401(k) Planning for 2022

Key Points – 401(k) Planning for 2022

- Breaking Down 401(k) Planning for 2022 for Young Professionals, People in Their 40s, Those Nearing Retirement, and Retirees

- When Does It Work Best to Go with Traditional or Roth?

- Remembering to Update Your Beneficiaries

- The Art of Rebalancing and Stress-Testing

- 19 minutes to read | 40 minutes to listen

If your 401(k) isn’t already your largest asset, there’s a good chance that it could be very soon. It’s time to do some 401(k) planning for 2022, and Drew Jones and Dean Barber are here to help. They cover everything from a new employee choosing between a Roth and traditional 401(k) to decisions to make for people who are in their mid-working years, those approaching retirement, and retirees.

Schedule a Complimentary Consultation Subscribe on YouTube

401(k) Planning for 2022 for Young Professionals

If you’re not a young professional and think that the first section of this article won’t apply to you, think again. While you might no longer be a young professional who is choosing between starting a Roth or traditional 401(k), the following advice could be very helpful to your children, grandchildren, or other people you know who are in the early stages of their career.

What to Watch Out for If You Get Automatically Enrolled in a 401(k) Plan

It’s fairly common now among employers to automatically enroll their employees in a 401(k) plan. One of the first things to watch out for in this situation is that those plans are normally lifecycle funds that outlines your risk level based on the X-number of years you have until retirement.

“Ask yourself if that Is that the right thing for you,” Drew said. “Maybe you should look at some of the other funds or models that they have within the choices within the plan administrator. Know what kind of plan you’re in and determine if it’s the best thing for you.”

The Power of Compound Interest

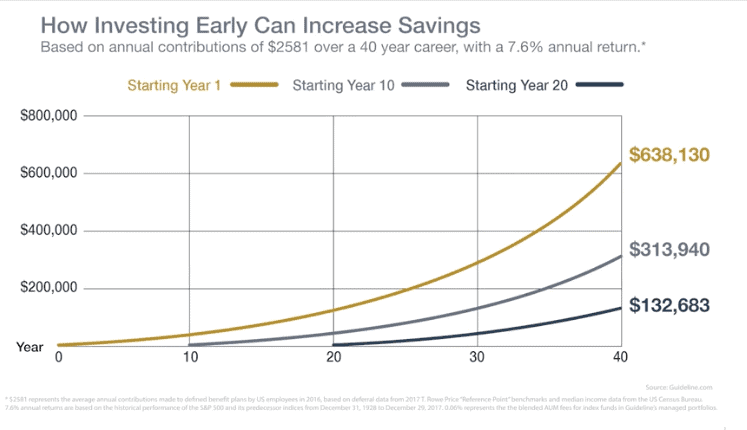

The next thing Drew wants young professionals to be aware of if they’re automatically being opted into a 401(k) plan is the power of compound interest. Here’s a great example of that below in Figure 1.

FIGURE 1 | How Investing Early Can Increase Savings

“In this example, we’re looking at somebody who is contributing a little over $200 a month. We’re considering a 40-year work span and looking at a 7.6% average rate of return,” Drew said. “If you start your 401(k) plan early in your career, you can see in Figure 1 how its value can grow to as opposed if you wait 10 years. When you’re starting that first job, you’re excited to maybe get a car and kind of do all those fun things. Waiting 10 years to invest in your 401(k) can really set you back on living out those dreams.”

Even if you don’t start your first job and 401(k) until 25 and are saving that average of a little over $200 a month (or $2,581 per year), you will have saved $638,000 after 40 years using that 7.6% rate of return.

However, let’s break it down if you decide to wait 10 years after starting you first job to start your 401(k). While you would’ve saved only $25,000 less, that compound interest over that next 40 years would result in $313,000 as opposed to $638,000.

“That power of compounding interest, especially in those early years, is huge,” Dean said. “Let’s say somebody waited until they were 40. They only got $132,000. The time is on your side when you’re young, so I encourage those people to get started with their 401(k).”

Lifecycle or Target Date Funds

Simply put, the lifecycle or target date funds we’re talking about here are funds inside of a fund. Whatever fund company that’s inside your 401(k) is a mixture of other funds that they own. Oftentimes those have an extra layer of fees on them that really aren’t necessary, so that’s why it’s critical to have a good understanding of how the different investment options work.

