Retiring with $1 Million

Key Points – Retiring with $1 Million

- Setting Up the Example

- The Average Couple’s Strategy

- Three Other Couples’ Strategies

- Tax Reduction Strategy

- Social Security Strategy

- Lifetime Income Comparisons of All Four Couples

- 15 minute read | 20 minute watch

Schedule with a CFP® Professional

Learn more about claiming your Social Security benefits and forward-looking tax planning with our downloadable guides: the Social Security Decisions Guide and Tax Reduction Strategies. Click below to download:

Retiring with $1 Million

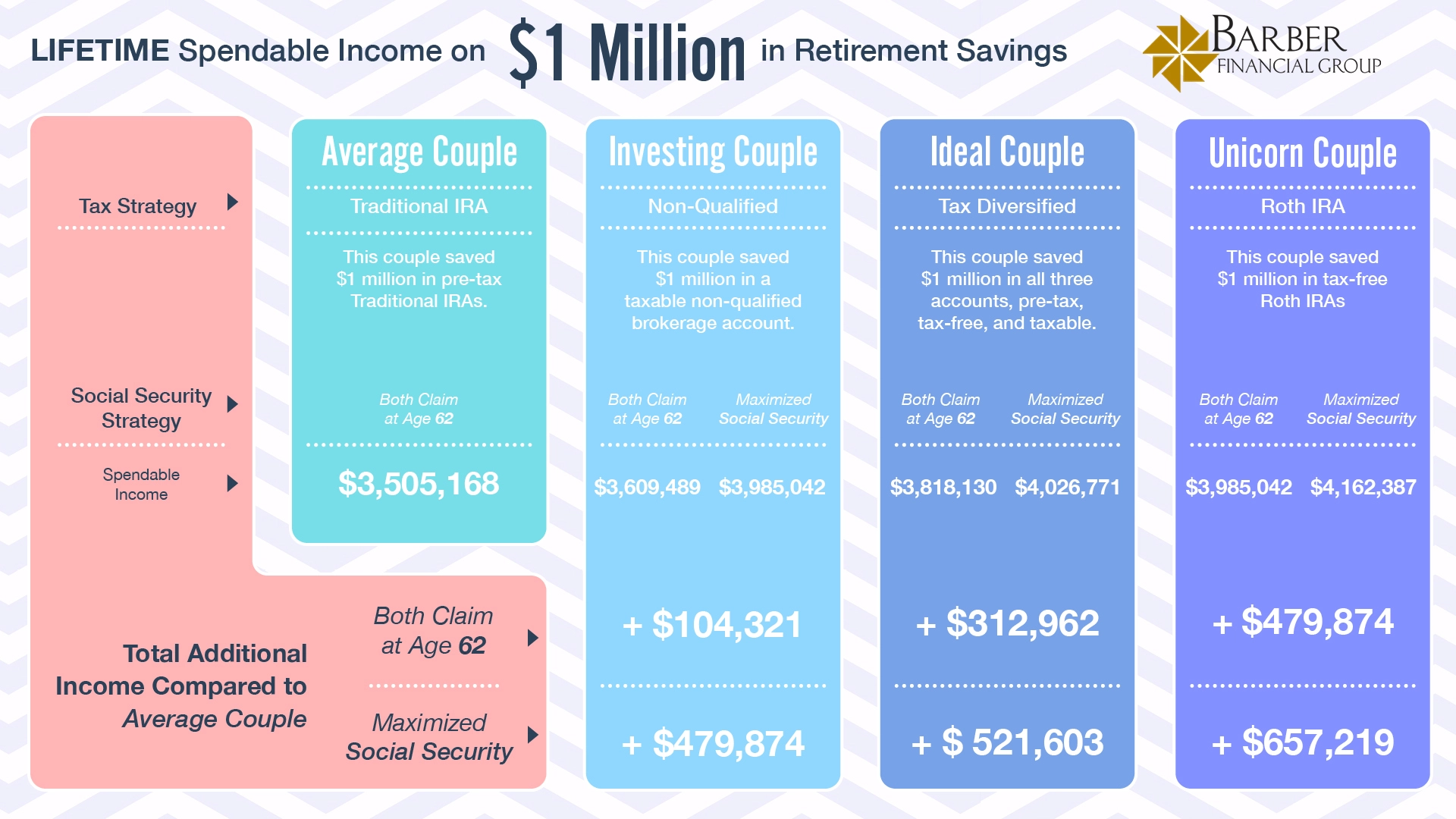

Dean Barber: What could retirement look like with $1 million? We’re going to show you four different couples. One couple, which we referred to as the average couple, with a 60/40 portfolio, claiming Social Security at 62, would be able to spend $3.5 million over a lifetime.

But we have other couples, the investing couple, the ideal couple, the unicorn couple. Just by applying some financial planning techniques, leaving the portfolio invested 60/40, you can increase your spendable income and retirement by $480,000, by $520,000, or by $657,000.

Stay tuned for the entire video so that you can learn how to live your one best financial life and make the most of the money that you’ve accumulated.

Setting the Stage for Retiring with $1 Million

Jason, welcome. Matt, welcome. I feel old here in the middle of two young CERTIFIED FINANCIAL PLANNER™ professionals, but you guys got some great talents. You’ve done great things for many of our clients and continue to do so.

We see it happen all the time that somebody has X-amount of dollars saved. In this example, we’re going to show $1 million. Let me set the stage for what we’re going to do, and then we’ll get into some details with the two of you.

