ABCs of Medicare

Key Points – ABCs of Medicare

- Understanding What Medicare Parts A and B Cover and Don’t Cover

- And What Medicare Parts C and D Cover

- What to Know About Medicare Open Enrollment

- What Prescription Drugs Are Covered Under Certain Plans

- Medicare.gov Is a Great Resource

- We’re Happy to Answer Your Questions About the ABCs of Medicare As Well

- 21 Minutes to Read | 36 Minutes to Listen

Reviewing All Things Medicare

My name is Tom Allen and I’m excited to be on the Modern Wealth Management Educational Series to review the ABCs of Medicare. With Medicare open enrollment underway (it runs from October 15 through December 7), I want to make sure that you have the information you need to make an informed, educated decision, whether you’re going into Medicare or are already on it and reviewing your decisions from last year.

Sign Up for the Modern Wealth Management Educational Series

Meet the Presenter

I’ve been in the health insurance industry for 43 years. My primary focus has been the senior market, which translates into the Medicare market. For the last 17 years, Tom has been certified with the Centers for Medicare & Medicaid, which is the overseer of our Medicare program.

History of Medicare

To begin this discussion on the ABCs of Medicare, we need to start with a quick history lesson. Following World War II, Harry Truman wanted to establish a widows and orphans fund. Sadly, there were too many widows and orphans in the U.S. due to World War II and it continued to be an issue leading into the Korean Conflict.

Pretty much anything that President Truman wanted to push forward was not embraced or was not popular. Going through the 1950s, Dwight Eisenhower had a program for orphans. It was a strong presidential running point even through John F. Kennedy. In fact, it was one of John F. Kennedy’s primary goals as president.

Sadly, we all know what happened to John Kennedy, but Lyndon B. Johnson picked up the mantle. In July 1965, the Medicare Act was passed. It is probably one of the singular most important gifts that the government has ever given to our age group.

Until the Medicare Act was passed, most people receive their health insurance through their employer. When they left employment, they could purchase individual health insurance if they could afford it, or they simply pay their own bills.

Medicare Coverage at a Glance

There are two ways to get your Medicare coverage. It’s Medicare A and Medicare B. What do each of them cover? Before we define each part, let’s define Medicare at a high level.

Original Medicare: What’s Covered?

Generally speaking, Medicare covers services like lab tests, surgeries, doctor visits, inpatient hospital care, durable medical equipment—like walkers, canes, wheelchairs—and things that are considered medically necessary to treat an illness or a disease. Now, let’s look at Part A.

Medicare Part A

Part A covers the inpatient hospitalization side. It includes the hospice care when those days come to us. Part A also includes skilled nursing care as long as custodial care isn’t the only coverage that you need. If it’s a service that can be provided in a skilled nursing facility where an improvement is expected or an improvement is likely, it is covered.

If you need to go into a nursing situation where there is no expectation of improvement, that’s considered long-term care. It’s not part of Medicare and certainly not part of Medicare Part A.

Nursing home care is covered. For an example, if you have a surgery and have recovered well enough to be discharged from the hospital but not to the point where you can go home and care for yourself. You’ll go into a nursing home or skilled nursing home. Many people consider this as a step-down unit. It’s a bridge to get you from inpatient hospitalization to your home setting. In the home setting, there are home health services that are provided by Medicare Part A as well.

Medicare Part B

Medicare Part B is the outpatient side. It’s services from doctors and other healthcare providers, clinical services, ambulance services, durable medical like crutches and wheelchairs and things of that nature, mental health, inpatient, outpatient, and some partial hospitalization for inpatient.

It covers getting a second surgical opinion, and it has limited outpatient prescription drugs. And they are extremely limited. Some examples would be some of the medications that you would receive for cancer patients.

Coverages would be for some of the more exotic or clinically or hospitalized administered drugs. But for our purposes, for the average person, Medicare doesn’t cover prescriptions. The prescriptions we take on a typical basis are not covered by Medicare.

Eligibility for Medicare Part B

Simply thinking of it, there’s a primary division between Medicare Part A and Medicare Part B. Medicare Part A is the hospitalization side. Medicare Part B is services from doctors and other health care providers in a non-hospital setting. That includes things like clinical research, ambulance service, durable medical equipment, canes, wheelchairs, crutches, things of that nature.

Medicare Part B also includes mental health services, inpatient, outpatient, and in some cases partial hospitalization. It includes getting a second surgical opinion preceding surgery. There’s a lot of talk about second surgical opinions. Is it worth your time? Is one doctor going to say that the other doctor is wrong with their diagnosis?

A Case Where Two Can Usually Be Better Than One

Physicians in the medical community welcome a patient who is interested in a second surgical opinion. It’s not that the first doctor may necessarily be wrong. It may be that the second doctor may have another treatment that may be a better fit. It’s always smart to have two very wise people making decisions for you instead of just one.

Medicare Part B has a limited outpatient prescription drug benefit. That’s important for a couple of reasons. For the first coverage that they have, you should simply think of it as prescriptions that are going to be provided and administered in a clinical setting or in a hospital setting. Chemotherapy drugs are a perfect example of that.

But for the day-to-day prescriptions that many of us in our age group take, Medicare doesn’t provide prescription drug coverage for that. It’s an important point that I’m going to come back and address in a couple different ways.

