Bear Market Rallies

Key Points – Bear Market Rallies

- The Uncertainty in the Markets Continues

- Analyzing the Bear Market Rallies of the Great Recession and Dot-Com Bubble

- Stress Testing Your Financial Plan to See How It Would Perform in a Bear Market

- Understanding Market Risk

- 8 minutes to read | 12 minutes to listen

We have rising interest rates and a stock market that is going crazy. There are so many individual stocks that are in bear market territory right now. We are seeing the probability of a little bear market rally. Dean Barber discusses that and so much more in May’s Monthly Economic Update.

Get a Complimentary Consultation Subscribe on YouTube

We’re Certain That These Are Uncertain Times

Let’s start off by just acknowledging that we are in very uncertain times. We have inflation that we haven’t seen in four decades. We have a Federal Reserve that is committed to fighting inflation even in the face of a slowing economy. There are a lot of different things that are happening right now.

I’m going to take you back through the Dot-Com Bubble and talk a little bit about what caused it. We’re going to talk about bear market rallies and we’re going to go through the Great Recession. Also, we’re going to talk about financial policy that was put in place after the Great Recession. What’s happening today is a result of the financial policies that were kind of making a new page off the Dot-Com Bubble as we came out of the COVID crisis.

An Update on the Major Indexes

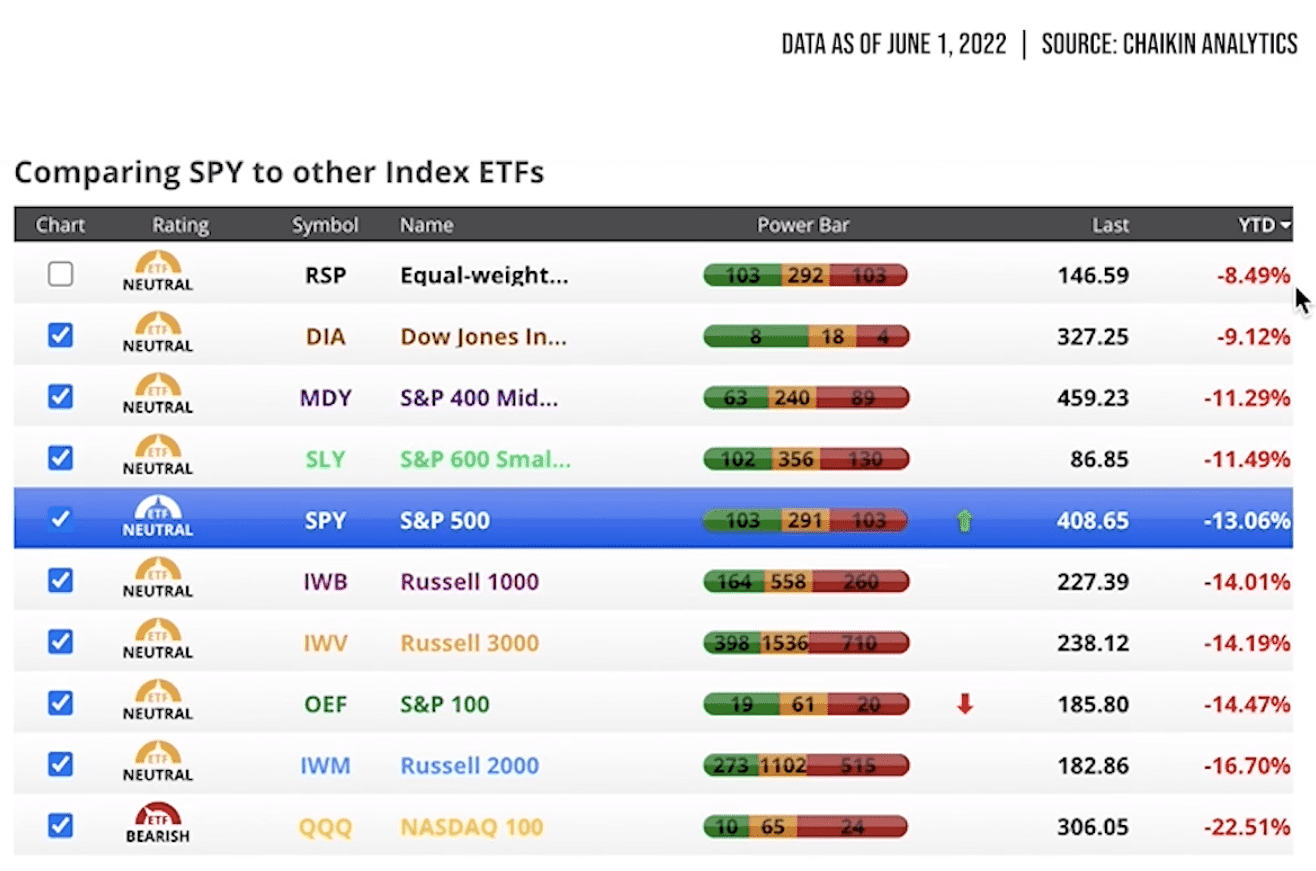

Now, let’s a look year-to-date at where we’re at on all the major indexes.

FIGURE 1 | Comparing SPY to Other Index ETFs | Chaikin Analytics

As you can see in Figure 1, the best performing index on a year-to-date basis is the RSP Equal Weight at -8.49%. And that’s after a big rally over the course of the last four or five business days. We’ll get to that rally here in just a few minutes.

The Dow Jones Industrial Average is at -9.12%. The S&P 500 is at-13%, while the NASDAQ Composite is at -22.51%. You can also see in Figure 1 how many of the stocks in each one of these indices are bullish versus neutral versus bearish.