“If you’re young, starting your first job, and unfamiliar with how 401(k) funds work, chances are your parents, grandparents, or somebody else you know has a financial advisor that you can talk to,” Dean said. “You can ask them some basic questions that can give you some simple answers. You don’t need a deep dive at that time because you don’t have much money in the account.”

Traditional or Roth?

One of those simple questions for young professionals to be asking about 401(k)s is whether to do a traditional 401(k) or Roth 401(k). That is 401(k) Planning for 2022 101.

Traditional 401(k) contributions go in pretax, while the Roth contributions go in after tax. There’s a difference in how much the contributions will reduce your take home pay by, but the Roth IRA grows 100% tax free. It comes out at retirement 100% tax free as well, so that long-term benefit is important to keep in mind.

“In simple terms, let’s say you’ve retired and take a $1 distribution from that IRA. You’re not going to get every bit of that $1. You’re going to probably get 70 cents, maybe 75 cents of it,” Drew said. ‘However, if you get started early and you have a Roth IRA and take out $1, you’ll get every bit of that dollar to spend. That’s powerful.’

Think About the Tax Bracket

Another huge benefit for these young professionals is that they’ll never be in a lower tax bracket for the rest of their lives. So why not pay taxes on that money before putting it into a 401(k)? Get it into the Roth portion so that when you’re in a high tax bracket later on, you can get that money out totally tax free.

“Whenever I’m meeting with people and we’re talking about 401(k)s, a lot of people don’t even know if they have the Roth 401(k) option,” Drew said. “You need to know if that’s an option because that opens up a different planning realm for you personally.”

Who Should You List as Your Beneficiary?

Another thing that is commonly overlooked by younger people as they start their 401(k) planning for 2022 is who they should put as their beneficiary. Of course, we don’t wish any sort of tragedy to take place, but accidents and other unfortunate things happen. Therefore, listing a beneficiary on your IRA is something young people should be doing.

“If you just say that it’s going to go to your estate, the 401(k) gets liquidated and all the tax benefits are suddenly lost when you pass away,” Dean said. “The entire account is taxed immediately. The state that you live in will then go through a probate court and decide where that money is going.”

When you’re just starting your career, you might not be married yet, so your siblings or other family members might be your primary beneficiary. If you do get married, changing your spouse to your primary beneficiary is obviously something that’s important to remember—assuming that’s what you want to do. Should you suddenly pass away, your spouse might understandably be a little upset if they hadn’t been listed as your primary beneficiary.

It is everyone’s hope that if they do get married, they’ll live happily ever after with their spouse, but we all know that happily ever after doesn’t always happen. If you get divorced, changing your beneficiary is something to keep in mind, whether or not you remarry.

We’ve Seen Some Bizarre Beneficiary Situations

Changing your beneficiary is simple, but there can be all sorts of problems if you forget about it. Just listen to this story from Dean that happened last year.

“An individual passed away, but he had gotten divorced and the ex-wife was still a client of ours,” Dean said. “While the IRA wasn’t here, she was still the beneficiary on his IRA. However, he also did a trust and left everything to his son. That’s all he thought he needed to do. So, the son and the mother started fighting over who gets the IRA money. The way that the law works is the beneficiary form trumps the trust. The ex-wife winds up with the IRA assets—in this case, 401(k) assets—and the son gets nothing. The son didn’t understand that just because his dad did a trust, he needed to name either the trust as the beneficiary or put his son directly on the beneficiary form if that’s what he wanted to have happen.”

A good rule of thumb is to review who your primary beneficiary is once a year. If you’ve recently experienced a life-changing event, you may need to check your beneficiary form. Keep this in mind for your 401(k) planning for 2022 and beyond.

A Contingent Beneficiary

Along with having a primary beneficiary, it’s critical to have a contingent beneficiary. Dean, Drew, and other members of our team have seen situations where husband and wife pass away within weeks of each other and they have each other as the beneficiaries. If there was no contingent beneficiary, there’s no living beneficiary for that account now.

“If they never got the money transferred into an IRA for themselves, and there’s no contingent, guess what happens? Courts step in and decide who gets the money.” Dean said. “Then, everything comes out of the 401(k) or IRA and it’s immediately taxable. Uncle Sam is suddenly the best friend of the ultimate beneficiary—whoever the court decides it will be.”