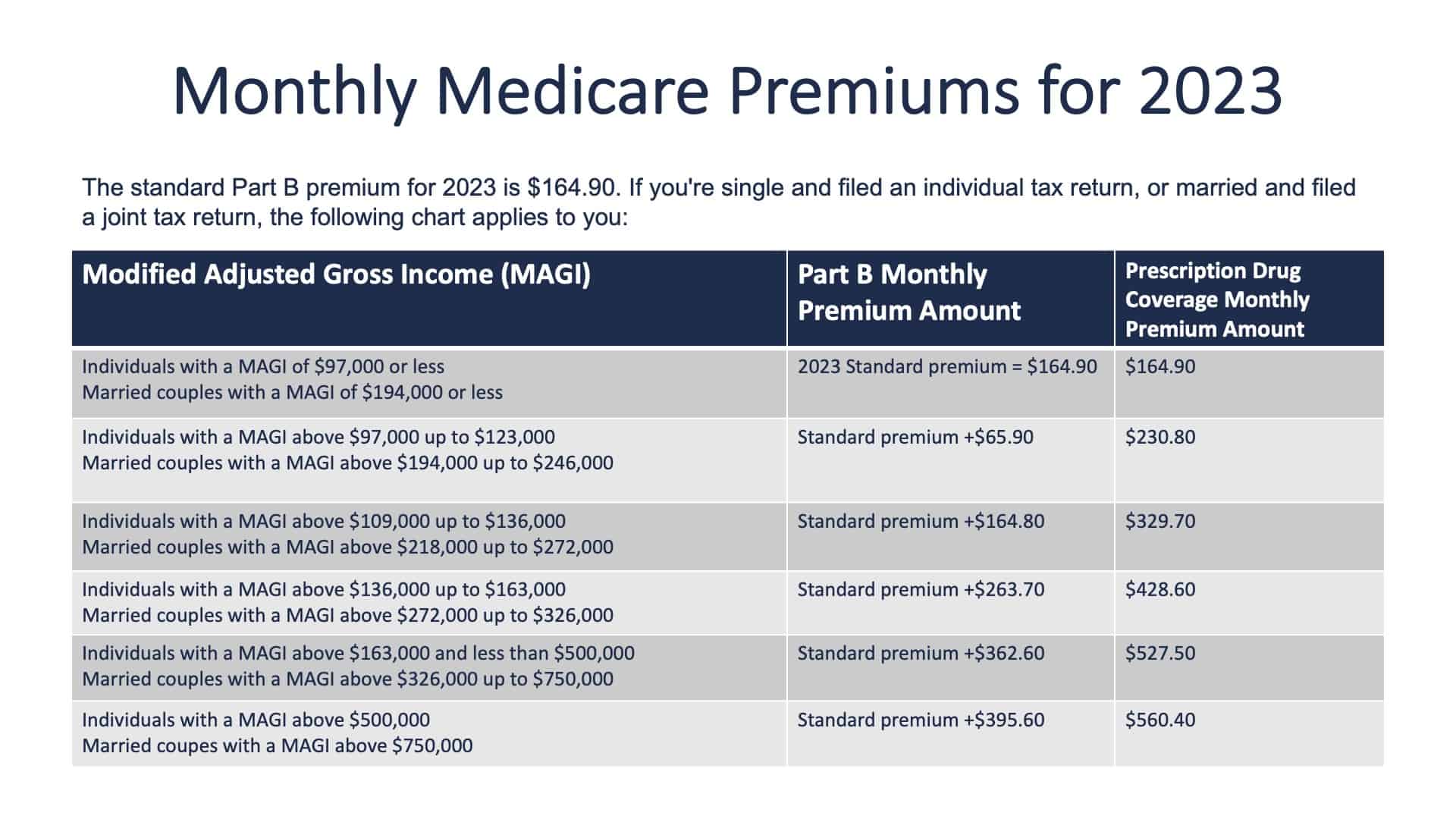

Medicare Part B Premium Falls for First Time in 41 Years

Monthly premium for Medicare has changed again this year. For 2023, the Medicare premium is $164.90. That’s down from $170.10. For the first time in 41 years, there has been a reduction in the Medicare Part B premium.

Drug Treatment for Dementia

When Medicare set the premium at $170.10 in 2022, the first drug was approved for the treatment of dementia. It was a very expensive drug. Medicare felt that there could be a potentially significant impact on the cost for that prescription.

During 2022, Medicare has realized that the cost associated with that prescription wouldn’t have nearly the impact that they were fearful that it would. This is one of the prescriptions that falls under the Medicare coverage for prescriptions. Again, it’s only a handful of prescriptions.

Your Adjusted Gross Income

Since Medicare recognized that their assessment of potential expenses was not developing, they reduced the premium. So, let’s talk about the premium. It’s $164.90. Medicare looks at your adjusted gross income looking back two years. If you have an adjusted gross income of $97,000 or less as an individual or $194,000 or less as a married couple, you’ll be in the threshold bracket of the $164.90 premium.

Please recognize that this is based on your adjusted income, not your total income. If you are just going into Medicare and Medicare looks at your adjusted gross income and realizes that you’re in a higher tax bracket, you will be paying an additional premium on top of the $164.90 based on the brackets of income that you fall into.

If Medicare assessed you a higher bracket two years ago because of adjusted gross income, please recognize that when your adjusted gross income should drop back down into a lower bracket. Please contact Medicare and explain to them that you are now paying a lower adjusted gross income tax. That’s often the case for people that are retiring or leaving their primary employment prior to retirement.

A Penalty for Making More Money?

Medicare will remove or reduce that additional premium. Many people call it a penalty. It’s a penalty for making more money. It’s a great penalty to have, I suppose. Contact Medicare and ask them to put you into the lower bracket.

You’ll find that Medicare is very receptive and will do so. There’s information available. Please get in touch with us at any point in time on this topic or frankly any other question you would have. We can address the specific brackets that you may fall into.

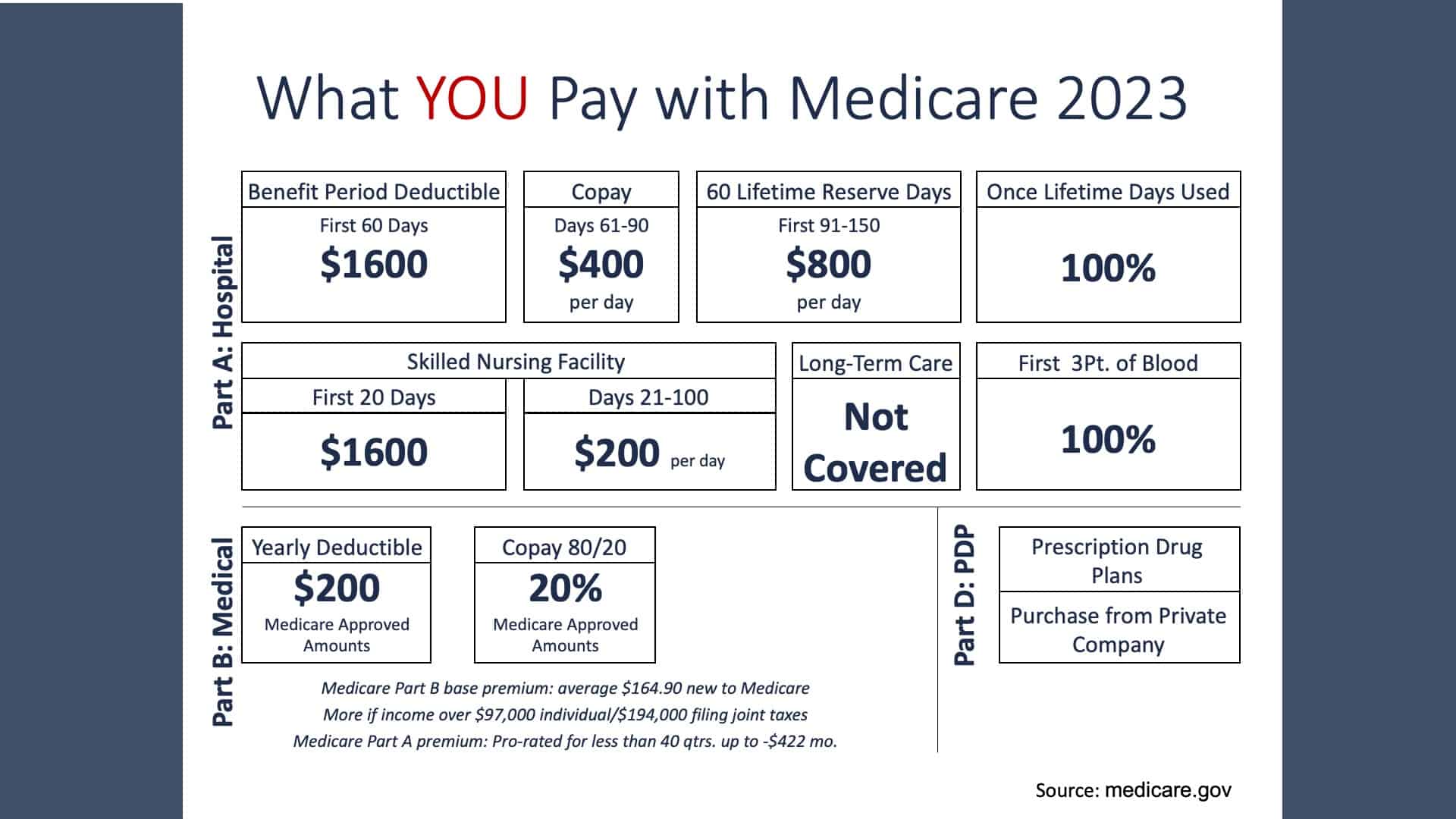

What You Pay with Medicare in 2023

Let’s move on to what you pay with Medicare in 2023. Each year, Medicare adjusts the cost associated with you as a consumer. Many things bring that into focus with medical inflation probably being the primary consideration.

