How to Mitigate Inflation on Healthcare Costs

Key Points – How to Mitigate Inflation on Healthcare Costs

- Keeping Healthcare Costs in Mind During Hectic Times

- Comparing Healthcare Costs Inflation to Economic-Wide Inflation

- Inflating Healthcare Costs Higher for Someone with Extenuating Healthcare Issues

- The Cheapest Way to Mitigate Inflation in Healthcare Costs: Preventative Care

- 6 Minutes to Read

Keeping Healthcare Costs in Mind During Hectic Times

Healthcare costs are oftentimes top of mind for retirees and pre-retirees alike. And as we recently shared in our article, Health Insurance Options for Retirees Under 65, that’s especially true for people who are thinking about retiring early.

Healthcare costs are something that shouldn’t ever be put on the back burner, but needless to say, there is a lot going on in the world right now. Of course, everyone’s eyes are on what has been happening with Russia’s invasion of Ukraine. Even if you haven’t been paying close attention to the Russia/Ukraine conflict, we’re all being impacted by it.

While inflation had already been rearing its ugly head, there tends to be a direct correlation between war times and rising gas prices. Unfortunately, they’re expected to keep rising, as analysts are projecting that some cities will start to see an average of $5 per gallon in a few weeks.

Even prior to Russia invading Ukraine, the likelihood of the Federal Reserve raising interest rates was already causing a lot of concern as well. As we see a shift from quantitative easing to quantitative tightening from the Fed, the first of a few rate hikes could very well come following the Fed’s March 16 meeting.

Economic Uncertainty Continues As COVID-19 Cases Plummet

Between his weekly discussions with Bud Kasper on America’s Wealth Management Show and his latest Monthly Economic Update with Logan DeGraeve, Dean Barber has thoroughly documented how all the uncertainty surrounding Russia/Ukraine, the Fed and interest rates, and inflation has caused the markets to go haywire. However, it was just a few weeks ago that there was another component contributing to this economic uncertainty. COVID-19 cases were skyrocketing in December and January due to the Omicron variant, but thankfully they are now plummeting.

While we can be hopeful that there won’t be another significant COVID-19 wave this spring, summer, or in the foreseeable future, this is a good time to remember that it’s important to take care of ourselves in all aspects of our health year-round. So, to avoid healthcare being put on the back burner, we’re going to discuss how to mitigate inflation in our healthcare costs.

