IRA Planning for 2022

Key Points – IRA Planning for 2022

- The Difference Between Roth and Traditional IRAs

- Reviewing Your Beneficiary Designations

- Organize Your Accounts to Mitigate Risks and Diversify

- The Crucial Component of Tax Diversification in IRA Planning

- Highlighting the Nuances of RMDs and QCDs

- 15 minutes to read | 30 minutes to watch

After reviewing 401(k) planning for 2022 in January, we’re slightly shifting gears here for this Modern Wealth Management Educational Series event to discuss IRA planning for 2022. While a 401(k) is often people’s largest asset, IRAs are oftentimes their second largest asset. Chris Rett recently joined Dean Barber to break down IRA planning for people at various stages of their lives.

Schedule a Complimentary Consultation Subscribe on YouTube

Video Resources:

- Ed Slott | Podcast Ep. 32 – How to Avoid the Biggest Tax Traps

- Ed Slott | Podcast Ep. 45 – Creating a Tax-Free Retirement

- Spring Cleaning Your Retirement

- Sign-up for our Modern Wealth Management Educational Series

- Retiring with $1 Million

IRA Planning Early in Your Career

Your IRA is something that you need to pay attention to. There are certain things to be aware, especially for pre-retirees and people that have retired and had a 401(k) and rolled it over to an IRA. Those are really two distinct type situations. First, though, let’s discuss IRA planning for people who are in their earlier working years.

The Difference Between Traditional and Roth IRAs

A good place to start when reviewing IRA planning early in your career is highlight the difference between traditional and Roth IRAs.

“The first thing with a traditional IRA is that everything that goes into it, you’re not going to pay taxes on,” Chris said. “It’s tax deductible, so it’s going to come off your income. The premise behind that is that it’s going to be growing and you’re not going to pay taxes until you take a distribution out at retirement.”

Once you reach retirement, you take it out and It’s taxed as ordinary income for whatever the given tax rate happens to be at that year. One thing that happens on the traditional IRA as person makes contributions to it is that if their income gets too high, the deductibility phases out over time. Then, it ultimately becomes a non-deductible contribution.

“Whether it makes sense to make a non-deductible contribution is really going to depend on a person’s overall financial situation,” Dean said. “The Roth IRA, on the other hand, also has its earnings limits. But when you put money into a Roth IRA, you don’t get to deduct that on your tax return.”

The benefit of the Roth IRA is that you get the compounding interest growing tax-free. When you go to take it out at retirement, you’re not going to pay taxes on it.

How Ed Slott Looks at IRAs: The Seed or The Harvest

Throughout Dean’s never-ending mission to provide financial education to Modern Wealth Management clients and prospective clients, he studies with several like-minded individuals. One of those people is America’s IRA expert, Ed Slott. You can learn all about IRA planning from in the following episodes of The Guided Retirement Show™.

Ed explains the traditional IRA like a farmer who buys the seed to plant the crops and gets to deduct the cost of the seed. Then, the farmer plants the seed, the crops grow, but he needs to pay tax on the entire harvest. For the Roth IRA, the farmer is taxed on the seed before planting it. But when the harvest comes out, the farmer gets the whole harvest tax-free. In this scenario, Dean says there is no farmer he knows that would ever do the traditional IRA versus the Roth.

“They would want to pay taxes on the seed. You pay taxes on the deposit, but then all the future earnings on that and the distributions later in life are totally tax-free,” Dean said. “I encourage people, especially as they start saving in their younger years, to forget about the tax deduction. It’s going to be meaningless over the long-term because you’re at a low tax rate then anyway. Pay the taxes on it, put the money into the Roth IRA, and get that compounding started.”

How Should Younger Workers Invest Their IRA Money?

A lot of younger investors aren’t at their peak earning years yet either. Factor that in along with the low tax rates, and it really is advantageous to strongly consider Roth IRAs. Contrary to a lot of our clients who are nearing retirement or have retired, people in their 20s and early 30s should have a lot more exposure to the market.

“You want to heavily invest in the market to get that compounded growth that we mentioned,” Chris said. “Whereas near-retirees have the concern of market volatility, those early in their careers aren’t as worried about it since they have time to grow it back.”