With Medicare Part A, you have a deductible of $1,600 for the first 60 days of care. For Medicare Part A, the deductible is not an annual deductible. Most of us are more accustomed to having a deductible through our employer plans where the deductible was a January 1 to December 31 time period.

Health Care Costs: The No. 1 Reason Retirees Can Go Bankrupt

With Medicare Part A, it is a benefit period deductible. That means you will pay $1,600 and that will cover a benefit period. Once you have been discharged from the hospital and you are without hospitalization for 60 days, you may now be facing an additional $1,600 deductible if there’s a subsequent follow up hospitalization. It’s not based on a time period. It’s based on the actual occurrence of the health care. And if 60 or more days pass and you require additional hospitalization during that calendar year, you will be subject to an additional deductible.

Once your deductible is satisfied, that pays up to the first 60 days of hospitalization. If you need hospitalization that last for 61-90 days, you’ll pay $400 a day for your hospitalization. There’s a 60-day lifetime reserve that takes you from Day 91 through Day 150. That’s $800 a day.

Once that is exhausted, the patient then pays 100% of the cost for their hospitalization. It’s already obvious that this provides a great benefit for you. It’s also obvious that you have an opportunity to spend money out-of-pocket. Medicare doesn’t cover 100%. Period. The number one reason people in our age group go bankrupt is health care costs.

Skilled Nursing Facilities

Now, let’s take a deeper look into Medicare coverage for skilled nursing facility stays. For the first 20 days, there is a $1,600 deductible matches the Medicare Part A hospitalization deductible. That gives you the first 20 days at a skilled nursing facility. Should you require additional nursing facility, you will pay $200 a day out-of-pocket for a 21-to-100-day stay.

Remember, long-term care is not covered. Many people consider long-term care to be custodial with there not being a treatment plan that is expected to bring an improvement.

A Quick Note About Blood

Blood is covered at 100% for the first three pints. It is a very expensive and extremely well received benefit, should you be in a situation where you need that.

More on Medicare Part B

Like I mentioned earlier, Medicare Part B is outpatient side. There is a $200 yearly deductible January 1 through December 31. They’ve taken a departure from Medicare Part A, which has a benefit period deductible.

Following your deductible with Medicare Part B, you pay 20% of the cost of the health care, and Medicare pays the 80% balance.

How to Find Out If Medicare Has You Covered

Now, I’m going to discuss how to find out if Medicare covers what you need. First, talk to your doctor or healthcare provider. Visit with them to make certain that the coverage is covered by Medicare.

The second way, which I highly suggest, is to also contact Medicare. You can go to medicare.gov, which provides a vast amount of information. The website is tailored and designed for people with Medicare in our age group.

Most of us do not want to surprise when it comes to looking at the billing. If it’s not a covered service, Medicare pays zero and the patient pays 100% of that, and it’s easy to make sure that that problem doesn’t occur.

Two Factors of Medicare Coverage

Medicare coverage is based on two main factors: federal and state law. National coverages are made by Medicare, whether something is covered or not. I’d like to give Medicare a compliment. Medicare does an exceptional job of watching the emerging trends in healthcare delivery. If they see that something new is rendering services and results, Medicare is very quick to review that and include it in Medicare coverage.

As Medicare recipients, we usually receive cutting edge health care in this country. Medicare does it for two reasons. Usually, the quicker you can respond to a problem, the less it’s going to cost. You can create savings for Medicare, which leads to less personal suffering and pain as a patient. Either way, it’s an excellent situation.

Medicare Part C

With Medicare Part C, most of us recognize the term Medicare Advantage. Medicare Advantage came about because of the government once again doing something very smart. Medicare recognized in the early 1990s that they had a huge problem coming down the pipeline: the baby boomers. Over 11,000 people today are turning 65 in this country. The peak will be over 12,000 a day.

Medicare and the Private Insurance Industry

Medicare recognized that they could rent offices, hire staff, and buy computers to handle this giant glut of human beings that are hitting the pipeline. But there’s a beginning, slowing, and tapering off of that bulge as it would go through the pipeline. Not too many years later, Medicare would be overstaffed, over computerized, and over officed.

So, Medicare went to the private insurance industry. They asked them if they could rent or outsource the capabilities that the private insurance industry had to act on behalf of Medicare. A private insurance company does the same thing Medicare does with printing ID cards and policies, adjudicating claims, and doing customer service. So, Medicare asked the private insurance industry if the private insurance industry perform and act on the behalf of Medicare for a set amount of money. The response was a resounding yes.

The amount of money Medicare was offering the private insurance industry in most cases exceeded the income that the private insurance company was receiving on their private book of business. The amount of money Medicare was offering was the actuarial assumption of what a person with certain demographics would cost monthly as far as health care and health care cost. That amount of money Medicare is paying is based on gender, geographic location, and age.

The Profit Cap

The private insurance industry was very interested in pursuing that. One of the things Medicare pointed out is that there is a profit cap. That wasn’t a negotiation factor or negotiation position for Medicare. It’s statute. The realization came quickly that the private insurance industry was going to receive more income than the profit cap would allow. This is where we could mention the government buying $325 hammers and things of that nature. But the point is that the private insurance industry couldn’t be as inefficient as an arm of the Federal Government.

So, conversations pretty much came to a standstill. Medicare was offering an amount of money that exceeded a profit cap, so the conversation ceased. The second step of that was the private insurance company going back to Medicare and stating for a set amount of money to act on behalf of Medicare and do everything the same as Medicare Part A and Part B. The only thing was that they would be making too much profit.

Annual Out-of-Pocket Maximum

Medicare liked that notion. The first thing they required was for there to be an annual maximum out-of-pocket. How high would the ceiling be? If this is a year that I have an extremely high claim, how much is it going to cost me out-of-pocket? Is there a cap on it?

And by statute, that has been $6,700 a year. For 2023, it’s going up to about $7,150. In the marketplace for the Kansas City area, the highest maximum out-of-pocket that I’m aware of is $6,500. The lowest is $3,125. Simply stated, that’s the most that you would pay for covered Medicare expenses if you have it rendered during that year. That’s the genesis for the Medicare Advantage program.

Medicare Advantage Programs Statistics

Medicare Advantage programs have become widely received. Of the roughly 66 million Americans that are Medicare age, a little less than 19 million are under Medicare supplement plan. About 23.5 million are under Medicare Advantage Program. And roughly the third that’s left are either retired military, retired civil service or sadly can’t afford the Medicare Part B premium. To enroll in a Medicare Advantage Plan, you must have Medicare Part A and Medicare Part B.

As I mentioned, Medicare Part C is a private health insurance company that has been approved by Medicare. It usually combines coverage of Medicare Part A and Medicare Part B, and in most cases, Medicare Part D, which is a prescription drug plan that I’m going to address shortly.

The Perks of Medicare Part C

The primary reason most people go to a Medicare Part C plan is that there are lower copays and little or no premium. And again, the plans have a maximum annual amount of potential exposure. Medicare Advantage Plans need to stay under an annual profit cap. As a result of that, most plans do not have a premium.