All the indexes in Figure 1 are in neutral territory except the NASDAQ Composite, which is in bearish territory. It only has 10 stocks that are bullish, 65 that are neutral, and 24 that are bearish. The NASDAQ Composite is in bearish territory not just because it’s down by 22.5%. It’s because there are so many stocks within the particular index that are in bear market territory already. Some of them very deep in bear market territory.

Avoiding the Major Pain within the Traditional Bond Market

Nothing has gone unscathed this year. Last month, we talked a little bit about what’s going on in bonds. With interest rates rising, it’s unfortunately been difficult to make money in the fixed income sector. We’ve made some changes to the fixed income sector of all our portfolios. And with that change, we have saved some of the pain that would have occurred had we not made those changes.

We also made some changes in several of the portfolios to get more defensive on the equity side of things. One of the things that I would really encourage is to make sure that you’re talking with your financial advisor here at Modern Wealth Management and understand what risk you have inside your portfolio now.

Patience Is Pivotal During Bear Market Rallies

If you want to reduce risk, we’ve got ways that you can do that. Just make sure that it’s something that you’re comfortable with. I’ve been saying this now for four or five months, but when we get into times like this, the most important thing you can do is have patience.

These bear markets and volatile markets are not unfamiliar to us, but they’re always uncomfortable. They’re uncomfortable for everyone because nobody really has a crystal ball and knows when it all will come to an end. But it will come to an end. We will come out on the other side of this and return to a bull market. The question is, when will that happen and what should you be doing to protect yourself right now?