Setting Up a Systematic Deposit

If young investors know they’re going to max out their Roth IRA each year, set up a systematic deposit and deposit the same amount every month. That’s dollar-cost averaging. They’re going to buy the shares of whatever ETF, fund, or stock at the price that it is on the day that they put it in that month.

So, they’re going to average that price out over the course of the year. If they get a lower price because the markets are down a little bit, they’re buying more shares. They’re getting it at a discount. It’s really a great way to do that as opposed to writing a one-time check each year into that either traditional or Roth IRA.

“We look at this as time in the market versus timing the market. It’s tough to time the market,” Chris said. “Even the greatest analysts in the world have a very hard time timing the market. It’s better to systematically do it each month with quarterly rebalances.”

Beneficiary Designations

A lot of times when younger people start saving money, they may not be married yet. However, they still need to designate a beneficiary. Beneficiary designation on the IRA or Roth IRA dictates where your money goes if something happens to you.

“I have a beneficiary designation horror story, but it involved a life insurance policy rather than an IRA or 401(k),” Dean said. “This guy had been sold a life insurance policy when he probably didn’t even need it. When he bought the policy, he was single and named his dad as the beneficiary. He got married, subsequently had two children, and suddenly developed an incurable brain cancer. Within six months, he passed away. So, he had this $1 million policy, but his dad was still the beneficiary. The wife and the two young kids got nothing. Therefore, a lot of fighting ensued along with the grieving.”

It doesn’t matter what age you are. You need to review your beneficiary form at least once a year to make sure it’s what you really want. Along with reviewing beneficiaries once a year, keep them in mind and update them when you have major events such as marriages, divorces, and death of a loved one.

“Dean’s example happens more often than it doesn’t. As we’re sitting down with clients, we ask them,” Chris said. “What is your estimated life expectancy? A lot of them have no idea. It really is important to have these things figured out ahead of time. When the client passes away, it’s oftentimes unexpected and there’s not a lot we can do as financial planners.”

The Beneficiary Form Has Final Say

At that time that the beneficiary form is filled out and finalized, it’s a legal document and has the final say. You can take the beneficiary form to any court and it will be upheld.

We also highly recommend for workers of all ages and retirees to have secondary and tertiary beneficiaries. We never like to see tragic scenarios unfold, and it’s even worse when there’s a snowball effect due to a lack of proper IRA planning.

“Let’s say you’re married and you have your spouse as the beneficiary. Then, you have kids, but don’t list them as contingents,” Dean said. “If you and your spouse you die in a plane crash or car crash or something like that, the IRA money suddenly has no beneficiary. That means it all gets forced out and becomes taxable. Then, the probate courts dictate where the money goes and charge a hefty fee when making that decision.”

So, you can see the importance of not only reviewing beneficiaries annually, but also following major life events. Dean and Drew Jones took an even deeper dive on reviewing beneficiaries during another recent Modern Wealth Management Educational Series event, Spring Cleaning for Your Retirement for 2022. That can also help you with your IRA planning for 2022.

IRA Planning in Your 40s and 50s

Now that we’ve covered IRA planning for individuals who are in the early stages of their careers, let’s shift gears to those in their mid-40s to late 50s. While that is a broad age range, many of those people are starting to think seriously about retirement. As they continue to accumulate assets, there are a few more things to be thinking about when it comes to IRA planning.

“Along with retirement planning, they need to start thinking about life insurance. Several people in that demographic are married and have kids,” Chris said. “With their IRAs and 401(k)s, they need to check with their employers to see how they can contribute to them. If they have employer matching, what is that matching? With every client that we sit down with, we want to make sure we’re maximizing their contributions to get those employer contributions, especially if they’ve had a job change or come into some money.”

Another thing that is becoming more common is that workers aren’t staying with one company for the majority or entirety of their careers like they used to. Therefore, people are creating a 401(k) and get that match. Then, they’ll get another job, possibly leave that 401(k) behind, and start putting money in another 401(k). That cycle can oftentimes continue for people who keep changing jobs.