The premium for the healthcare cost is being borne entirely by Medicare. Medicare plans eliminate the major exposure found under Medicare Part A and Part B. For Part B, they pay 80%. There are deductibles and opportunity for multiple deductibles throughout the year under Medicare Part A.

Potential Erosion of Assets with Only Having Traditional Medicare

Here’s the best way of looking at this with Medicare Advantage plans. For many of us that just have traditional Medicare, it’s just not enough coverage. There’s a potential erosion of assets that can easily occur.

If you have just traditional Medicare, many people in our age group will either go with a Medicare Advantage plan, Medicare Part C, or they will go with a Medicare tie-in plan. A Medicare tie-in plan is also known as a supplement plan and or a Medigap plan. All three mean the same.

With a Medicare Advantage Plan, you don’t have a deductible or a premium. It covers Medicare Part A and Part B potential exposure, deductibles, and co-insurance. In most cases, it includes Medicare Part D prescription drug plan.

Wellness Coverages

It has a manual maximum out-of-pocket and things like the wellness coverages, which Medicare mandates be covered at 100%. If we do all the things that we should do like physical exams, mammograms, pap smears, and bone density tests, all those are covered at 100% with no out-of-pocket cost.

Again, it helps Medicare. The quicker problem can be diagnosed, the quicker treatment can be rendered. And in most cases, it’s going to be less cost to Medicare. As a patient, the sooner we get health care and the sooner we’re restored to the state of health, we’ve gone through less personal suffering and pain.

When to Enroll in a Medicare Advantage Plan?

Many people will first enroll in a Medicare Advantage Plan when they first enter the Medicare services. That’s predicated or based on turning 65. There are situations where people under 65 with some disability issues can go into a Medicare prior to turning 65. But for most of us, we get Medicare at 65.

That’s when we look at adding an additional layer of coverage to help protect our assets and to maintain the opportunity to have access to good quality health care. The second opportunity to go into a Medicare Advantage Plan is during the annual open enrollment period. That period is from October 15 to December 7 for an effective date of the following January 1.

Medicare Advantage Advertising Is Oftentimes Overwhelming

We really don’t need to look at a calendar to determine if we were in that period. Simply turn on the TV or go to your mailbox and we are deluged with the Medicare Advantage, Part C advertising. That illustrates how profitable this is to the private insurance industry.

During the open enrollment period, you can freely move from Medicare Advantage carrier to Medicare Advantage carrier if there’s one that has benefits or services that more closely match your personal needs.

The TV commercials about Medicare open enrollment allow you to draw a conclusion that’s not completely accurate. Although they certainly aren’t lying to us. They give the impression that you can freely move from plan to plan without underwriting during the open enrollment period. That is expressly true for a Medicare Advantage Plan and for a Medicare Part D prescription drug plan. It is not true for those people that went with a supplement plan.

If you went with a Medicare supplement plan, there’s a premium and medical underwriting that’s required after the initial enrollment period. So, a person that is under a Medicare supplement plan may or may not be able to change to a different carrier unless they can pass medical underwriting.

If you choose to go with the Medicare supplement plan, assume that you’re going to be with that carrier for the balance of your life unless you can luckily pass underwriting. That becomes more difficult as we age.

The Two Categories of Medicare Part C

Medicare Part C plans generally fall into two categories: Health Maintenance Organization or Preferred Provider Organization. Most of us have become very familiar that there’s a significant difference in coverage. An HMO plan generally has a panel of providers. You must seek and receive care from that panel. Should you need hospitalization, the HMO plan will pick the hospital that you’ll be receiving care from. If you receive care from a non-HMO panel, then the patient’s responsible in most cases for 100% of the cost associated with that.

In contrast to that, the PPO has an inpatient panel of physicians and providers along with outpatient coverage. Should you choose to receive care from the inpatient panel, the cost associated with that care is generally significantly less than if you choose to go out of network.

For many of us, we’ll probably receive all our care from that inpatient panel. But many of us would also like to have the ability and knowledge that if we were to choose a provider that’s not in the PPO panel that we’ll have good coverage. In most cases, that coverage closely matches what we’re accustomed to receiving through our employer during our employment years.

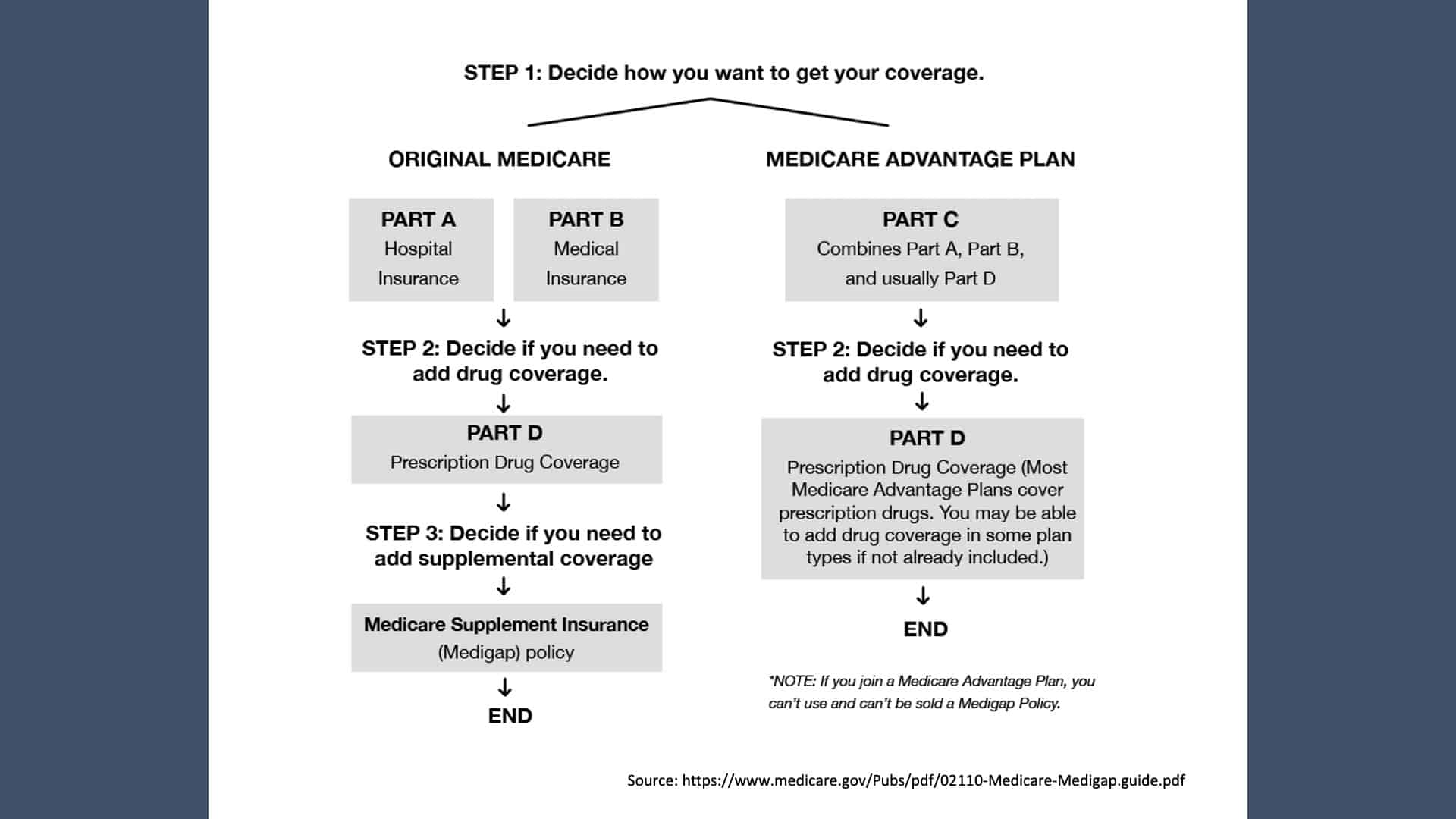

Decide How You Want to Receive Coverage

With Original Medicare Parts A and Part B, you would probably want to add an additional Medicare Part D prescription drug coverage. Again, Medicare generally doesn’t cover most of the prescriptions we take. Or you’ll want to go to a Medicare Advantage Plan, Medicare Part C. Remember, it combines Medicare Part A, Part B, and in most cases, Part D prescription drugs.

