4 Things We Learned in 2022

Key Points – 4 Things We Learned in 2022

- Happy New Year!

- Inflation was the Story of they Year

- The Bond Market Did Some Weird Stuff

- The Fed Should Have Started Raising Rates in 2021

- The Yield Curve Is Signaling Recession

- 7 Minutes to Read | 34 Minutes to Watch

4 Things We Learned in 2022

Happy New Year, everybody! We’re going to take a step back and reflect a little bit because we need to learn from history. In this case, we’re calling 2022 history! 2022, was a year with insane inflation, bumbling bonds, a fumbling fed, and some simmering signals. So, sayonara 2022, get in the rearview mirror!

While we learned a lot more than just these four items in 2022, we wanted to focus in on these specifically, as they were the biggest impacts in 2022. Here are four of the things we learned in 2022.

- Inflation was the story of the year

- The Bond market did some weird stuff

- The Fed should have started raising rates in 2021

- The Yield Curve is signaling a recession

1. Inflation Was the Story of the Year

2021 was an amazing year, by all standards. But what 2021 ushered in for 2022 was inflation that we haven’t seen in this country over 40 years.

It has devastated many parts of the economy. The housing market is in a recession. Many who recently purchased homes with minimal amounts down have home values less than their mortgage. That’s a terrifying thing.

Going back to January 1, 2022, with how the excellent year that 2021 was, Dean and Bud made it a point to say at the beginning of 2022, that it was time to rebalance your portfolio.

Little did we know that inflation was not transitory, as Powell told us it was in mid 2021. He saw inflation as short-term, and that is obviously not the case with persistent inflation throughout 2022. With inflation running hot, the Fed eventually began raising rates putting pressure on the stock, but the timing wreaked havoc on the bond market as well. The bond market did some things in 2022 that we have not seen.

When the Fed really started raising rates, and it was apparent that the inflation was not transitory, there was evidence that the traditional Bond was not going to fare very well.

2. The Bond Market Did Some Weird Stuff

If you have bonds in your portfolio, you need to have a conversation with your CFP® professional about the construction of those bonds and their outlook 2023 and in 2024.

Dean has always said, “Bonds are a stay rich investment.” Contrary to that is what we saw in 2022 because bonds became our nemesis.

Let’s break that down a little bit. When we entered 2022, in the corporate bond, if you went out and tried to buy a corporate bond that matured in seven or eight years, you would pay a premium for that bond. So, the bond might have been yielding 5%. But you might have had to pay 15% premium for that bond, because in January, interest rates were zero.

So, when you have a bond that is trading at a 15% premium, when that bond matures, it’s going to trade at par, which means you’re going to lose 15% of your investment over that period of time. Yes, you will have gotten the interest every single year, but you have to calculate something called the yield to maturity.

That’s where I think people need to focus today. “If I own bonds, what is my yield to maturity? What is my effective duration, on the bonds that I own? And what is my yield to worst?” Then you can start to have an informed conversation about what you own, why you own it, and what is the outlook for that particular investment in the next 12, 18, to 24 months.

“The bond market today is becoming more and more attractive. People need to be thinking about that as a strategy heading into 2023, especially with the fear of a recession on the horizon.” – Dean Barber

3. The Fed Should Have Started Raising Rates in 2021

The bond market has suffered because of what the Federal Reserve failed to do at the appropriate time, raising rates in 2021. It all came home to roost in 2022. However, now that could bear opportunity.

If you roll into 2023, without a good solid plan, you’re going to be running on a plan of hope. “I hope that we don’t have a recession. I hope that things recover and I hope that things go better.”

When we’re making plan for somebody, hope isn’t in the plan. When we have difficult times, like what we’ve had in 2022, the plan can actually save us. Because in the plan itself, you’re looking for ways to reduce taxes, you’re looking for ways to increase Social Security, you’re looking for ways to reduce volatility, and you’re looking for ways to improve your probability of success.

There are certain things that are within your control that you can focus on. Where if you don’t have the plan, you’re focusing on things that are totally out of your control. For example, what Jerome Powell and the Federal Reserve is doing or what the stock market is doing?

“The likelihood that there’s going to be recession in 2023 is very, very high. Does that mean that we go into another horrible year? No, even if the economy is in recession, when Jerome Powell says inflation is under control, the market is going to take off because the market is a leading indicator, not a lagging indicator.” – Dean Barber

A comprehensive financial plan can provide clarity, confidence and control as you roll into 2023.

Kick 2023 Off with a Plan!

Download our 2023 Retirement Planning Calendar

The Retirement Planning Calendar is here to help you through 2023 as you venture to and through retirement. This calendar will be updated regularly to include new dates, links, and more. Click below to download your copy today!