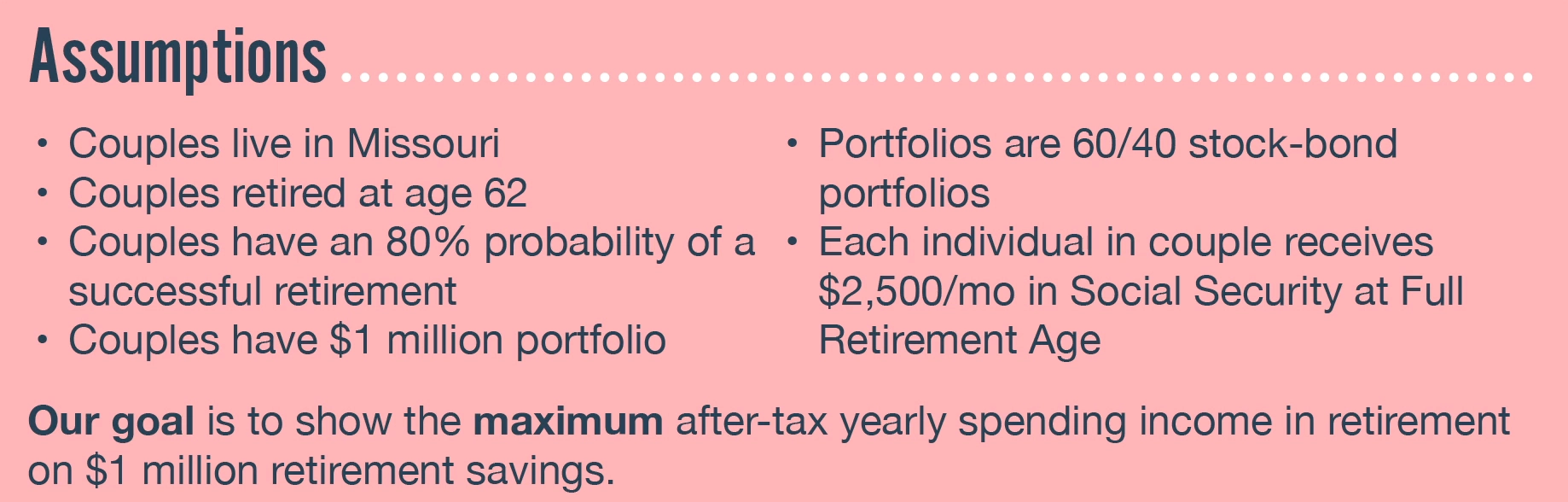

The Assumptions

GRAPHIC 1

We’re going to make some assumptions here.

We’re going to show you four different couples. All four couples have saved exactly $1 million and have the exact same earnings history, so their Social Security is going to be the same. On the surface, you would assume that every single couple will have the same spendable income throughout their retirement years, but nothing could be further from the truth. That’s why financial planning is so critical.

The Average Couple Retiring with $1 Million

GRAPHIC 2

Retirement Savings

Dean Barber: To start, let me explain why most people—we’re going to call this the average couple—start work, start saving money into their 401(k), get the company match, save and save, save, and think that is their retirement nest egg. That’s what they’re going to live on and retire on.

Social Security Strategy

The other thing that people do, which we could say is average, is think that claiming your Social Security on the day you retire is what you’re supposed to do. They believe Social Security claiming is synonymous with the retirement date.

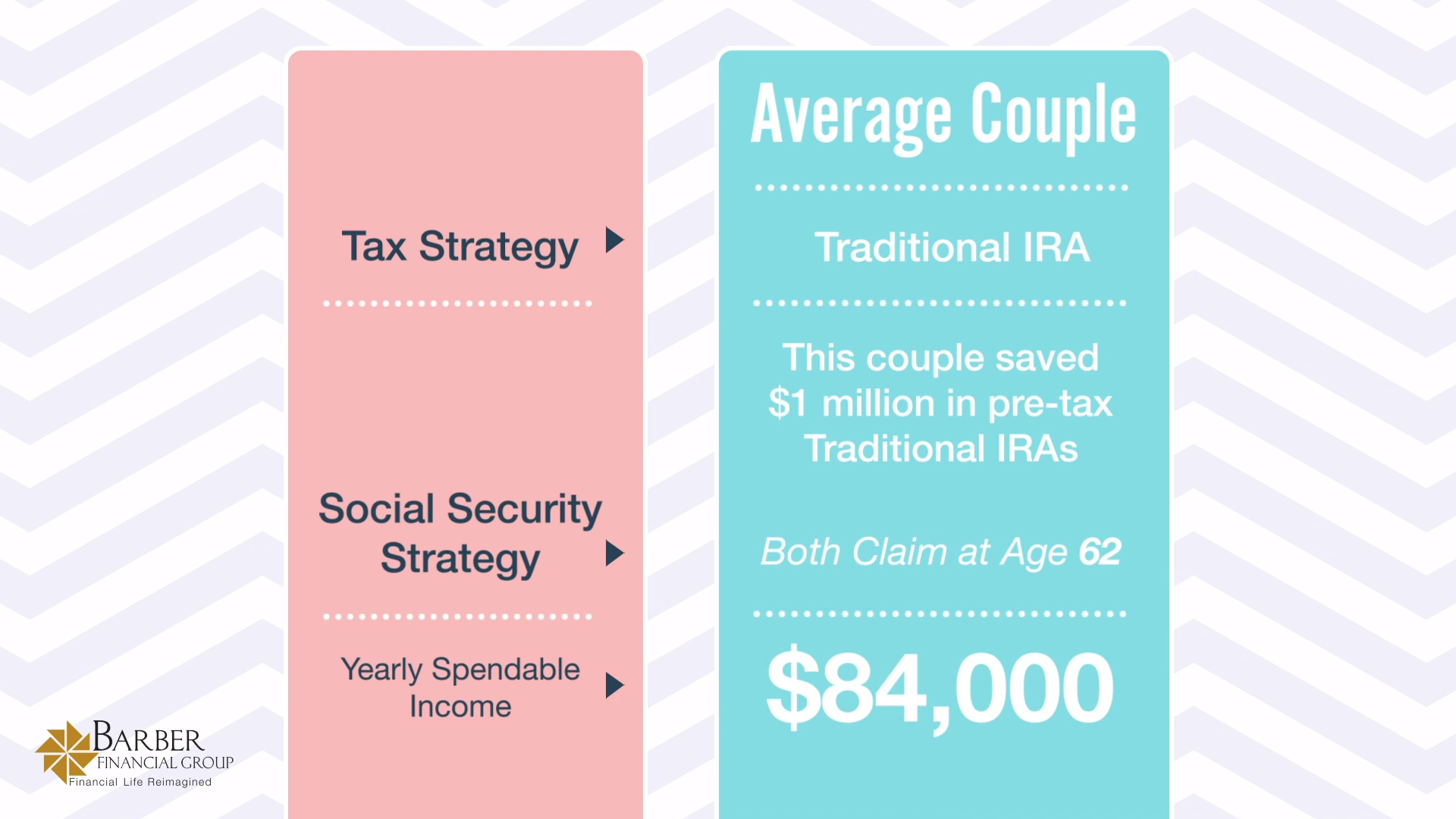

GRAPHIC 3

The average couple we’re setting up here has all their money in traditional 401(k) or IRA assets. They’re going to retire at age 62 and take their Social Security as soon as they can, both at 62. This couple is based on a 60/40 portfolio. Every couple we’re going to look at is based on the exact same investment strategy.

The only thing we’re going to do is we’re going to look at tax strategies, and we’re going to look at Social Security strategies. Those are just a couple of financial planning techniques that we apply here at Modern Wealth Management to improve our clients’ outcomes.