Comparing Healthcare Costs Inflation to Economic-Wide Inflation

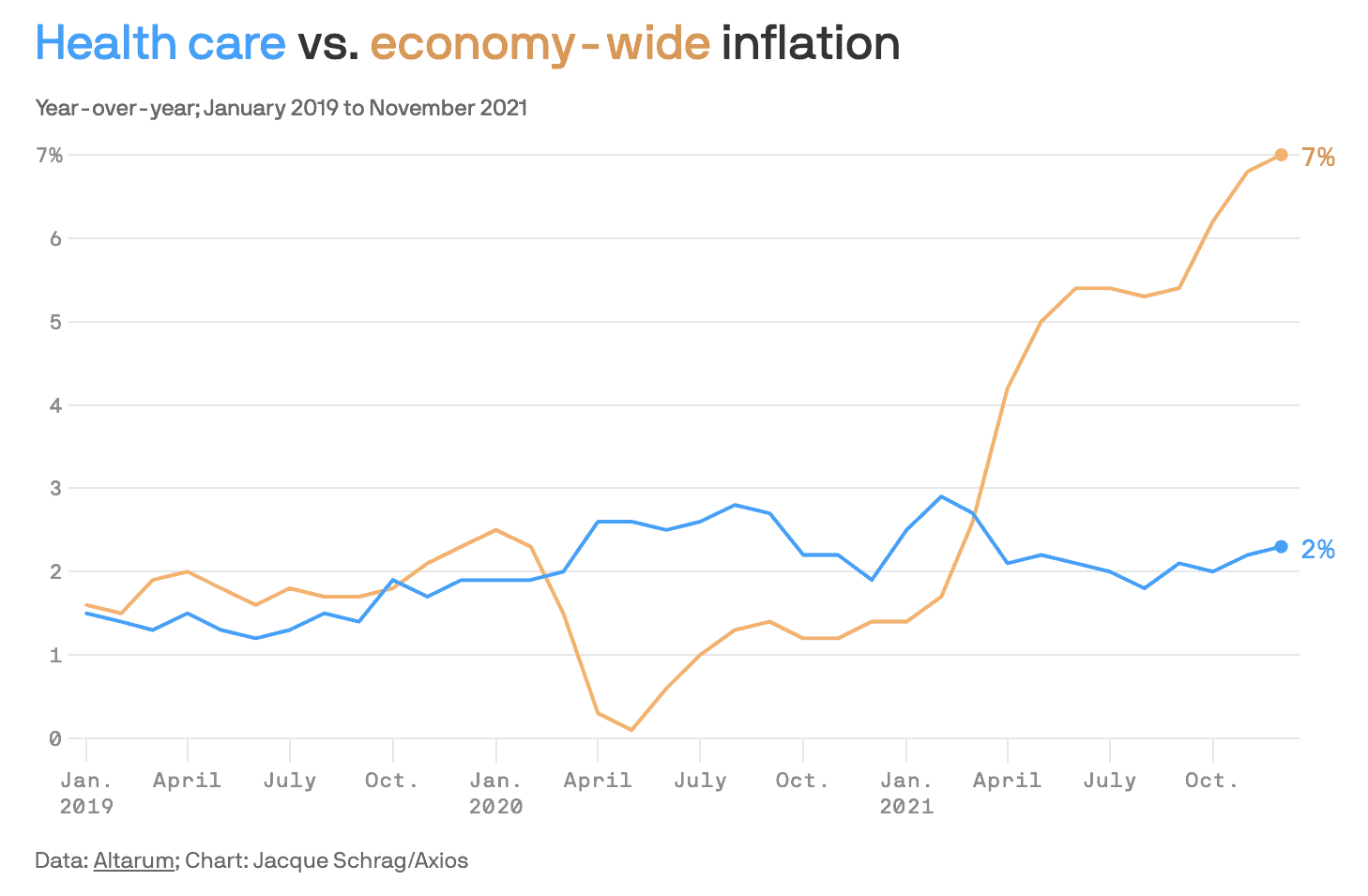

While year-over-year inflation continues to soar well over 7%, inflation’s impact hasn’t been felt as hard with healthcare costs. According to Axois, inflation of healthcare costs has been between 2% and 3% since the onset of the pandemic two years ago. You can see how that’s compared with economic-wide inflation in Figure 1.

FIGURE 1 | Healthcare Costs vs. Economy-Wide Inflation | AXOIS

However, we all know that healthcare costs are far from cheap to begin with. So, whether or not inflation of healthcare costs rises—even if it’s incrementally—mitigating it is in everyone’s best interests.

Common Questions About Inflation as It Pertains to Healthcare Costs

With being right in the thick of tax season, our tax team members have been fielding all sorts of questions—some of which have been related to healthcare costs. Let’s do a quick Q&A.

Questions: I’m paying so much for my medical premiums. Are they going to be deductible? How does it impact my taxes?

Answer: Those are great questions to ask, as it’s only logical to wonder if you’ll get help from a tax perspective, especially as premiums go up due to inflation. It depends on the individual’s situation and the rest of their income that they have. We still have the 7.5% floor that you need to exceed. Once again, it comes down to the retirement distribution.

Question: Should I be getting health insurance off the exchange and spend down on my taxable account or look at Roth conversions because of the long-term impact on the plan?

Answer: There is a whole lot to unpack with that question. As we discussed when reviewing health insurance options for retirees under 65, long-term income is the goal for everyone in retirement. Roth conversions can be an excellent way to recognize capital gains and build long-term income to mitigate any inflation with your healthcare costs. But remember, everyone has their own unique answers for their unique health and financial situation. If you’re struggling with how to mitigate inflation with your healthcare costs, our team of professionals is here to help.

Budgeting in Retirement to Mitigate Inflation of Healthcare Costs

Earlier this year, Dean helped to explain seven ways to build the best retirement plan. In doing so, he shared that it’s important to think of your financial plan as a spending plan. Here is a hypothetical scenario in which he shares how healthcare costs and their inflation rate are incorporated into a plan.