2023 Retirement Planning Calendar

4. The Inverted Yield Curve is Signaling a Recession

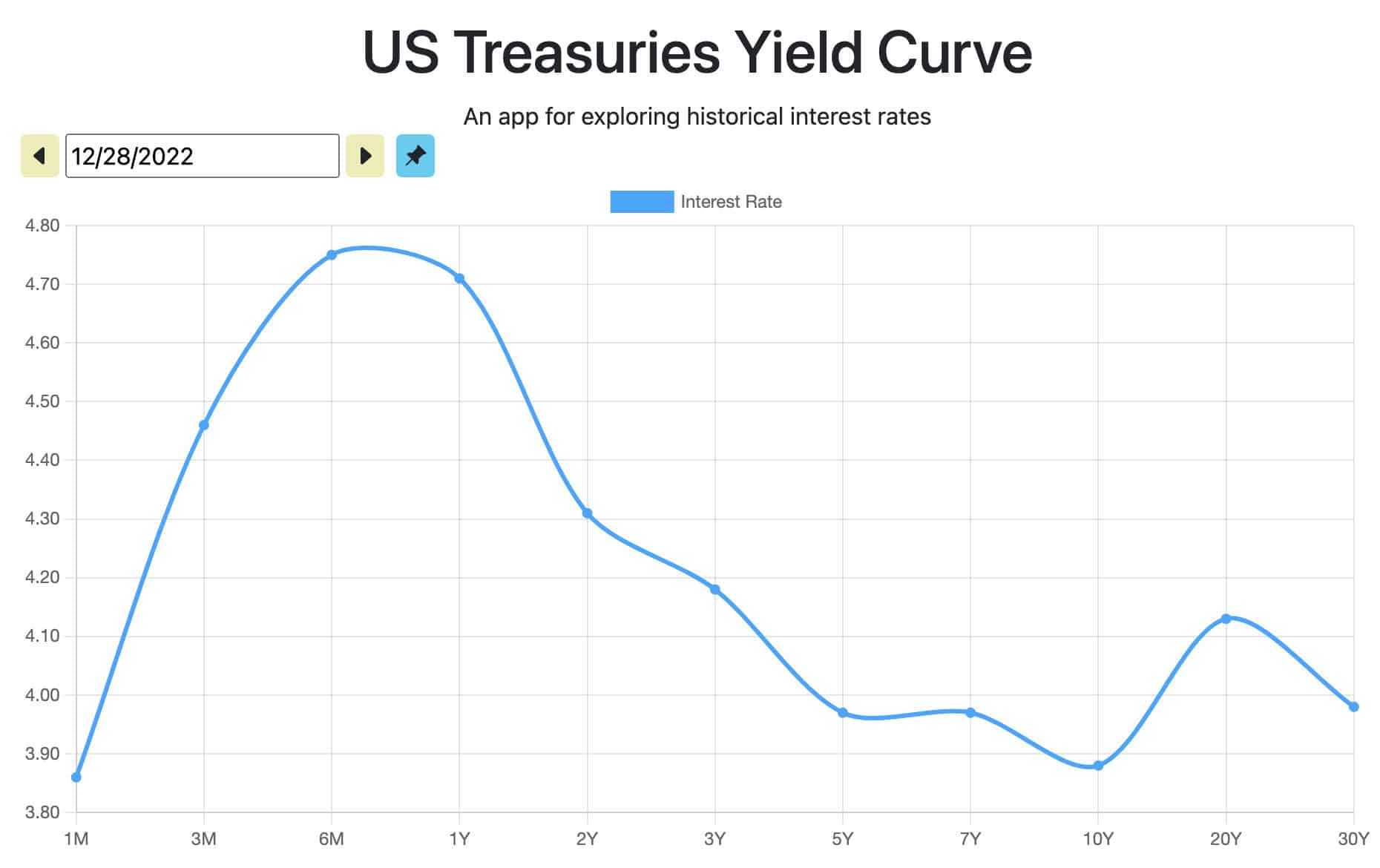

If you don’t know what the inverted yield curve is, it’s the anomaly when a short maturity bond is paying more than a longer maturity bonds. So, we always use in the example tens and twos. If on the 10-Year Treasury you’re getting paid less than you would versus the Two-Year treasury, that’s not normal.

But it’s gotten even worse than that, because the highest yielding treasury is now the Six-month Treasury yielding a full 1% higher yield than the 10-Year treasury.

The Inverted Yield Curve

FIGURE 1 – The U.S. Treasury Yield Curve – ustreasuryyieldcurve.com

If you look at the chart of a of the yield curve, Figure 1, it looks like you are at the top of a ski slope and you go off the thing, and you just kind of you could slide down and then and then the 30 years a little bit higher than the 10 year. So it’s like I was one of those ramps you see in the Olympics

Normally the yield curve is like climbing up a hill, and today it’s exactly the opposite. Every single time we’ve had a yield curve that’s been inverted, where the short yields are higher than the long yields, there has been a recession that follows within the next 12 to 18 months. The yield curve inverted in the second quarter of 2022.

You need to be asking yourself, “If we go into recession, how is it going to affect me personally? How is it going to affect my overall ability, do the things that I want to do? Can I continue to spend the way that I’m spending? If I’m nearing retirement, am I going to be able to hit my retirement goal and objective? How would a recession in 2023 impact my probability of success?”

If you don’t know the answers, then there’s a good possibility that you don’t have a proper financial plan. So, how does a recession in the next 12 to 18 months affect your ability to do what you want to do? What adjustments can we make in your personal situation to make it work?

Start the New Year Right

If you learned one thing in 2022, we hope it’s that you need a financial plan. If you don’t have a financial plan, start your new year right by building your plan on your own from the comfort of home. Our financial planning software is built for professionals, giving you access to robust financial planning tools for retirement. Click “Start Planning” below to get your plan started today. If you run into a snag, you can always schedule a conversation with a CFP® professional to help you through the process.

We wish you a happy, safe, and prosperous 2023.

4 Things We Learned in 2022 | Watch Guide

Disclosures and Introduction: 00:00

1. Inflation Was the Story of the Year: 01:21

2. The Bond Market Did Some Weird Stuff: 03:44

3. The Fed Should Have Started Raising Rates in 2021: 17:53

4. The Inverted Yield Curve Is Signaling Recession: 24:23

Conclusion: 32:15

Resources Mentioned in this Episode

Articles:

Other Episodes

Downloads:

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.