I always mention that you need to add the Part D coverage. It’s noteworthy. Should you choose not to go with a Medicare Part D plan or the Medicare Part B plan when you’re first eligible, you need to make sure that you’re right. Medicare charges a penalty for not going into the Medicare B or the Medicare D level of coverage when you’re first eligible.

Remember that group health insurance is based on the assumption of many while shouldering expenses of a few. We need the younger, healthy shoulders to offset the expenses for the people that are using more services.

Even if you’re currently not using many prescription drugs, I would urge you to spend some time looking into it or contact us. We’d be happy to help guide you through that. It may be better for you to go out and take a Medicare Part D plan to offset the potential penalty. We also don’t know when we will start taking a prescription. It’s good to have the coverage when you have it available.

Medicare Part D, the Prescription Drug Plan

As I mentioned, Medicare Part A and Part B covers some prescriptions but not nearly enough. In most cases, they’re either in a hospital setting or a clinical setting. To be eligible to sign up for the Medicare Part D prescription drug plan, you must have Medicare Part A and/or Medicare Part B. Plans are not required to offer all prescription drugs. They’re required to offer a standard minimum, and that’s evaluated by Medicare on an annual basis. There are deductibles, copays, and formularies. There’s the donut hole, which is no longer referred to as a donut hole. But it certainly still feels like the donut hole when picking a Medicare Part C carrier.

Medicare’s Website Is an Excellent Resource

What I would urge people to do is to go to medicare.gov and pick a plan. It can be in Medicare Advantage as well as a Medicare Part D choice. You can list all the prescriptions you’re currently taking and the frequency, strengths, and so forth.

Medicare will give you a printout of which Medicare Part D carriers or Medicare Advantage carriers in our service area that most closely match the prescriptions you’re currently taking. You’ll see which plans will have a formulary that will have the lowest out-of-pocket cost for you. Once you’ve made this decision, it’s a good investment of your time to review if there’s a carrier that is now is a better fit during the annual open enrollment period.

Two Things that You’ll Want to Consider

First, are the prescriptions you’re taking covered by the Medicare Part D carrier? Second, Medicare doesn’t require a carrier to cover everything.

Let’s make up an example and assume there are 41 high blood pressure medications. Let’s further assume that I, through my provider, have tried several of them. Then, I finally find a high blood pressure medication that satisfies the need. I can also tolerate it the best.

When I’m picking out a Medicare Part D carrier or a Medicare Advantage carrier that has the prescription drugs included, I want to know that the prescriptions I need to take are going to be covered by that carrier.

So, let’s further that example and say Carrier A and Carrier B both covered that brand name high blood pressure medication that you take. Carrier A may have that as a tier four formulary drug. Carrier B may have that as a tier three formulary drug. There’s potentially a significant difference in the copay on a monthly or an annual basis.

Make sure that your prescriptions that you need to take are covered. Check and see if there’s a carrier that covers them at a less expensive copay for you. That will help you narrow down which carrier you’ll choose to go to. Again, medicare.gov is a superb tool. I urge you to use it.

More on Medicare Part D

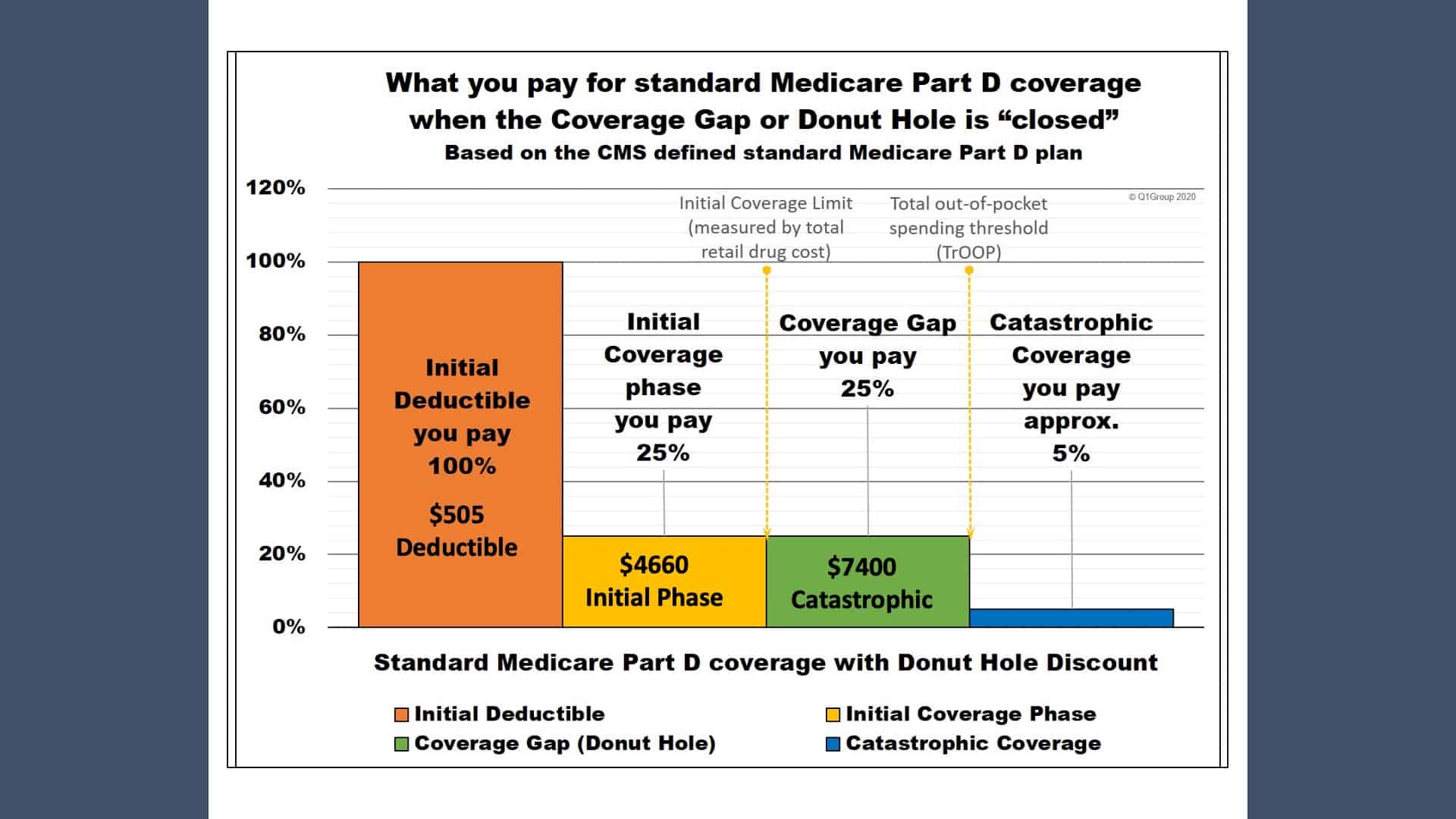

Now, let’s talk about how the prescription drug plan works. Remember, the Medicare Part D prescription coverage is an insurance policy between an insurance carrier and a patient. For 2023, Medicare Part D has a $505 deductible. Just like most deductibles, this is what you pay before the carrier is going to pay what they’re going to pay. And with the Medicare Part D, it is an annual deductible.