This average couple could spend $84,000 per year, which would increase with inflation. They would have what we would call an 80% probability of success of doing that until age 92. To start, Jason, explain the 80% probability of success so that our viewers know what that means.

Probability of a Successful Retirement

Jason Newcomer: There’s a calculator we use in financial planning and retirement planning, and it’s called a Monte Carlo calculator. It takes all the data you just said, the ages they’re going to retire at, how long they will live, what they have saved, and how it’s invested.

It simulates their retirement lifetime 1,000 times, randomizing things like the sequence of investment returns, how well the investments performed, and how inflation impacted their plans. After 1,000 trials in these examples, 80% of those, or 800 out of 1,000, did not run out of money during retirement.

Dean Barber: The 20% doesn’t mean that they ran out of money. It just means that maybe there’s a 20% chance that they may have to adjust how much they’re spending.

Jason Newcomer: That’s a good way of putting it.

Dean Barber: It’s not necessarily a failure, but could be some adjustments when they need to dial back for a couple of years. If you get some other good performance numbers in there, you can dial that back up. By the way, every single one of the couples that we’re going to introduce here is all going to that 80% probability of success. None of them are any different, so they’re all identical.

Tax Strategy

Matt, take it away and let’s start talking about the tax diversification part of this. Most people think that taxes are just taxes, and what your money is in doesn’t matter. Still, we know that tax allocation or tax diversification is just as critical as the diversification of your investments.

Matt Kasper: Absolutely. When you think about accumulating great wealth and how you get to these $1 million levels, that traditionally happens inside of a tax-deferred account, like a 401(k) or inside of an IRA. However, we all know we have a partner inside of that account. That partner is, unfortunately, Uncle Sam.

That’s where we need to make sure you have the clarity of how much participation is Uncle Sam going to take away from your lifestyle when you go throughout retirement. When we think about tax diversification, rather than investment diversification, we’re saying rather than putting all our eggs in one tax-deferred basket, why don’t we open our minds to tax-free buckets? This is what we’re talking about with a Roth IRA. Or a taxable bucket, which is what we’re talking about with a non-qualified account.

Just put a just quick definition, Roth IRAs have this tax-free appreciation, comes out tax-free. When you think about a non-qualified account, once you attain the age of 59 and a half, if you put $100,00 into a taxable investment and that $100,000 grew to $120,000, and you want to pull it all out. You might have a tax event on that $20,000. You will have a tax event, but not on that $100,000 of principal that you just applied.