The Bear Market Rallies During the Dot-Com Bubble

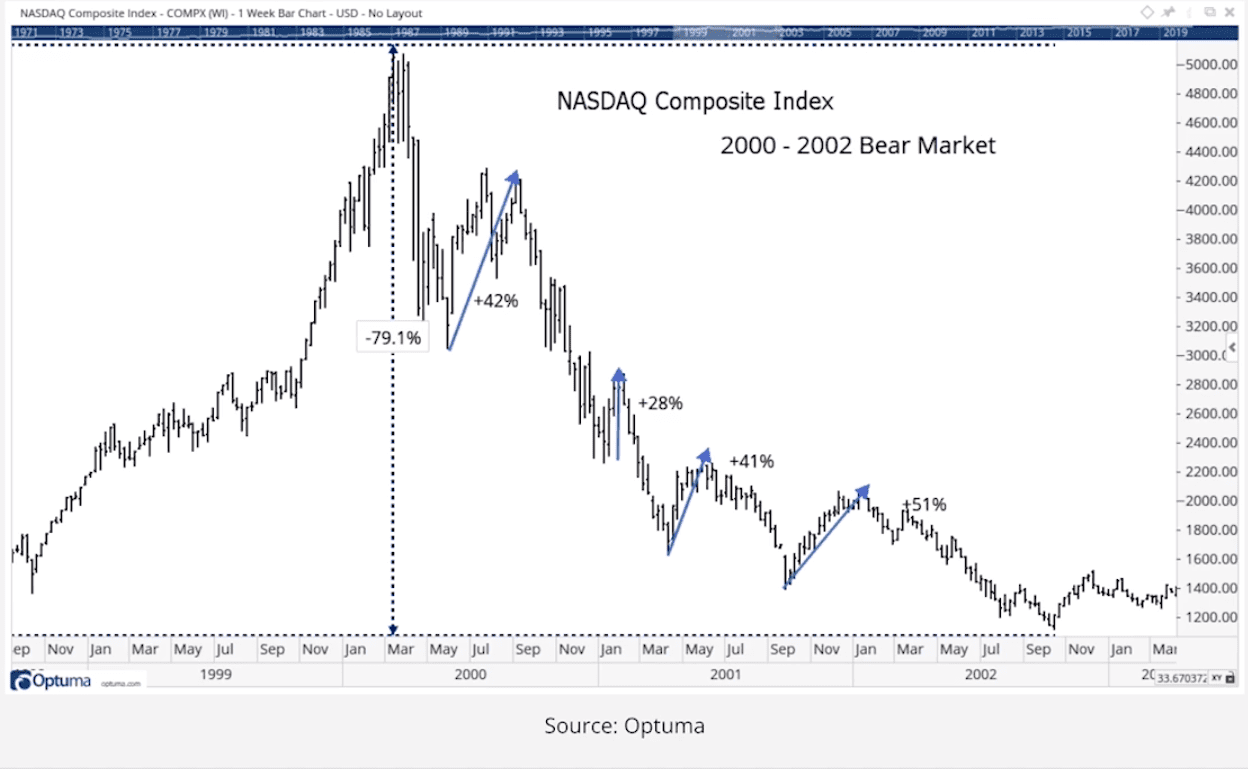

I want to take a step back and discuss what happened with the Dot-Com Bubble bursting. We’re going to talk about bear market rallies.

FIGURE 2 | NASDAQ Composite Index 2000-2002 Bear Market | Optuma

From March 2000 to September 2002, the NASDAQ Composite had a total loss of 79%. What happened during that almost three-year period that I find fascinating is you have these huge bear market rallies that can occur during bear markets. Basically, your longer-term bear market is what’s called a secular bear market. Then, you can have cyclical bull runs within that secular bear market.

There was a cyclical bull market run that lasted for about two, three months to bring the market up by 42%. Another bear market rally brought the market up by 28%. A third one brought it up 41%, and the final bear market rally that brought the markets up by 51%. However, it fell even further by almost another 50% from that final bear market rally.

Scott Minerd Mulls the Future of the Markets

A lot of people in our industry that refer to these bear market rallies as bear market traps. I don’t know when the end of this market volatility will come along. I do know that Scott Minerd, who’s the chief investment officer at Guggenheim, stated last week that he believes that the S&P 500 could fall 45% from its January high and that the NASDAQ could fall as much as 75% from its November 2021 high.

All this is in reaction to the Fed kind of taking away the punchbowl. The Fed is not going to be able to be accommodative to the stock markets right now. They need to get back to a more normalized rate environment and shrink their balance sheet. That is going to be forced to be done because of inflation, even in a market that we said earlier in the year was overvalued.

Is There Money to Be Made in a Bear Market?

So, will we have chances to make money during the bear market? Absolutely. You can see that in the bear market rallies outlined in Figure 2. But it’s also important to know that sometimes it’s OK to take some risk off the table. It’s OK to be a little bit more conservative. The last thing that we want to do is to see the markets erode the wealth that you’ve accumulated over time. We know that we still need to generate income through these periods.