Once you’ve paid your $505 deductible, you’re in what’s considered the initial phase coverage. You pay 25% of the cost of the prescription. Your Medicare Part D carriers pay 75%. Of note, the $4,660 is the combined cost between what’s covered by the carrier and by the patient. Once you have hit $4,660 at a combined cost, you enter what’s considered the catastrophic coverage.

During the catastrophic coverage, once your charges hit $7,400 combined between you and your Part D carrier, you will go into what’s considered the catastrophic phase. You’ll pay 5% of the cost of that prescription.

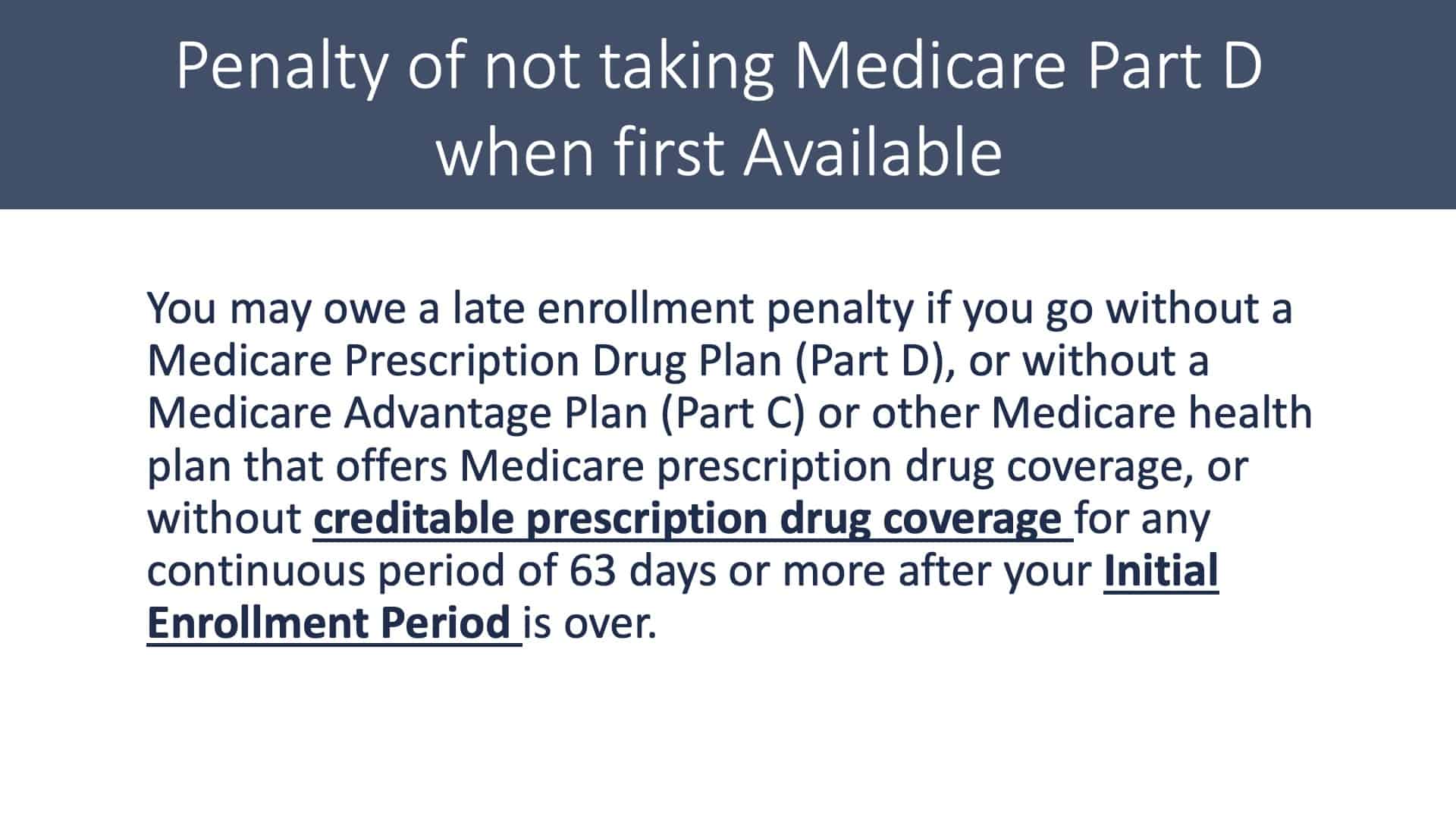

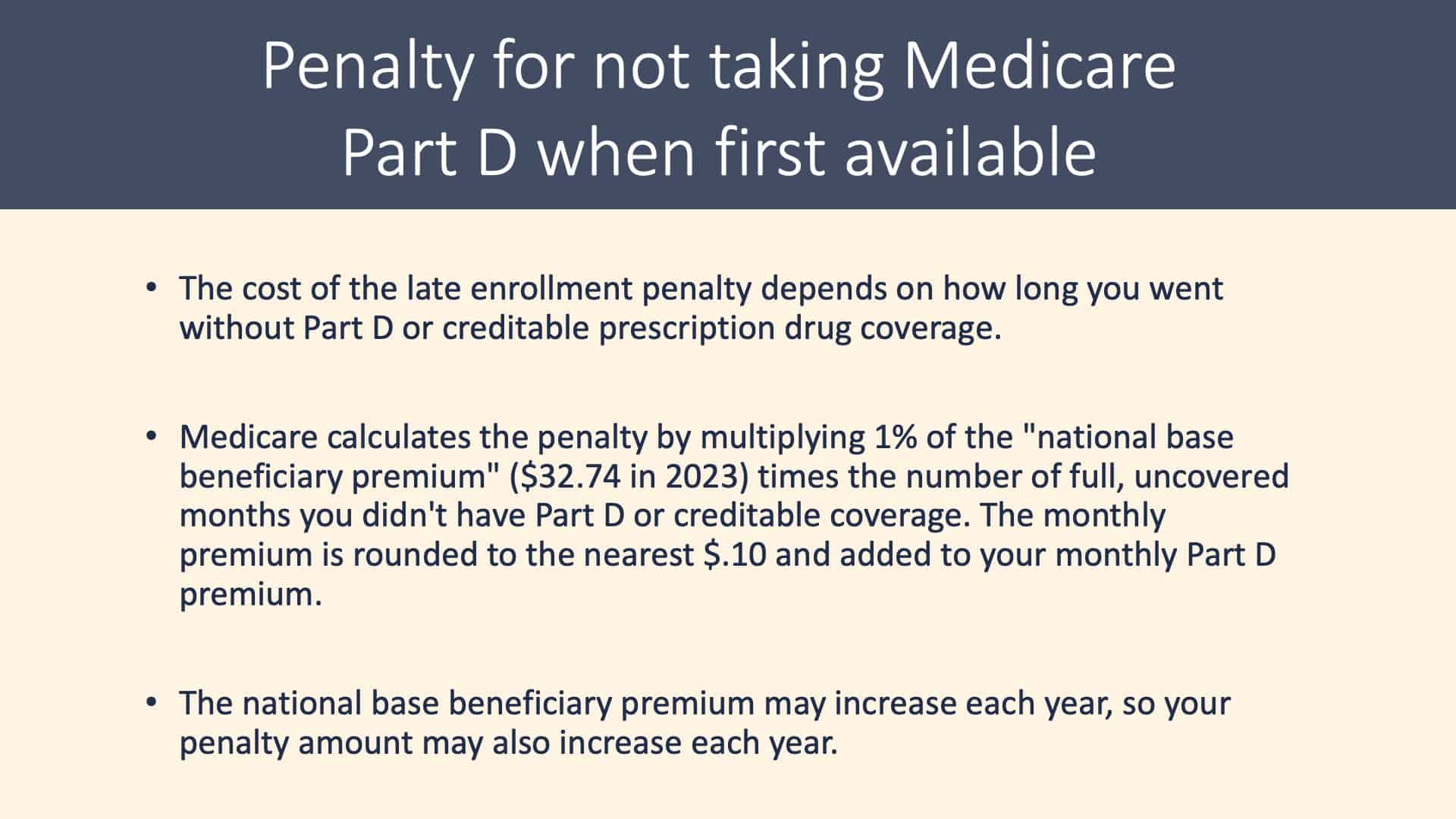

Penalty for Not Taking Medicare Part D When First Available

I want to circle back to talking about the penalty for not taking a Medicare Part D when it’s first available. You may owe a late enrollment penalty if you go without a Medicare Prescription Drug Plan Part D coverage or without a Medicare Part C plan if it includes the prescription coverage.