401(k) Planning for 2022 for People in Their 40s

Now, let’s move on to 401(k) planning for 2022 for people who are midway through their careers or in their 40s. Checking your primary beneficiary is something that has a much better chance of coming into play. But there’s much more to think about with 401(k) planning for 2022 for this demographic.

Paying Attention to Asset Allocation

This is the time when paying attention to the asset allocation of your 401(k) really becomes critical. When you’re in your 40s, you’ve been contributing and these funds have been kicking off capital gains. So, let’s review rebalancing your 401(k) and some other asset allocation strategies.

“People in their 40s will usually reinvest those capital gains,” Drew said. “But what you’ll start to see over time is that those allocations might get a little out of whack as opposed to where it really started. You may have gone in with 60% equities/40% fixed income or a 70/30 or 80/20 allocation, but over time, you’ll start to see it being overweighted in certain areas. Given specific economic events or market returns, that’s going to skew what that allocation that you set in place to begin with is going to do for you.”

Looking Back at Rebalancing in 2021

Even though January is almost over, there is still a lot that we can go back and learn from 2021. Let’s take an even deeper look at how rebalancing came into play last year.

“If we looked at somebody in 2021 who had a 60/40 allocation at the beginning of last year, it was likely around 75/25 at the end of 2021,” Dean said. “Suddenly, they went from having 60% exposure to the stock market to 75% exposure. If that compounds over time, you can wind up with a disproportionate amount of money in the stock market when maybe that’s not where you want to have all your money.”

Understanding the Amount of Risk in Your 401(k)

Your 40s is a time when you really need to start understanding the amount of risk in each of the different investments within the 401(k). However, that’s something that’s much easier said than done. You can’t understand that risk simply by looking at data from past performances.

“For example, you might see five funds in your lineup that all have an average annual return the last five years of 12%,” Dean said. “It might not seem like it matters which one you pick, but it does. I promise you that each one of those funds is carrying a different level of risk. As you get a little bit older, that’s a critical thing to realize.”

While understanding the risk within your 401(k) is crucial, that task isn’t something that you have to put solely on your shoulders. Hiring a financial professional to assist you with asset allocation decisions and controlling that risk can end up making or breaking your retirement, even if you’re planning to work for 15-20 more years.

Stress-Testing Your 401(k)

That process is what financial advisors call stress-testing. Let’s go back to Dean’s example of having an average annual return of 12% over a five-year period. That’s great, but things can change in a hurry. Just look at what happened at the onset of the pandemic and during The Great Recession.

“Can you go through difficult times like that and be OK financially?” Drew said. “If you can, good, but not a lot of people go to the next level of stress-testing their 401(k) on their own. That’s usually what we’re doing behind the scenes as CERTIFIED FINANCIAL PLANNER™ professionals.”

Beginning to Think About When You Want to Retire

Fifteen to 20 years might seem like a long time until retirement, but it’s certainly not too early to start thinking about it. Simply thinking about what you want your retirement lifestyle to be like and determining how much income that will require are important first steps to building your best retirement plan.

“You can start to develop that plan and then arrive at what we call your Personal Return Index,” Dean said. “Based upon how much money have you accumulated so far and how much you’re currently putting into your 401(k), what rate return do you need to achieve to accomplish your objectives? Then, you can start having a real strategic discussion around the asset allocation.”

So many people will go on autopilot and not think about their 401(k) other than maybe taking a quick look at their quarterly statements. Don’t be one of those people who don’t even think about their 401(k) for 15-20 years after they start making contributions. That’s a huge mistake.

Watch Out for the Retirement Calculators

Another 401(k) mistake that’s easy to make is depending on retirement calculators that are provided by 401(k) providers. They tend to be very basic.

“Those calculators just assume that if you get your average rate of return, here’s what you could have 15, 20 years from now,” Drew said.

“But they’re not taking all those different scenarios or different sources of income like Social Security. Those calculators don’t analyze or look at what your goals are, what they’ll cost you, and how much time they’ll take to achieve.”

Is It Time to Change to a Traditional 401(k)?

The other thing the retirement calculators don’t account for is taxes. While a young professional more than likely should be starting with the Roth contribution, the traditional side starts to make more sense with a higher income in your 40s. During this stage of your life, your income is more likely to be at a level now where it makes sense to do traditional contributions so you’re getting a bigger tax deduction today.

