to live in fear of running out of money.

We appreciate you joining us here on America’s Wealth Management Show. I’m Dean Barber, along with Bud Kasper. Everybody stay healthy, stay safe. We’ll be back with you next week. Same time, same place.

Schedule Complimentary Consultation

Click below and select the office you would like to meet with. Then it’s just two simple steps to schedule your complimentary consultation. We can meet in-person, by virtual meeting, or by phone.

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.