“I can’t tell you how many people in their 50s who we’ve talked to that might have four different 401(k) plans and three or four different custodial IRAs. They’ll have all kinds of stuff scattered all over the place,” Dean said. “It’s almost like they’ve taken the junk drawer approach to investing. Except that’s not diversification. When scatters out like that, it’s really hard to track and manage what you have.”

Organize Your Accounts to Mitigate Risks and Diversify

It can be hard to understand what risk is, but that’s something that you really need to start thinking about in your 50s. Look back to what happened in the 2000s with the Dot-Com Bubble or The Great Recession. It’s critical to pay attention to risk during bear markets and those types of events.

Consolidating Your Accounts Is Critical for IRA Planning

While it’s unknown when the next bear market will be, there is obviously a lot to keep tabs on right now in the markets. Major events in the markets can put off one’s retirement by a few years or prevent their ability to even get to retirement. As you enter those pre-retirement years, it’s pivotal to sit down with your advisor and make sure you have proper balance.

“When talking about IRA planning for 2022, the idea is to have consolidation. At the most, I think that a couple should have four IRAs—one Roth and one traditional for each spouse,” Dean said. “You can get all the diversification you need in a single IRA. You don’t have to diversify or fund companies. Get somebody that you can trust and work with to create the right asset allocation.”

Having the critical craft of proper IRA planning consolidation makes it much easier to manage and track your accounts and much easier to plan. So, don’t wait to consolidate.

IRA Planning as You Go into Retirement

That brings us to IRA planning for people who are preparing to transition into retirement. This is where Dean says that the fun starts with IRA planning because you get an opportunity to start taking advantage of the tax code.

“When you’re in retirement, you have more control over your taxes than at any time during your working career unless you happen to be a business owner,” Dean said. “Where your withdrawals come from out of which account and at what time dictates how much tax you will pay.”

The Crucial Component of Tax Diversification in IRA Planning

Part of having control when you retire is making sure you have different tax buckets to pull from. Dean went over the importance of tax diversification in detail in a video titled, Retiring with $1 Million. The video outlines tax diversification strategies for four different couples and how they can retire with $1 million.

As you start to think about tax diversification and distribution strategy, suddenly you’ve got to start thinking about your Social Security claiming strategy. How and when you claim Social Security will dictate how and when you take distributions from which IRA—the Roth or the traditional. Or do you spend from an account that’s taxable?

“When you’re getting close to retirement, you should start projecting where your income is going to come from,” Dean said. “What opportunities are you going to have to move money that’s in the traditional during retirement over to your Roth? Can you do it at a tax rate that was lower than what you deducted it at, whether it was going into your 401(k) plan or into your deductible IRA?”

Forward-Looking Tax Planning

As an example, let’s say somebody is in their 50s and in their peak earning years. they’re up in the 32% tax bracket. If they’re putting in pre-tax in their 401(k) in that 32% bracket, they’ve got the tax diversification. They can start to do some conversions from traditional to Roth and convert all the way up to the top of the 12% bracket. Suddenly, they have money in a Roth IRA, only paid 12% tax on it, and got deducted at 32%. That’s when you really start to win the game of paying less taxes over your lifetime.

The same rules apply with growing that money tax-free. The idea is that you’re retiring with tax diversification. You will have money to live on and can put some off to the side that can grow tax-free somewhat more aggressively than the rest of your accounts.

Roth IRAs Don’t Have RMDs

The other part about the Roth IRA is that it doesn’t have a Required Minimum Distribution. So, you’re not forced at any point to start taking money out. At age 72, IRAs are structured in a way that make you take distributions. Roth conversion, when it benefits, can help.

“For example, maybe you had a year where you lost a job and it took you six months to get a job. During that year, you were down in a low tax bracket,” Dean said. “Take advantage of it. Convert a little bit of that traditional IRA over into the Roth IRA and let that tax-free compounding begin.”

And it’s not only with Roth conversions. Chris recently had a situation with a client who is nearing retirement that inquired about tax strategies. Chris explained that they can contribute what the IRS dictates of $7,000-plus catch-up of an additional $1,000. That’s $7,000 each spouse, so $14,000. Or they could use that to pay the taxes on what in that case was a $50,000 conversion. They elected to move $50,000 of tax-deferred to tax-free as they begin with a five-year window until they retire. They can access that and grow it tax-free.