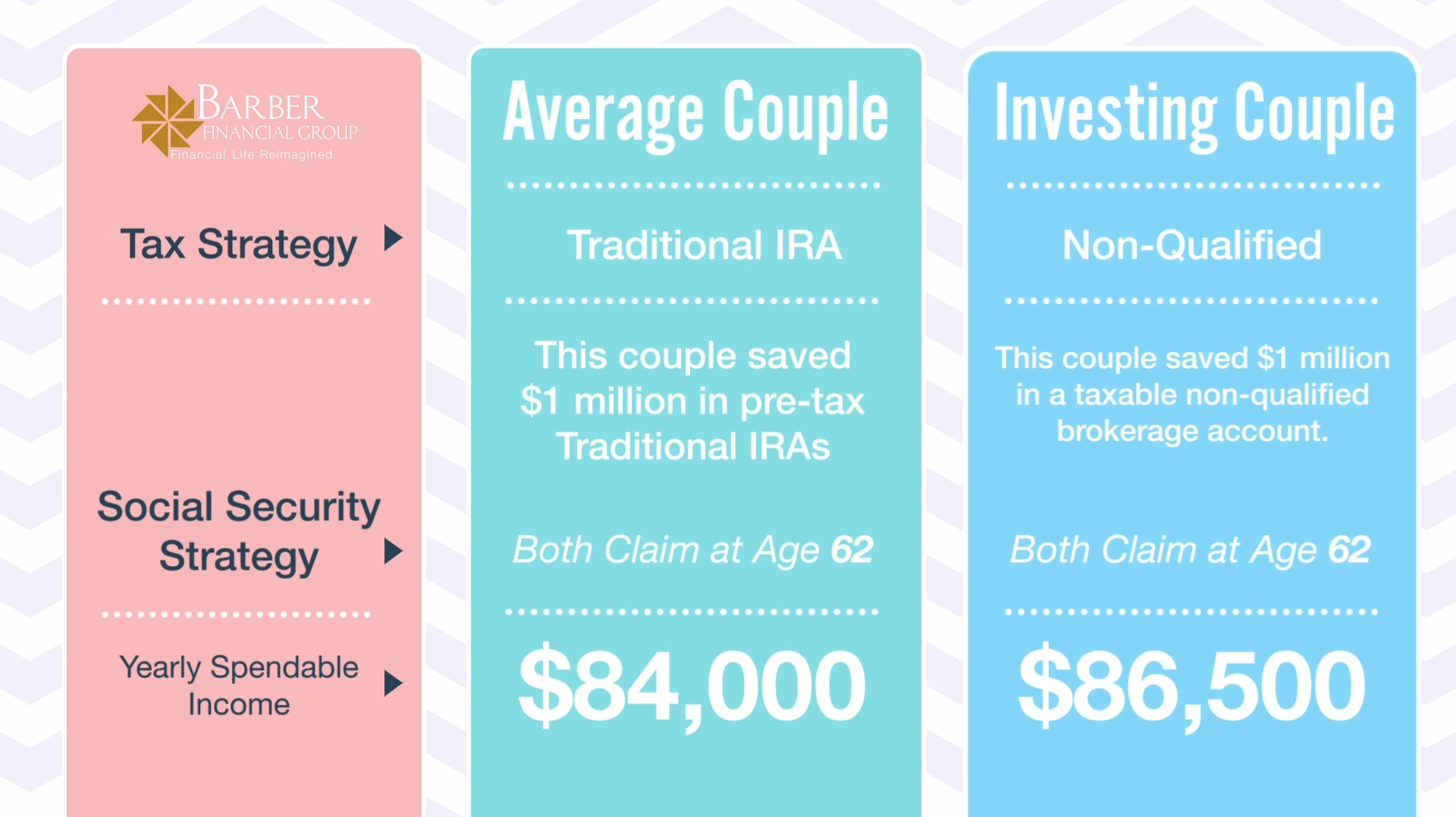

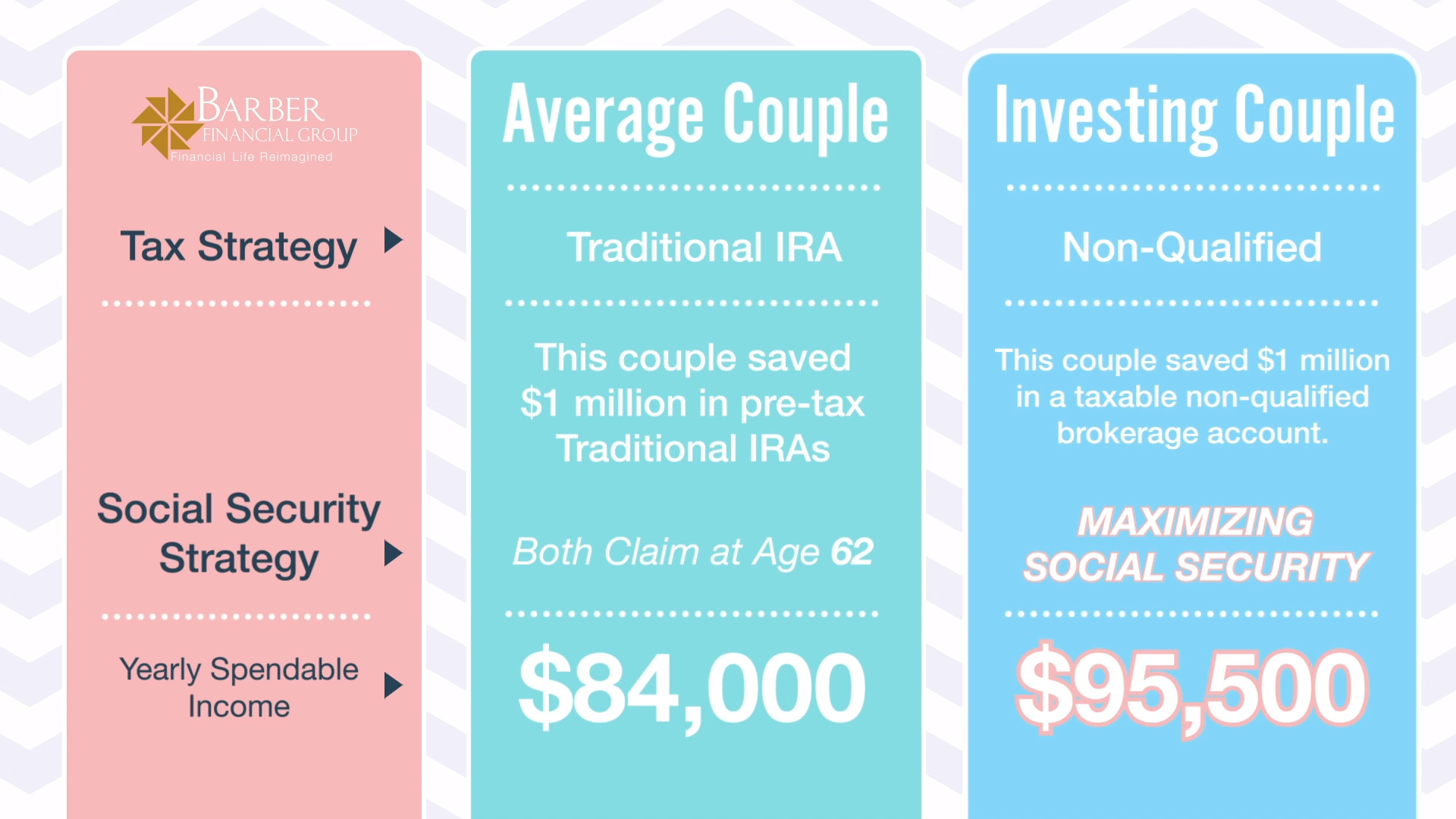

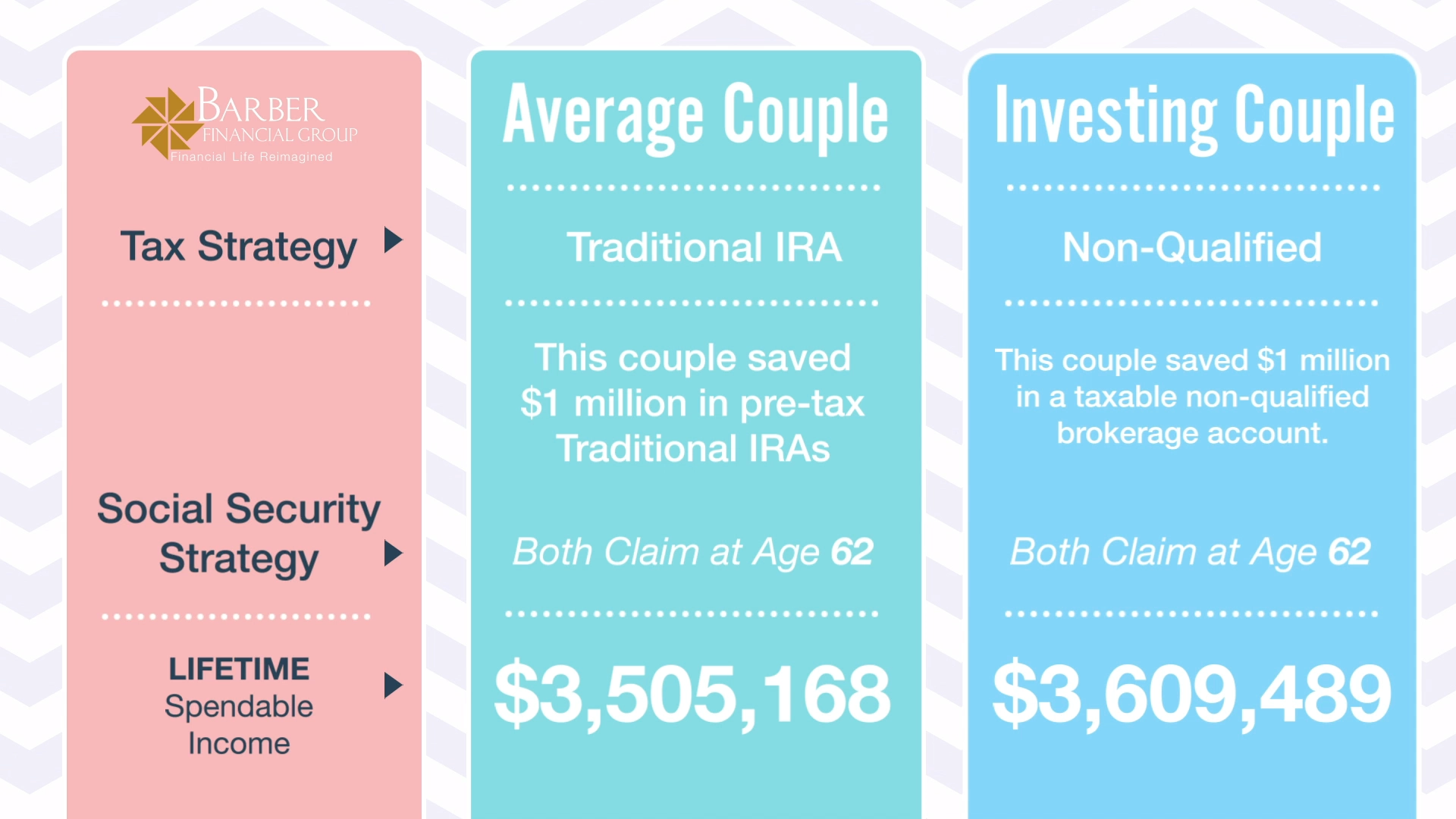

The Investing Couple Retiring with $1 Million

Dean Barber: Right. Let’s go to the couple here, Matt. We’re going to call them the investing couple. This couple either didn’t have access to a company plan, never believed in IRAs or Roth IRAs, or they said, “We’re just going to invest, and we’re going to keep the money all owned jointly.”

Matt Kasper: When you think about this, it is still a great way to accumulate assets. We want our clients to be aware that this is a good opportunity throughout their careers and retirement because it gives them tax flexibility. Some of their most tax-efficient assets may be inside of this non-qualified investing type of portfolio.

Essentially, yes, we want to be tax-aware of what’s going on with this type of investment. These are all 60/40 portfolios, so they have the same risk profile, but the taxation of those investments will be determined by the ultimate withdrawal strategy from this non-qualified account.

Dean Barber: It kind of goes to what I talk about on the radio and all the time in the podcast. You don’t want to put money into something until you know what the rules are to come out.

Tax Strategy

GRAPHIC 4

Jason, let’s dig in and let’s look at the difference in how much additional spendable income the tax diversification or the tax allocation can have on somebody.

Jason Newcomer: Absolutely. Take that same couple that you described with 100% of their assets in these retirement accounts, IRAs, 401(k)s. The only thing that we’re changing here is the type of account that they’ve saved too. The second example they’ve now used brokerage accounts or non-qualified accounts entirely. They can spend about $2,500 per year, more, of spendable income over their retirement.

Dean Barber: That’s assuming that that couple claimed Social Security at 62.

Jason Newcomer: The same claiming strategy. Yep.