We’re working very diligently at Modern Wealth Management to make sure that we not only keep you safe during these periods, but also have an opportunity to get growth when the right time occurs to get that growth.

Bear Market Rallies During the Great Recession

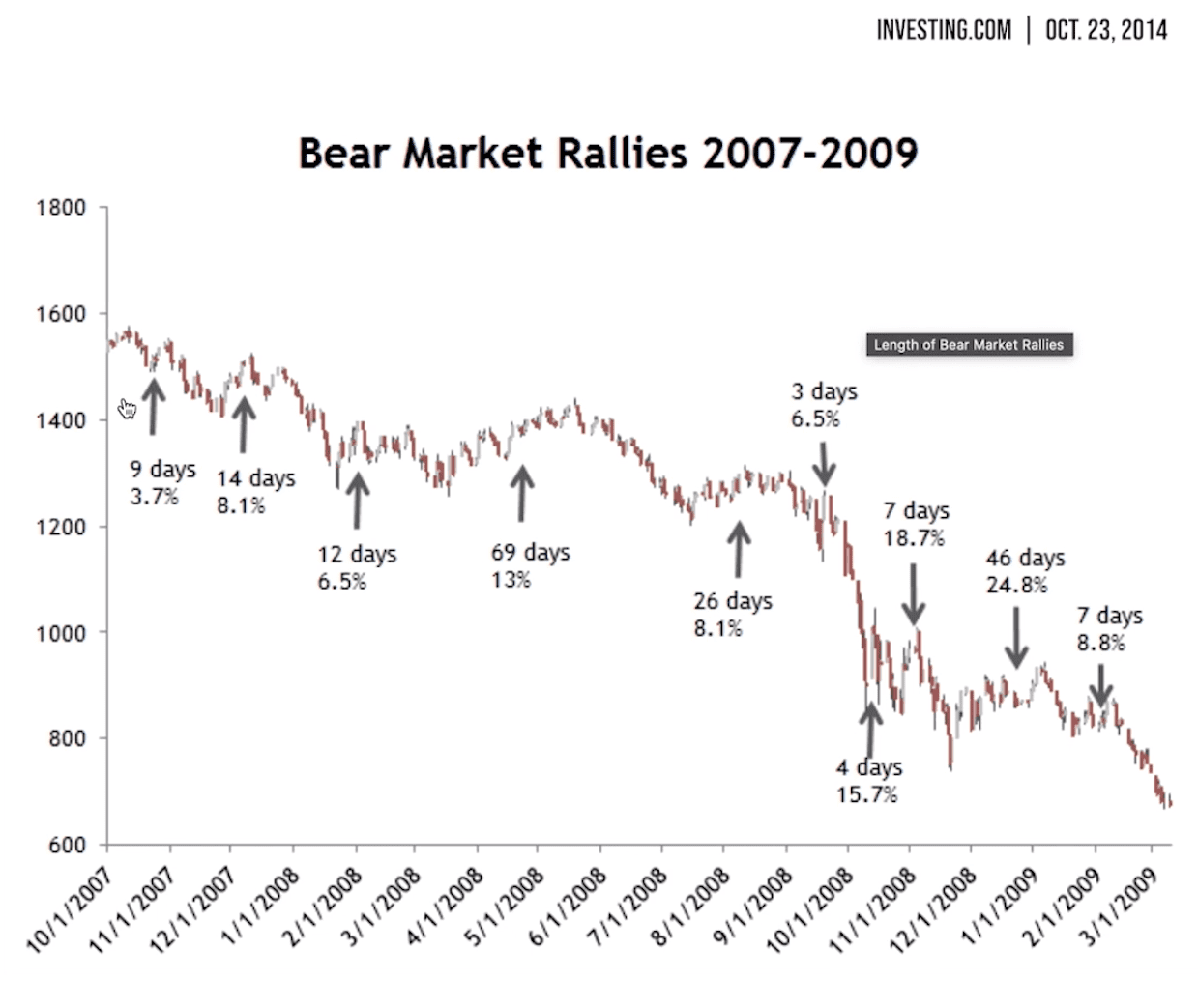

Let’s now look at the bear market rallies that occurred during the Great Recession.

