What Is Modern Wealth Management?

At Modern Wealth Management, our goal is to reimagine the delivery of financial advice. We want to ensure that you thoroughly understand your financial wellbeing by providing a full suite of wealth management services. The Modern Wealth Management team is built with experts specializing in financial planning, tax planning and preparation, risk management, estate planning, investment management, and more.

We strive to provide our clients with the confidence that they’re doing the right things with their money, freedom from financial stress, and time to spend doing the things they love. Confidence, freedom, and time.

How We Work

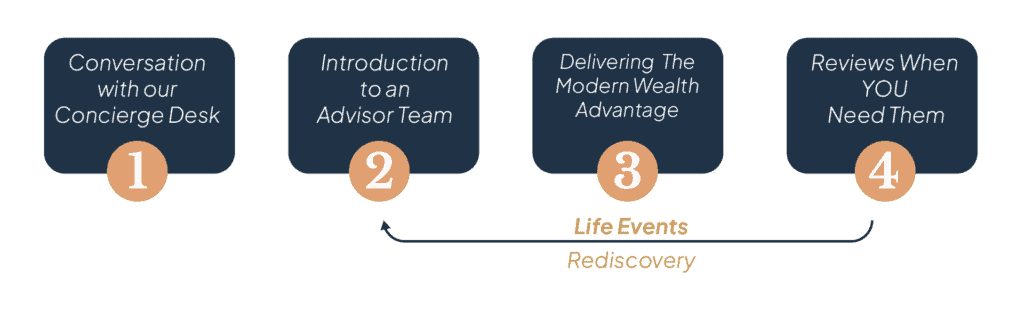

Our Process

- Conversation with our concierge desk

- Introduction to an advisor team

- Delivering the Modern Wealth Advantage

- Reviews when YOU need them

1. Conversation with Our Concierge Desk

- We’re glad you found us! Your first stop will be with our concierge desk.

- They’ll ask you some questions to better understand how we can help.

- Answer any questions you may have about our services.

- Gather some information.

- Schedule a time for you to meet with an advisor team.

2. Introduction to an Advisor Team

- When it’s time to meet with an advisor team, they’ll review the information gathered by the concierge desk.

- You’ll get to know each other.

- Determine if we should work together.

Moving Forward with Modern Wealth

If you’re interested in what Modern Wealth can offer you, there are two paths in which you can move forward.

Let’s Work Together

If you’re all in on Modern Wealth Management, it’s time to sign a client agreement. Then, we’ll set your next meeting, and we’ll start working together!

Let’s Talk More

If you still want to learn more about Modern Wealth’s services and our team, let’s schedule another meeting. We welcome the opportunity to keep getting to know more about each other.

3. Delivering the Modern Wealth Advantage

- Once you become a Modern Wealth client, we’ll walk you through some paperwork and set up your accounts.

- You and your advisor team will develop a robust financial plan.

- We’ll make sure we have every detail surrounding your financial life and goals.

- You’ll get access to an online portal to link your accounts.

- Your advisor team will work with our other subject matter experts as needed to support your goals and needs.

4. Reviews When YOU Need Them

- You’ll regularly meet with your advisor team based on your situation and schedule.

- We’ll keep a close watch on your financial plan, investments, tax situation, and goals.

- As life unfolds, we’ll monitor your plan as a team, and make necessary adjustments so you stay on track.

- Insurance and estate planning reviews are also recommended every other year, and we will bring those experts in when the time is right.

Understanding What Wealth Management Is All About

Many people think wealth management simply involves the managing of your investments. Asset management is important, but there’s so much more to wealth management than your investments. Wealth management must consider taxes, risk management, estate planning, investments, and most importantly—your goals.

Think of your investments as the fuel that powers your goals-based financial plan. Our team won’t take any more risk than is necessary with your money to accomplish your goals.

We’re Ready to Deliver the Modern Wealth Advantage

Our clients’ needs, wants, and wishes always come first. We’re ready to build you a plan that helps you gain more confidence, freedom, and time. Schedule a meeting below to get started.