If you go 63 days with a gap in coverage, which includes when you first leave your employer, you will be subject to the penalty. The penalty is based on a national based beneficiary premium. For 2023, that’s $32.74 times the number of full uncovered months that you didn’t have Part B or cutable coverage. The premium is rounded to the nearest 10 cents. You should assume as a national base beneficiary premium may increase each year. Your penalty may increase subsequent to that.

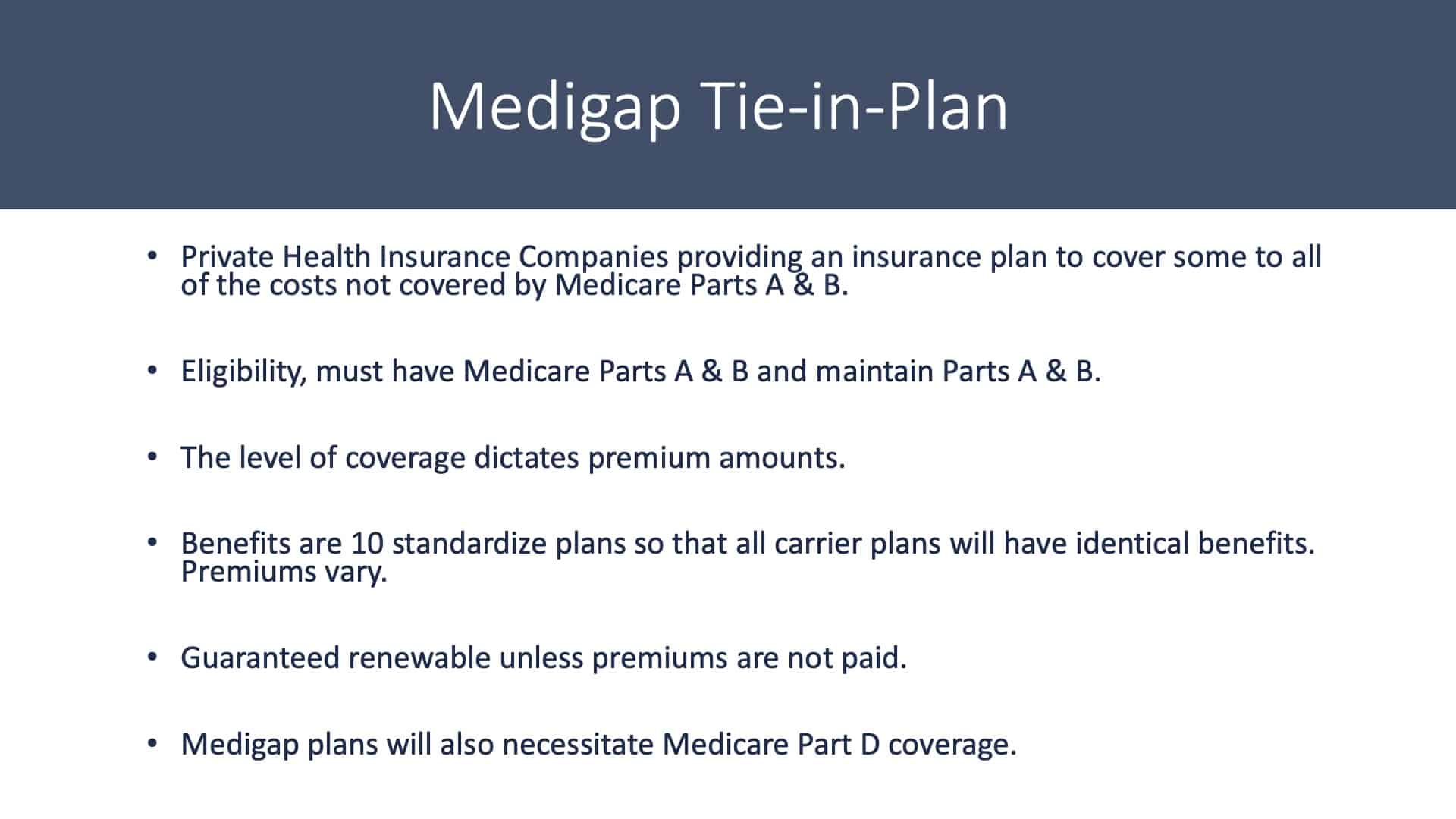

Medigap Tie-In Plans

We’ve talked about having traditional Medicare only. We’ve talked about Medicare Part C, commonly known as Medicare Advantage Plans. The Medicare supplement plans are kind of the Y in the road. You can choose a Medicare Advantage Plan or you can choose a Medicare tie-in plan, supplement plan, Medigap plan. They all mean the same thing.

It’s private health insurance provided from an insurance company to you. The Medigap tie-in plan covers a many or most of the expenses that are not covered by Medicare Part A and Part B. To be eligible to purchase a Medicare Medigap tie-in plan, you must have Medicare Part A and Part B. And you must maintain Part A and Part B. There are different levels of coverage. The higher the benefits, the higher the premium.