There’s no rule of thumb on that, though. That’s why it’s imperative to create a financial plan that helps to tell you whether you should be doing Roth, traditional, or a mix of both.

“We can only plan around taxes as we know them now. But the next best thing is the tax forecasting that’s a part of a comprehensive financial planning process,” Drew said. “Where am I going to be tax bracket wise in the future? That can be pivotal with deciding to do a Roth or traditional 401(k).”

Organizing Your 401(k) Accounts

As we continue to highlight key components of 401(k) planning for people in their 40s, there are a few more things to keep in mind. There’s a chance that you’ve changed jobs since you started your career. What have you done with that 401(k) that you had through your old employer?

“The beneficiary forms could be wrong on that 401(k) even if you have updated on the 401(k) with your current employer,” Dean said. “Again, you may have gone through a divorce or lost a spouse. You may have children that are now adults that you want to put on as contingent beneficiaries. Those are all things that people need to pay attention to because your 401(k) is gradually becoming your largest asset. You need to pay attention to it.”

The job market has obviously had some major ups and downs throughout the last two years. With that, our team at Modern Wealth Management has seen a lot more outside 401(k)s. It’s important to know your 401(k) options and what you can do with them.

“Sometimes it makes sense to leave your 401(k) with a current employer. Other times, it makes more sense to transfer it to a new employer,” Dean said. “There are also times when it makes sense to transfer it to a self-directed IRA where you can handle the investments on your own. You can also hire a professional to help you with that, but those choices need to be made.”

Avoiding the “Junk Drawer” Approach to Your Accounts

Dean and Drew have both seen their fair shares of occasions of people who are a couple years away from retirement and want to pull out money from a variety of IRAs or 401(k)s. You can avoid doing that by keeping your 401(k)s organized in your 40s. There is a lot of opportunity to be lost and risk to be had if you don’t.

“You could have totally been over-weighted in large cap values or small cap values, whatever it might be,” Drew said. “Whenever you’ve got that junk drawer situation of your 401(k)s being here, there, and everywhere, you really have no way to really identify what that risk is.”

You’re the Manager of Your 401(k)

This case has been had been many people outside of their 40s as well, but there a misconception because a 401(k) is an employer-sponsored plan that there is somebody magically behind the scenes there that knows you and what you’re doing to take care of that investment for you. Nothing could be further from the truth.

They’re simply providing a plan form for you to save. The investment decisions are on your shoulders. As that asset grows, it becomes a much more critical part of the success of your financial life.

“A 401(k) is a cost to the employer,” Drew said. “They’re going to keep it bare minimum with your options. Any kind of work that you think might be done in the background is very basic because of cost.”

A Proactive Approach to Managing Your 401(k)

And remember, while your 401(k) falls on your shoulders, there are financial advisors who are happy to help you. Those professionals can provide a lot of knowledge about asset allocation and keep an eye on market conditions so you can still focus more on being successful in your career. You just need to have a proactive approach.

“Financial advisors can actually actively manage your 401(k). Because your choices are limited within that 401(k), we as financial advisors start the asset allocation inside the 401(k),” Dean said. “Then, we build everything else around it to fit around what’s the best inside your 401(k). You can have a total wealth asset allocation.”

401(k) Planning for 2022 for People Who Are Five Years Away from Retirement

Let’s shift gears to 401(k) planning for 2022 for people who are five years away from retirement. This is probably the most critical time in a person’s life because one little mistake could lead to working for another five years. A small mistake could also force you to spend far less in retirement than what you could have. Rebalancing becomes critical at this point.

The Great Recession: When 401(k)s Became 201(k)s

Look back again to how the importance of rebalancing was magnified during The Great Recession. Our team has heard countless stories of people who were getting close to retirement prior to 2007. Some people lost around 50% of their assets because they were taking almost 100% risk in the market.

“The saying back then was a 401(k) becoming a 201(k). We can snicker at that now, but my God, that’s not funny,” Dean said. “Nobody could have guessed that the market was going to go down 50%, but there were so many warning signs. People should have been getting more conservative.”

The problem is that it’s hard to be conservative if greed starts to set in. When you’re making money, it’s easy to ignore the fundamentals of the economy that can give you the warning signs to back off a little bit.