“In that scenario, that becomes a no-brainer. Utilizing our Guided Retirement System, people can see what the dollar difference is, not just in the portfolio value, but in the amount of taxes they’ll need to pay,” Dean said. “At the end of the day, we’re striving to get as much money into the individual or couple’s checking account as possible after taxes during their retirement years.”

You Can’t Control Tax Rates

Of course, there are some variables that you can’t account for while financial planning. It would be easy if everyone knew what future tax rates would be and exactly when they were going to pass away. If those two things were known, financial planners could project peoples’ financial futures with much more conviction. Those unknowns, though, make it that much more important to have a tax plan, whether you’re beginning your career, nearing retirement, or already retired.

Rebalancing as You Approach Retirement

Rebalancing is another important risk control strategy, especially for those in pre-retirement years. There is offensive and defensive rebalancing. Defensive rebalancing occurs when your equity exposure gets bigger than what you want it to be after outperforming the fixed income component. So, you sell off some of the winnings and rebalance back out.

“Let’s say we wanted it to be 60/40. 2021 was a great year in equities, so suddenly we’re at 75/25 at the end of the year,” Dean said. “We need to rebalance back to the 60/40 because that’s a risk control. That’s a defensive rebalancing.”

The same thing was true in the first quarter of 2020 when equities got smashed and fixed income was good. Go back and add more to equities. That’s offensive rebalancing.

“As opposed to just saying 60/40, 70/30, 80/20, 50/50, we use the Guided Retirement System to illustrate how much someone has and how much they can have if they continue saving,” Dean said. “Once we find out how much they want to spend in retirement, we come up with a plan of how to best distribute those retirement savings and what the tax implications look like.”

Identifying Your Personal Return Index

After you complete those initial steps within the Guided Retirement System, you can identify what we refer to as your Personal Return Index. What return does your money need to get you to do all those the things you want to do in retirement. What allocation from a historical perspective has delivered that rate of return the most consistently with the least amount of risk?

“Oftentimes, people aren’t revisiting that on a yearly basis,” Chris said. “We see it all the time with new clients. They want to retire, but usually don’t have the allocation they think they have. We set up a risk questionnaire for them. While they don’t feel risk, they haven’t rebalanced in so long that even a 50/50 allocation can grow to be 60% to 80% stocks depending on when the last time was that they rebalanced.”

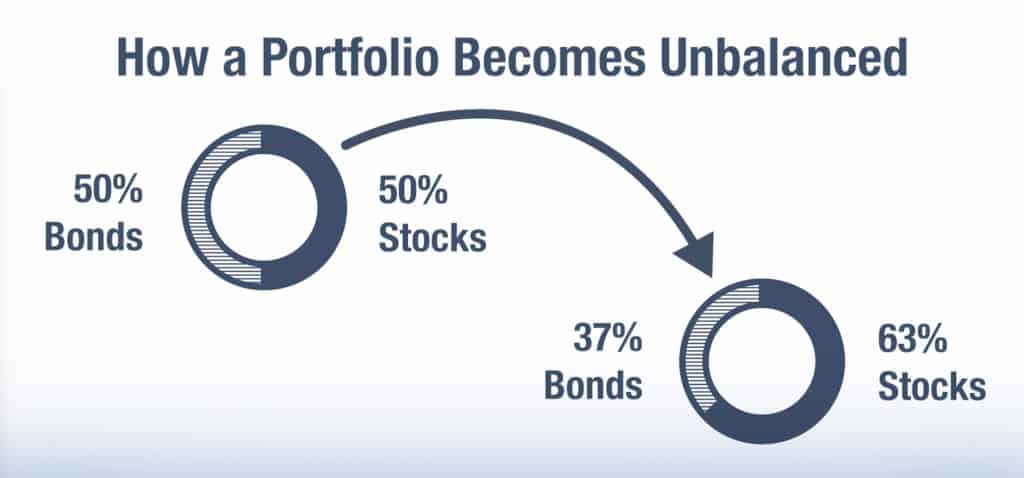

How a Portfolio Becomes Unbalanced

For example, let’s say a client comes in and hadn’t seen their advisor for five years. The advisor knows that the client doesn’t like risk and is preparing for retirement. So, maybe a 50/50 blend of stocks and bonds was what worked best for them five years ago.