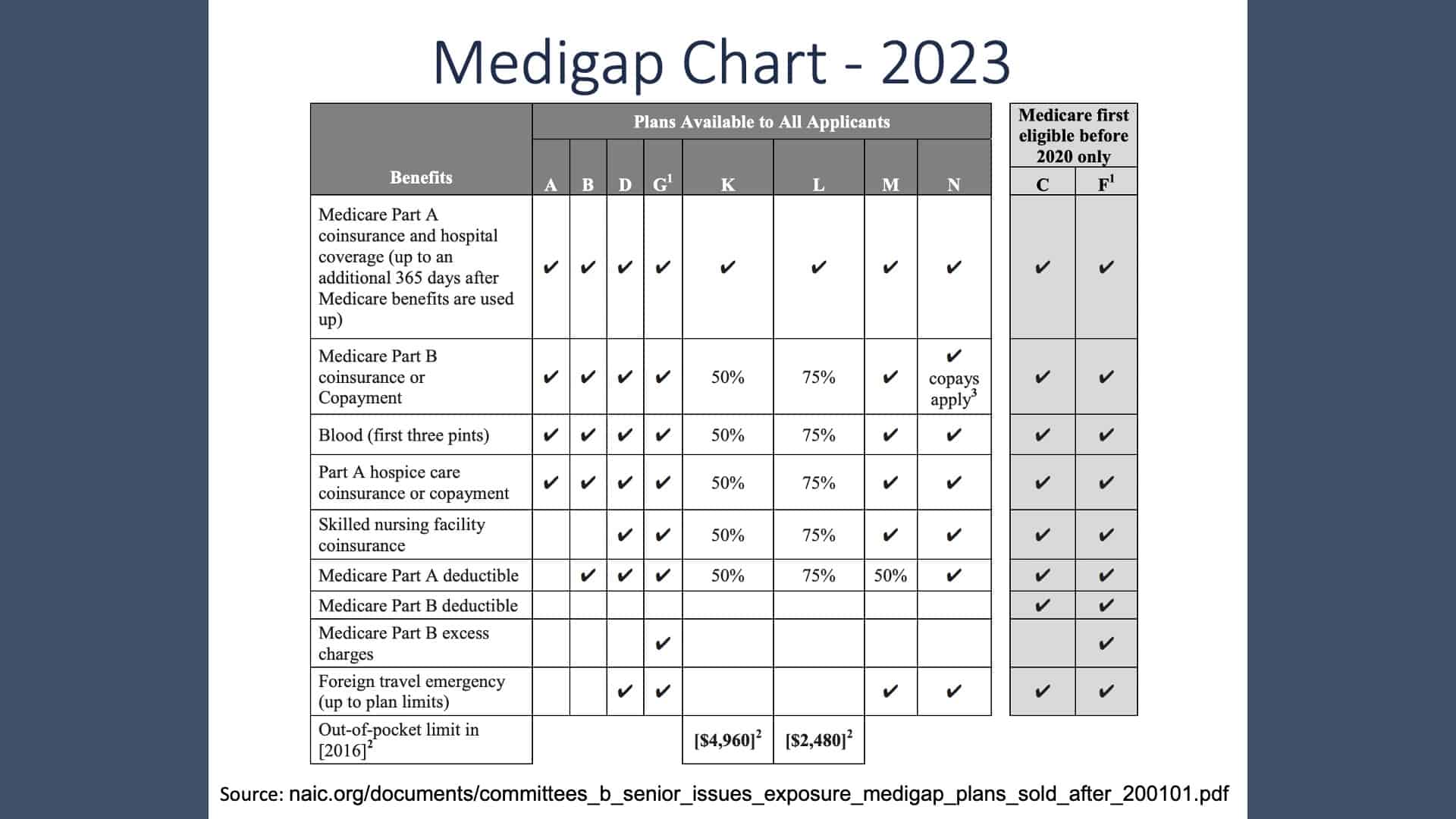

Medicare Part G is the highest tier of benefit under our Medigap plan. There are 10 standardized plans to choose from. The government standardized these plans in the 1970s. Tier G is going to include the same benefits irrespective of which carrier you purchase them from. The carrier can charge any premium that they choose or whatever the market will bear, but the benefit structure is standardized through Medicare.

Some Questions to Ponder

The policies are guaranteed renewable unless you simply stop paying the premium or if you drop or allowed Medicare Part B to be dropped. The reason I make a point of that is because this is a year that I have a $886,000 claim. What kind of an increase am I going to see? And more importantly, can they kick me out because I cost them too much money? Well, the answer is no. They must offer renewal. The renewal is going to be based on what’s considered community rating.

Everyone in my age and gender group and geographic area is going to receive the same increase. It’s not going to be based on the large claim that I had.

If you go with a Medigap or a supplement plan, consider purchasing a Medicare Part D prescription drug plan. Because the Medicare tie-in or the Medigap plans do not cover prescriptions. They cover the gaps in what Medicare Part A and Part B covers.

Since Medicare Part A and Part B don’t cover prescription drugs with a handful of exceptions, your tie-in plan or your supplement plan is not going to cover prescriptions as well.

Medigap Chart for 2023

I mentioned that the supplement plans are all standardized. They go through A through N with G being the highest tier. The A plan has the least benefits and the least premium. Again, we’d be happy to spend some time with you to explain to you what the different levels are and how they might impact you. There are some high deductible plans that have a lower premium that may be attractive to people that are experiencing better health.

8 Things to Know About a Medigap Policy

Again, Medigap, tie in, and supplement all mean the same thing. Here are eight things to know about Medigap Policy.

- You must have Medicare Part A and Part B to purchase it.

- If you have a Medicare Advantage Plan, you can apply for a Medigap policy, but make sure you can leave the Medicare Advantage Plan before the Medigap coverage begins. It is illegal to have a Medigap plan and Medicare Advantage Plan at the same time.

- You pay a private insurance company a monthly premium for your Medigap policy. That’s in addition to the monthly Medicare Part B premium.

- A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you’ll need to buy separate policies. Many carriers will offer up to a 15% if two people living in the same household receive their Medicare supplement or Medigap coverage from the same carrier.

- You can buy Medigap policy from any insurance company that’s licensed in your state to sell one.

- Any standard Medigap policy is guaranteed renewable even if you have health problems. This means the insurance company can’t cancel your Medigap policy as long as you pay the premium.

- Some Medigap policies sold in the past cover prescription drugs, but Medigap policies sold after January 1, 2006, after allowed to include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D).

- It’s illegal for anyone to sell your Medigap policy if you have a Medical Savings Account plan (MSA).

Why Is it Important to Buy a Medicare Policy When You’re First Eligible?

When you become eligible for Medicare Part B, a clock starts ticking. That clock ticks for six months. During that six months, you can go into any Medigap tie-in policy that’s sold in your service area without underwriting. The yes/no questions concerning health care and health care assessment are not even answered. It’s what’s considered a guaranteed issue period.

You go into that carrier with no underwriting whatsoever. After that six months, you will need to satisfy underwriting. That’s why I urge people to consider their Medigap carrier to be the carrier they’re going to be with for the balance of their life. Some people can pass underwriting and move to a different carrier, but most can’t because of preexisting health conditions. So, during that six-month window, it’s important to make that decision.

We’re Here to Answer Your Medicare Questions

We’ve covered a great deal of information in a very short time. Modern Wealth Management provides these Educational Series webinars to try to assist people in better understanding what they’re dealing with and the options they have. You can also see how the ABCs of Medicare relate to you personally by using Modern Wealth Management’s financial planning tool. Just click the “Start Planning” button below to use the same tool that Modern Wealth Management’s CFP® Professionals use from the comfort of your own home.

Also, please do not hesitate to contact me directly or contact me through Modern Wealth Management. Our whole purpose of this is to provide you the information and the background you need to make an informed decision. It is a very important decision and there’s opportunity for penalties. There’s opportunity for missing the time period when there’s a guaranteed issue period. And it’s just an important decision that many of us are going to have to live with during the balance of our life.

Again, my name’s Tom Allen. We thank you very much for your time and hope this has been helpful.

Schedule Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.