A Financial Plan Is a Must When You’re in Nearing Retirement

Another thing you can’t ignore at this point in your life is the importance of creating a financial plan. As you’re getting closer to retirement, the answer to your personal return index is changing. What kind of return do you need to get?

“You need to determine what options you have inside your 401(k) that can give you the highest probability of achieving that return with the lowest amount of risk,” Dean said. “Your asset allocation should be changing. You should be reducing the exposure to equities and increasing your exposure to more secure assets. That’s all in an attempt to get to a point where you’re no longer working for your money. Your retirement marks the point when your money goes to work for you.”

What Do You Want Your Retirement Lifestyle to Look Like?

This brings us back to a very important question: what do you want your retirement lifestyle to look like? While that should be a question that you start asking yourself 15 to 20 years in retirement, now you need to come up with some definitive answers. You need to have your 401(k) in order for you to live out that ideal retirement lifestyle.

“Are you going to roll that money over? How are you going to do it?” Drew said. “Start having those thoughts in your head so when that time does come, you know exactly what you’re going to do. Don’t just show up at retirement’s doorstep and say, ‘Hey, here I am.’”

Controlling Risk in Your Peak Earning Years

Unfortunately, people show up at retirement’s doorstep and do that all too often. Your retirement is all about the pre-planning. Obviously, the goal is to only retire once. If you don’t have a financial plan created to give you clarity and confidence going into retirement, you face higher odds of possibly going back to work. Our Guided Retirement System is designed to not only get you to retirement, but through retirement.

“It just so happens that the 401(k) plays a huge role here. Again, don’t forget to double check your beneficiaries,” Dean said. “The biggest key here is controlling the risk. At that point in your life, you are likely earning the most money that you’ve ever earned in your life. You’re in your peak earning years. Therefore, the question of Roth versus traditional becomes even more critical.”

Roth Conversions Early in Retirement

Our team believes that the tax allocation heading into retirement is as important as the asset allocation. Sometimes it’s even more important. What that does is dictate how much you can spend in retirement. That is how you start getting Uncle Sam out of your pocket as much as possible during retirement.

“One of our favorite things to do is to start looking at Roth conversions early on in retirement,” Dean said. “It’s at that point in time that if you’ve built the right tax allocation, you can now start to do Roth conversions.”

Let’s say you’re in a 35% tax bracket in your peak earning years. If you start doing conversions in the 12% or 22% bracket, you need to deduct it at 35%. Now, you put it into a Roth where it can grow tax free forever at 12 or 22%. You get to start winning that tax game, which is crucial later in your career.

“Whenever we’re talking about Roth’s conversions, we’re obviously going to pay tax on those conversions,” Drew said. “However, it’s paramount to have a plan in place. Whatever you’re setting your life expectancy at—90, 95, even 100— I think it’s powerful to see within the plan that if I’m going to write a check, what will the result be? When you go through the plan, you can see that by doing these conversions that you’ll be paying a little more upfront, but you’ll also see a massive difference in taxes paid over your lifetime.’’

The Wonders of Forward-Looking Tax Planning

People often get tax filing and tax planning confused. By implementing forward-looking tax planning within your financial plan, our team has seen several instances of people savings around $250,000 in taxes over the 25 to 30 or so years of their retirement.

“That’s real money that you can keep in your pocket or that you can spend throughout your retirement years,” Dean said. “It’s powerful. But you don’t ever see that unless you first have the financial plan fully in place. We get our CPAs involved to run some scenarios. For example, what if we did more Roth? What if we did more traditional? Then there are the conversions in retirement and other scenarios that people need to be thinking of.”

Leaving a Legacy

This also brings us back to legacy planning, which ties right into tax planning. It’s important to make sure the surviving spouse stays in a lower tax bracket. Then from more of a legacy perspective, it’s crucial to many people to leave money behind for their children. In that case, the best way to leave them money will be through Roth IRA money instead of traditional money.

“This is especially true with the new SECURE Act that requires all the money come out within a 10-year period,” Dean said. “If it’s all Roth money, great. It’s all tax-free.”

401(k) Planning If You’re Already Retired

We’ll wrap things about by talking about 401(k) planning for retirees. You have a choice after you retire to leave your money in the 401(k) or roll it into an IRA. There are pros and cons to both, but there is a specific reason why somebody might want to leave money in the 401(k).