However, we know that the market has been very good over the last five years. Let’s say that the stock positions have doubled because of those strong market performances. Meanwhile, the bonds haven’t kept up in a way that they should have.

In that case, the client would be asking what the new allocation should be when it had been 50/50 five years ago. It would be 63% stocks, 37% bonds. Therefore, when we’re entering volatility and they’re entering retirement, that would be a reason to defensively rebalance.

Combating Greed and Fear

There’s a psychological part of this as well. Two emotions that typically drive investment decisions are fear and greed.

Let’s go back to the person we just explained that might have had a 50/50 mix and is now at 63/37. When their advisor tells them to go back to 50/50, they probably think they’re crazy. After all, stocks have done so well, so why would they want to take money out of there and put into something that isn’t doing that well? It’s difficult not to let that greed take over, but it’s pivotal to prevent it from happening.

“It’s critical for those approaching retirement or in retirement to look at how much risk is in your portfolio on at least a yearly basis,” Dean said. “You never know when that next bad thing is going to happen.”

It all comes back to having a plan and sticking to it. Rebalancing is all about constantly selling your winners at the top and buying your under-performers at the bottom.

“It’s important to revisit rebalancing at least once a year with your IRAs,” Chris said. “Honestly, it should be set up for you to automatically do yearly, semi-annual, or quarterly rebalances.”

IRA Planning for People Approaching Required Minimum Distribution Age

As we finish discussing IRA planning for 2022, let’s review how strategies for people who are approaching the Required Minimum Distribution age of 72. Since these people have already retired, their distribution strategy has already been set up and Roth conversions have been done. So, what exactly happens at that magical age of 72, though?

“If you have IRAs or 401(k) money and you’re no longer working at 72, the government is going to require you take a distribution from that account,” Chris said. “It’s nothing that you or I can phone into our Senator and avoid. It’s something that is in the tax code. You need to take it. The IRS doesn’t care. They’ve allowed you to defer taxes for so long and want some of their money back.”

Inherited Roth IRAs and the SECURE Act

The only exceptions are if you’ve got a 401(k) or Roth IRA and you’re still working. If that is the case, you don’t have to take the Required Minimum Distribution. However, if you inherit a Roth IRA from someone else, it does have a required minimum distribution.

After the SECURE Act was passed, all IRAs—whether Roth, traditional, 401(k)—are forced out to the beneficiary within 10 years. There’s no required minimum each year. It just states that that account needs to be drained within 10 years.

“Even with IRAs, you’re still going to be taxed as you’re distributing that over 10 years or taking a lump sum,” Chris said. “But with Roths, even though you’re inheriting it tax-free, you’re still not going to pay taxes on those distributions.”

Using Qualified Charitable Distributions to Satisfy RMDs

A year and a half before those Required Minimum Distributions start, Qualified Charitable Distributions come into play. At 70.5, those who have the spirit of giving, can take all or a portion of their RMD and give money directly from the IRA to charity. It never shows up on your tax return. It also doesn’t cause more Social Security to become taxable or Medicare premiums to go up.

“QCDs are great for a lot of our clients who are charitably inclined,” Chris said. “We sit down all the time with clients that want to give back, especially if they feel like they have more than they need and have done proper planning. It’s a great strategy to donate to charity while also satisfying the RMD and doesn’t show up on your taxes.”

We Have Even More Education to Help Answer Your IRA Planning Questions

We’re honestly just scratching the surface of IRA planning with this article. IRA planning has been a hot topic from the very beginning of the Guided Retirement Show™.

If you have any questions about IRA planning for 2022, please schedule a complimentary consultation or 20-minute ask anything session with one of our CERTIFIED FINANCIAL PLANNER™ professionals. We can meet with you in-person, virtually, or over the phone.

Schedule Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.