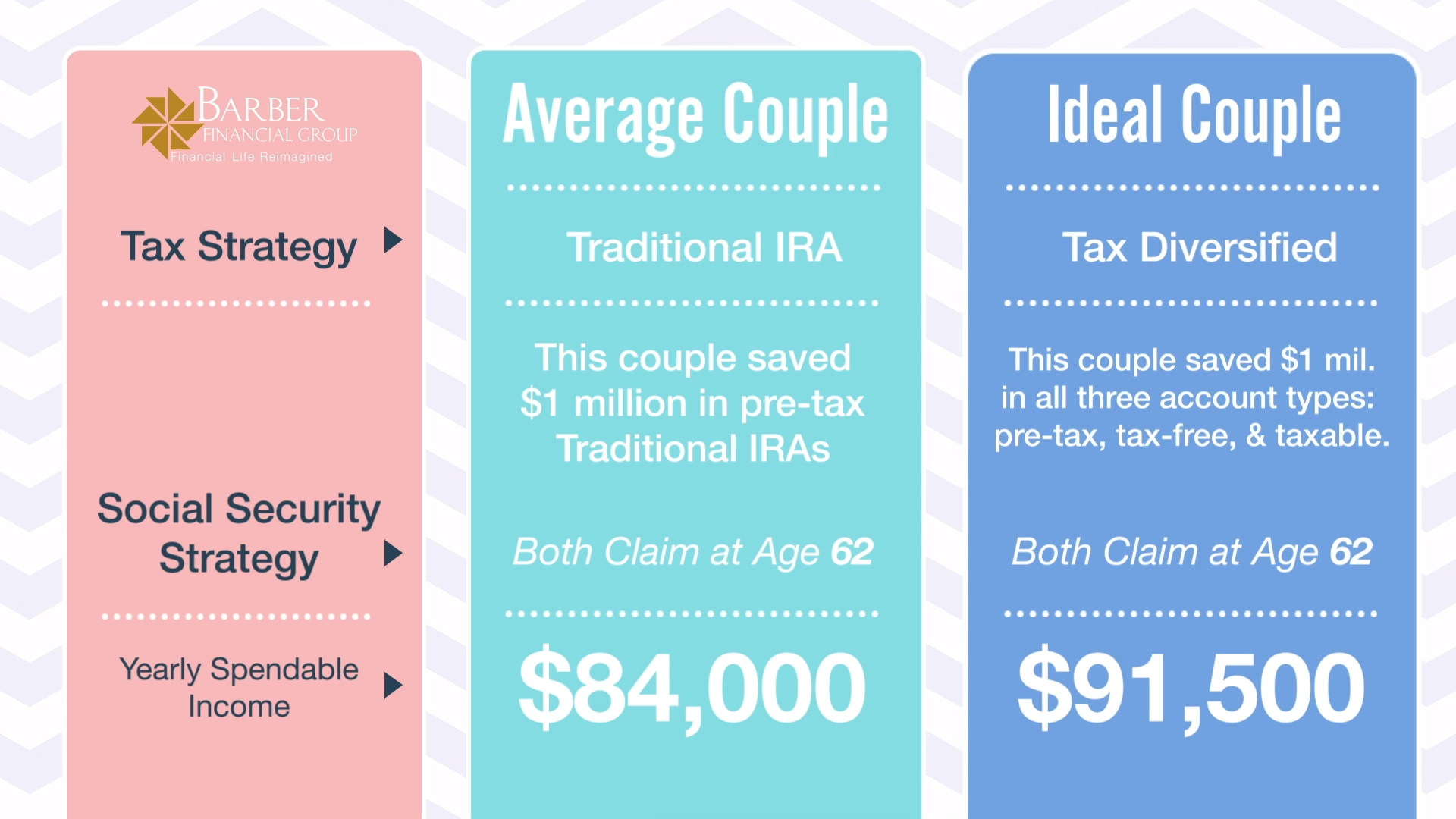

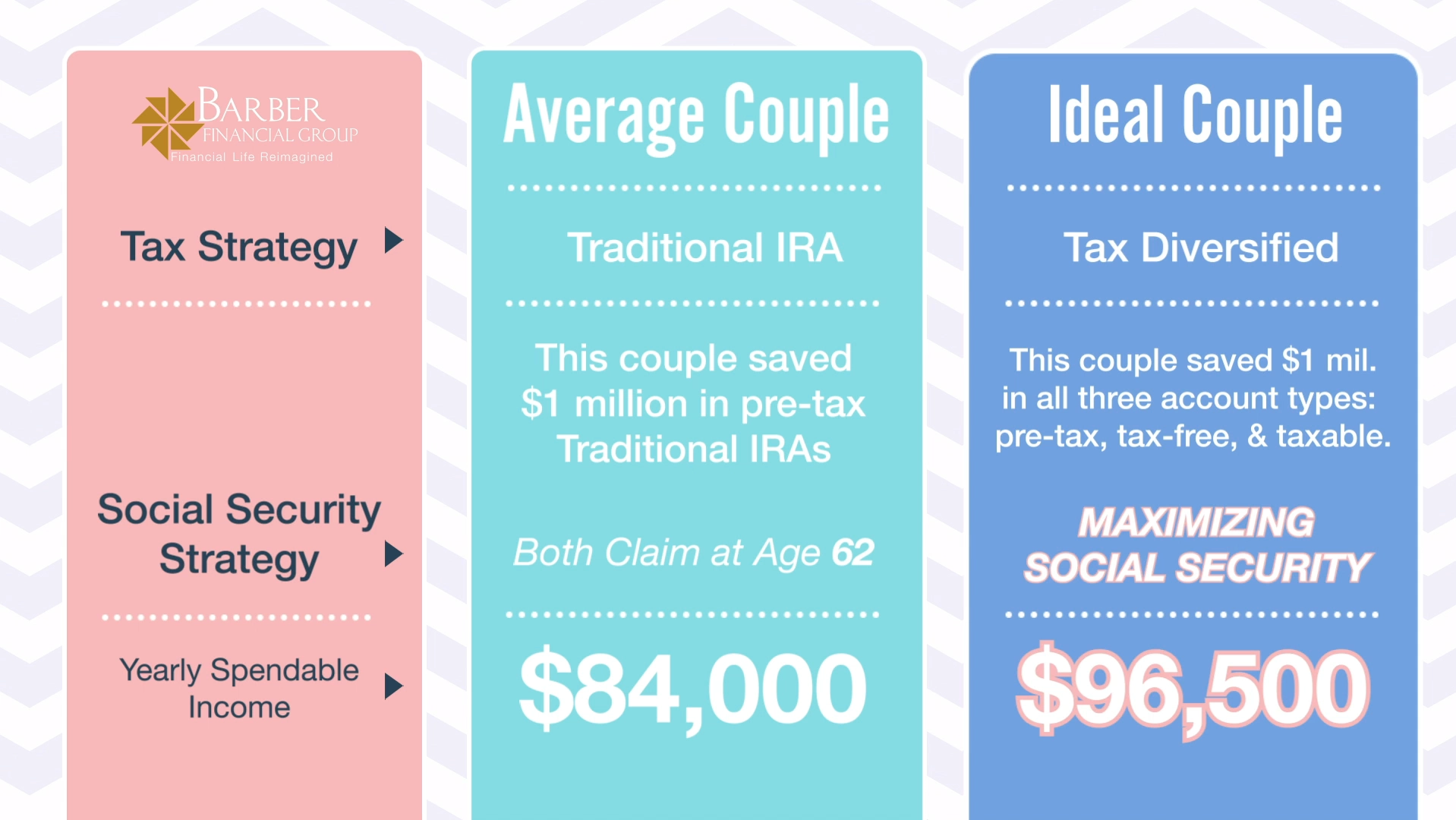

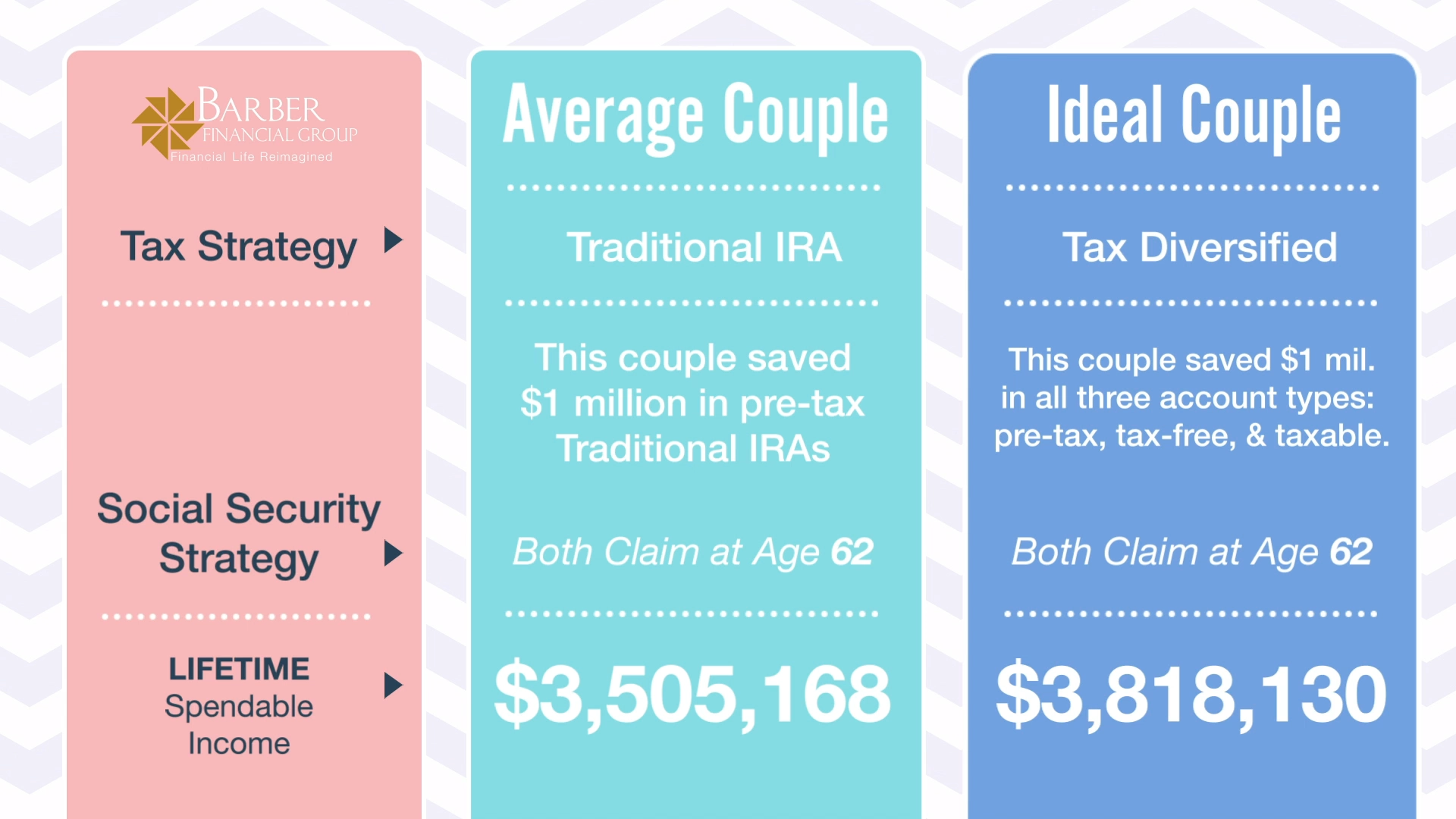

The Ideal Couple Retiring with $1 Million

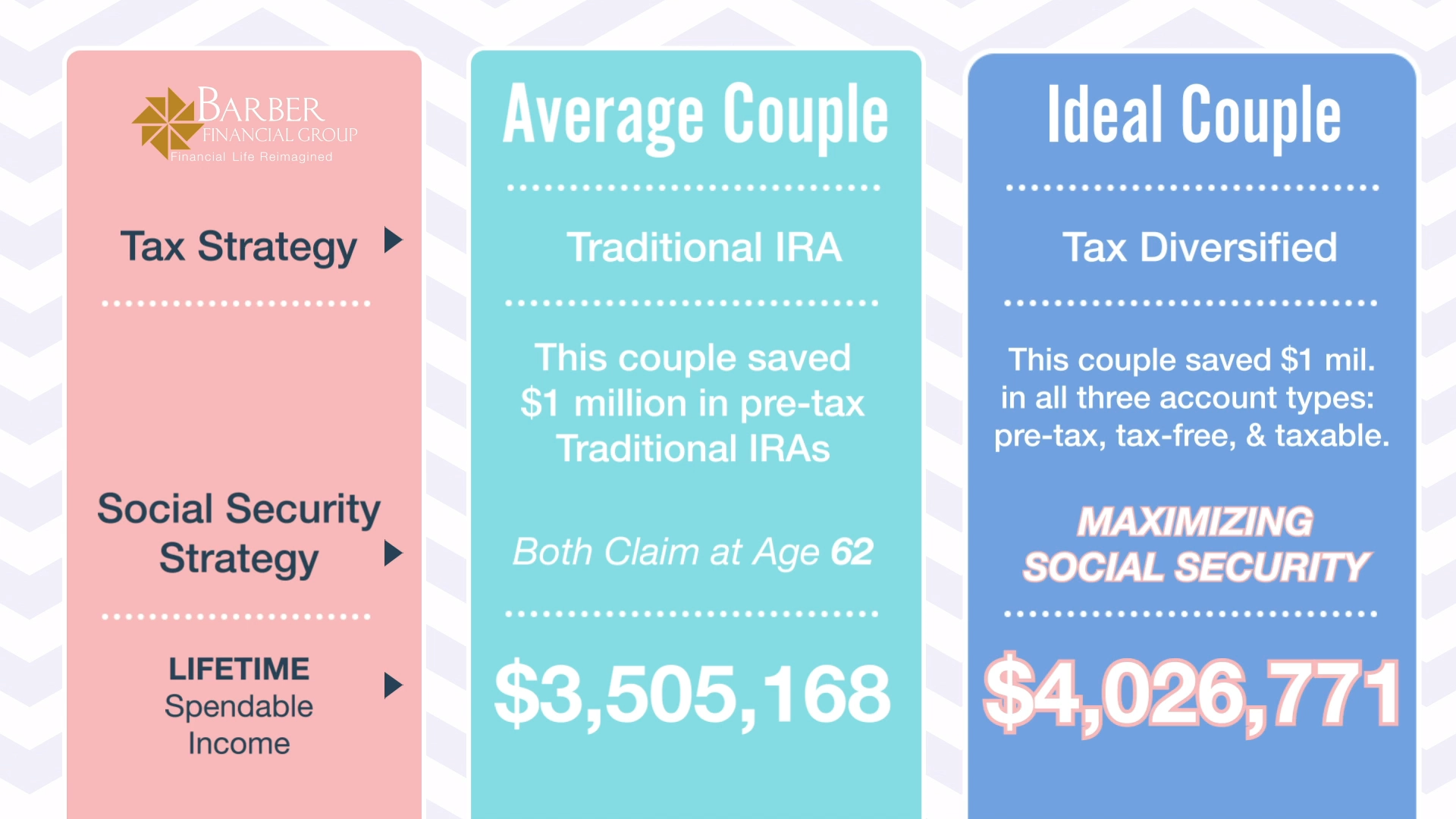

GRAPHIC 5

Dean Barber: Now, let’s look at someone who said, “I’d like to participate in the different types of plans. I like my Roth 401(k) option. I know my match will go into the tax-deferred option, and I’m going to save some money outside of that as well. I’m going to create some different tax buckets.” How does that work out for somebody?

Jason Newcomer: Sounds like what we would call an ideal couple. Someone who is not only diversified in their investment strategy but diversified in their investment type of accounts, their tax strategy.

In this example, the tax-diversified ideal couple retiring with $1 million, on top of the $84,000 that the original couple could spend, had an extra $7,500 per year, more of spendable income. It is all because that ideal couple saved to the right types of accounts over their retirement.

Dean Barber: I think that is huge. It’s almost 10% per year, more spendable income than the average couple, just because they saved the right way.