“Let’s say that you’re retired and your annual budget is $100,000,” Dean said. “In this example, your healthcare costs will amount to about $20,000 of that $100,000. To build a plan that has a flat, 8.5% inflation rate, that’s going to give you a 3.5% raise every year on that $1,000. However, healthcare costs are moving higher at 6.5% to 7%. In time, your healthcare costs are making up greater than what was initially 20% of your budget. So, the higher healthcare costs affect your standard of living negatively if you don’t factor them in. You may have the right inflation rate assumption on the plan, but if you’re not using the right inflationary assumption on healthcare, that’s when things can start to look bad.”

What We’ve Learned About Mitigating Inflation in Healthcare Costs in Recent Years

Each of our CERTIFIED FINANCIAL PLANNER™ professionals echo Dean’s dedication to providing financial education to clients and prospective clients. To do that to the highest level, our team is continuously educating ourselves about the best financial planning techniques. We used to lump a lot of living expenses—healthcare expenses included—together when building financial plans.

For the past couple of years, though, we have proactively separated healthcare expenses because of the many different stages involved. The separation that we do is on spending. The 3.88% is our inflation factor and then for healthcare costs, we go to 6.7%. We make it a deliberate point to separate these expenses out.

One of the biggest challenges we run into is that we always start with kind of a national average of healthcare costs. But it’s amazing to hear how some of these prescription drug costs are way higher than some of the averages. You can’t assume that everyone is going to have a ballpark figure for healthcare costs. It’s going to be unique based on each person’s health circumstances. We work with people who have yet to reach Medicare age as well as those that have. The two spouses could be at different stages health wise.

Speaking of Medicare, we know how complicated it can be. We’ve been fortunate to have Medicare expert Tom Allen to join us on The Guided Retirement Show™ to help explain its nuances. We hope you can benefit from his Medicare expertise shared in the following episodes.

- Understanding Medicare Options, Costs, and Coverage

- Understanding Medicare Options, Costs, and Coverage Pt. 2

- Medicare Supplement Plans, A Closer Look

Inflating Healthcare Costs Higher for Someone with Extenuating Healthcare Issues

While we would love for all our clients and prospective clients that we work with to be in great health, we know that isn’t always the case. The reason we go up to that 6.7% inflation rate for healthcare costs is not only to compensate for how expensive they can be, but also to account for any unexpected health issues that arise.

Obviously, some healthcare issues are more serious than others. For the more serious issues, we’ll want to consider inflating healthcare costs even higher within the plan. For example, let’s say that someone is undergoing cancer treatments. Unfortunately, insurance might not completely cover specific parts of their treatment plan. So, we’ll inflate healthcare costs higher in their plan, if for no other reason to give them peace of mind that they’ll be OK financially.

The Cheapest Way to Mitigate Inflation on Healthcare Costs: Preventative Care

Healthcare costs are no doubt a critical element of someone’s retirement, as is inflation. It’s no secret that the older we get, the more medical attention that we will likely need. We want to wrap up here by reminding you of some of the easiest ways to mitigate inflation in healthcare costs. We’re talking about preventative care options.

Dean knows all about the importance of preventative care from a personal level. About a decade ago, he wasn’t taking the best care of himself. He remembers having to go to the hospital as a 47-year-old because he thought he was having a heart attack. Now, Dean exercises regularly, eats healthier, and prioritizes many other forms of preventative care to help decrease possible health scares.

Along with making sure he stays healthy, Dean wants all Modern Wealth Management clients and prospective clients to benefit from preventative care. That’s a big reason why he welcomed Dr. Laura Lile as a guest on The Guided Retirement Show™. Dean has learned a lot from Laura, and so can you by listening to, How Preventative Care Can Keep You Healthy in Retirement.

We’re Here to Help You Live Your One Best Financial Life

With preventative care physicians like Laura sharing their medical expertise and our team’s willingness to provide financial education, there are a lot of resources to help you in the battle of mitigating inflation on healthcare costs. Our number one goal is to help you live your one best financial life.

If you have any questions about how to mitigate inflation on healthcare costs, we encourage you to schedule a complimentary consultation or a 20-minute ask anything session with one of our CERTIFIED FINANCIAL PLANNER™ professionals. We can meet with you by in person, virtually, or by phone.

Schedule Complimentary Consultation

Select the office you would like to meet with. We can meet in person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Lenexa Office Lee’s Summit Office North Kansas City Office

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.