FIGURE 3 | Bear Market Rallies 2007-2009 | Investing.com

And as you can see in Figure 3, there were 10 bear market rallies that occurred through the 2008 financial crisis.

The biggest one was a 24% increase that lasted 46 days toward the end of 2008 and early 2009. There was a 26-day bear market rally that went up 8.1%. There was a three-day bear market rally that went up 6.5%, only to see the index fall by 25% to 30%. Then, there was a four-day bear market rally that brought the markets up by 15.7% and a seven-day bear market rally that bought the markets up by 18.7%.

These wild swings in the markets are normal during bear market cycles. In fact, if you go back and look at the history of the best days in the stock market, most of them occurred during bear markets. But that doesn’t mean that you simply say, “Well, I’m going to stay in the market through the whole bear market just so that I can get those best days.”

Lower Highs and Lower Lows

You really need to understand that the markets will continue to drop. And we see that right now. When the markets are rallying, they’re making lower highs. And then when the markets are falling, they’re making lower lows. That’s very typical in a bear market. I expect the volatility to continue through the summer.

I also expect for interest rates to continue rising. The silver lining would be that if we get our next couple of inflationary numbers and the Fed can see that the inflation has started to subside, that can allow the Fed to begin increasing rates at a slower rate and maybe not as rapidly as what some of the Fed presidents are wanting.

Where Will the Fed Funds Rate Go from Here?

Several of the Fed presidents that are saying they’d like to see the Fed funds rate between 3% and 3.5% by the end of this year. Right now, it’s between 0.75% and 1%. We’re seeing the 10-year treasury just below 3%. If the Fed funds overnight rate reaches 3% to 3.5%, that means that we would probably see the 10-year treasury increase to 4%, 4.5%, maybe even 5%.

There are many people that are calling for the 30-year mortgage to be between 6.5% and 7% by the end of the year. That obviously will have a dramatic impact on refinances and on purchases of existing homes and purchases of new homes. There are just a lot of unknowns right now. What’s going on with Russia’s invasion of Ukraine is exacerbating the problem by causing disruption in food and oil supply.

Those two things alone will continue to cause inflation to rear its ugly head. The Fed has a really difficult time in front of them, so we’re going to need to have some patience as we get through this. And again, I think the most important thing is that we make sure we take a step back. That’s what we do all the time at Modern Wealth Management.

Stress Testing Your Financial Plan

If you want to see how this is done, have our advisors take you through the stress testing of your plan through bear market cycles so that you can see how it would perform. What would be the outcome of your plan be at the end of the Dot-Com Bubble or Great Recession?

It might not be a time when you want to be quite as aggressive. Maybe you should take more of a balanced approach. There will be opportunities for making money over the next several months, but you need to be in a cautious mode as you do that. I don’t want to sound like gloom and doom for the markets. I still believe, as I started saying early this year, that there’s going to be quite a bit of volatility.

Could the Markets Be in Positive Territory by Year’s End?

There’s been more volatility than what I anticipated, but it’s still very possible that by the end of the year that we could see the markets back in positive territory. So again, patience is key. Understand what the downside risk is in the holdings that you have today is also key. We can share that with you through the technology that we have at Modern Wealth Management.

We’re Here to Help

I hope everybody’s having a very beautiful beginning to summer and getting time to enjoy your families. And with that, I want to thank you for joining me for the Monthly Economic Update.

If you’re not a client of Modern Wealth Management, but would like to know how what you’re holding today would have performed through the Dot-Com Bubble and through the Great Recession, you can schedule a 20-minute “Ask Anything” Session or Complimentary Consultation with one of our CFP® professionals.

In that session, they can share with you our industry-leading financial planning software. From the comfort of your own home, you can start building out that plan so that we can stress test it through all those market cycles for you. Thanks again for joining us for the Monthly Economic Update.

Schedule a Conversation

Click below to select the office you would like to meet with and check the calendar. We can meet in person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your conversation.

Get a Complimentary Consultation

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.