“If you sever service between 55 and 59.5, you might want to leave some of that money in the 401(k),” Drew said. “The reason being is that during the time, you can take distributions from the 401(k). You’re still going to pay federal and state income tax, but you’re going to avoid the 10% penalty on an early withdrawal that you would have in a traditional IRA or a 401(k) rollover in an IRA.”

There’s Also IRS Code Section 72(t), But…

That’s the most efficient way to do it. There is another way to do it under IRS code Section 72(t), but our team tries to avoid it. That method allows people to have an IRA and take systematic withdrawals out of that IRA.

The problem with that is those systematic withdrawals need to follow a very special formula that will give you the amount that can come out. If you change that amount any time before 59.5 or for five years—whichever period is longer—then the entire amount that you’ve taken out suddenly becomes subject to the 10% penalty and you can’t go up or down in the amount.

“Let’s say that you were taking it out, but two years later you have a great consulting opportunity,” Dean said. “You could be making $200,000 a year, so you don’t need $60,000 coming out of your IRA anymore. If you turn it off, then you have $120,000 that subject to a 10% penalty. That’s not good. Don’t encumber yourself with that 72(t) option unless you absolutely need to.”

Other Reasons to Leave Your Money in a 401(k) After Retirement

There are also certain 401(k) plans that might allow you to have an open-ended investment strategy. If you are more of do-it-yourselfer and want to utilize that, that may be a reason to keep money in your 401(k).

Some plans have what they call a brokerage link. You can have that money in that brokerage link where you can buy stocks, bonds, ETFs, etc. That could be optimal for a do-it-yourselfer with it being a less expensive way to manage that money.

However, since most 401(k) plans are very basic and limited in what they offer, very few of them offer that brokerage link. It’s something that you would just have to know within the 401(k) plan parameters.

When Does It Make Sense to Rollover a 401(k)?

So, when does it makes sense to take the money out of the 401(k) and go to an IRA? Dean says most of the time.

“There’s enough low-cost options on the IRA side of things,” Dean said. “You certainly broaden your horizon of how easily you can manage that money. The setting up of systematic withdrawals to get your income and the tax withholding all becomes dramatically easier.”

One thing to be aware of is that there are some creditor protection things that the 401(k) has that the IRA doesn’t have. And if you’re still working after the Required Minimum Distribution age of 72, keep that money in the 401(k). You don’t have to take distributions from the 401(k) as a RMD as long as you’re still working.

Another Reminder to Update Your Beneficiary Forms

For people who do choose to leave money in the 401(k) after they retire, you still need to remember to keep your beneficiary forms up to date. It can be even more critical to do that in retirement.

Dean has spent a good part of his career studying with Ed Slott, who’s considered to be America’s IRA expert. He’s sat on Ed’s advisory boards for about 15 years and gets together with him twice a year to study the IRS code as it pertains to 401(k)s and IRAs. In every one of those scenarios, they spend about a half a day going through court cases from the previous six months of people contesting mistakes that were made within the 401(k) world.

“There was a divorced couple that in California that we reviewed where the husband kept his money in the 401(k) plan. He renamed his three children as primary beneficiaries of the 401(k). Everything was good up to that point, but about five years after that, he decided to remarry. Unfortunately, he passed away a month later. When the kids—who were named as beneficiaries on the 401(k)—went to get their money, the 401(k) plan provider said not so fast. Now, ERISA law steps in, which says that unless your current spouse has signed a waiver to waive their rights to that 401(k), it’s their money. In this instance, this went all the way to the California Supreme Court. The wife of one month took over $2 million out of the 401(k) plan, while the kids were disinherited. There was nothing they could do.”

We’re Here to Answer Your 401(k) Planning Questions for 2022

That is one of many examples of why it’s crucial to keep your beneficiaries forms up to date. So much of comprehensive financial planning revolves around 401(k)s for 2022 and beyond. Hopefully you are now more educated on what your 401(k) can do for you and how to manage it to (and in some cases) through retirement.

If you have any questions about 401(k) planning for 2022, please schedule a complimentary consultation or 20-minute ask anything session with one of our CERTIFIED FINANCIAL PLANNER™ professionals. We can meet with you in-person, virtually, or over the phone.

Schedule Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.