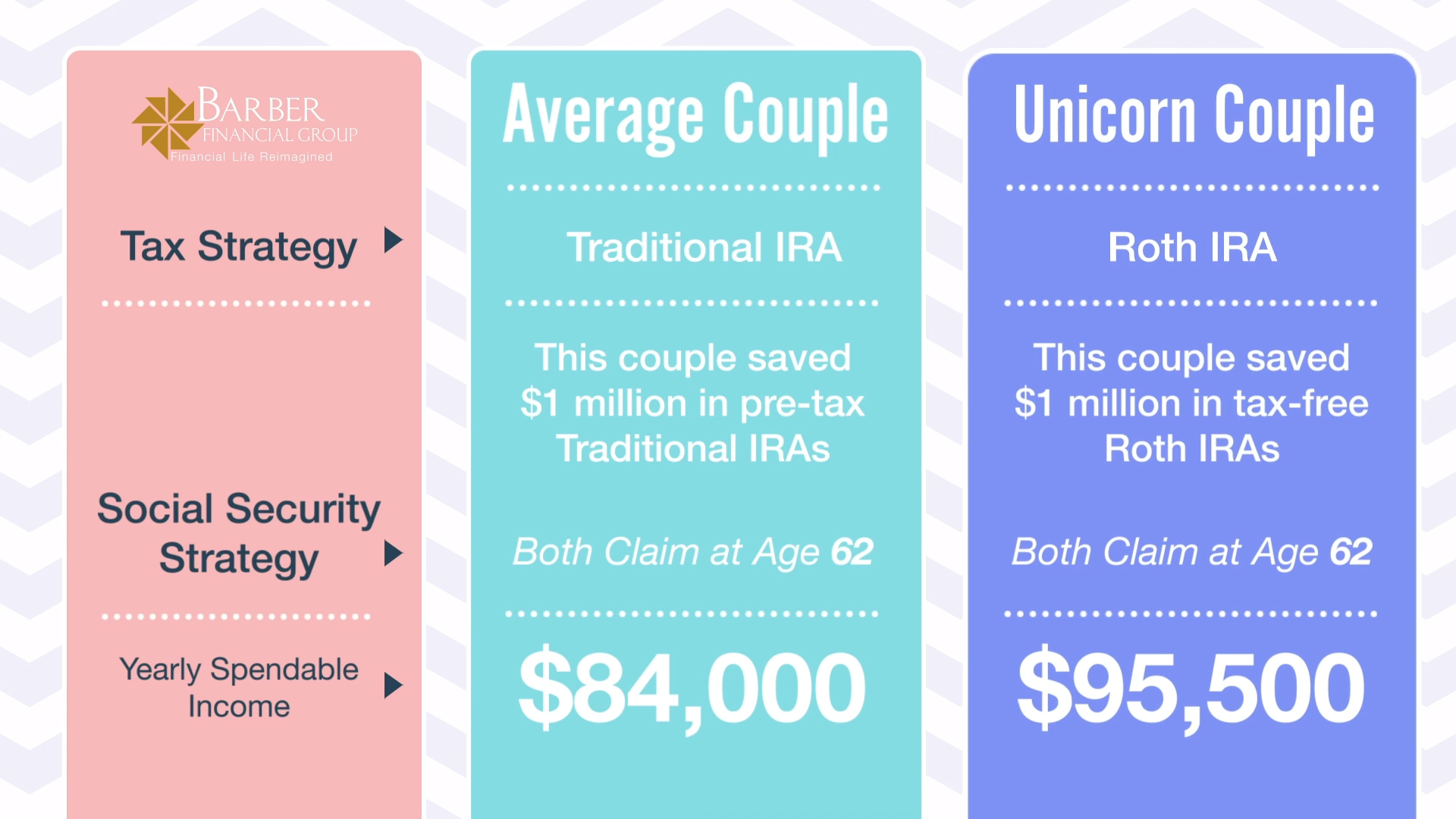

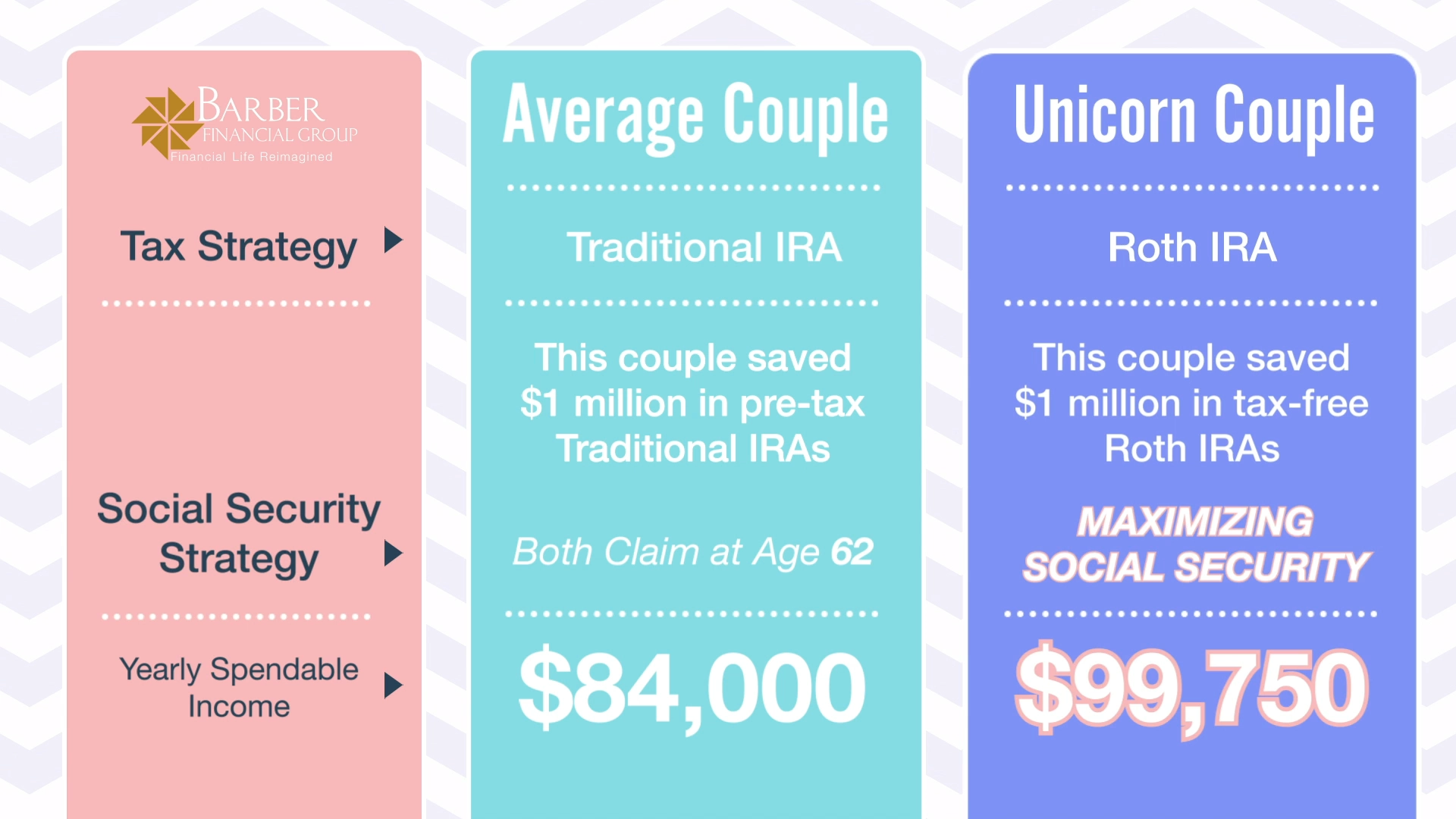

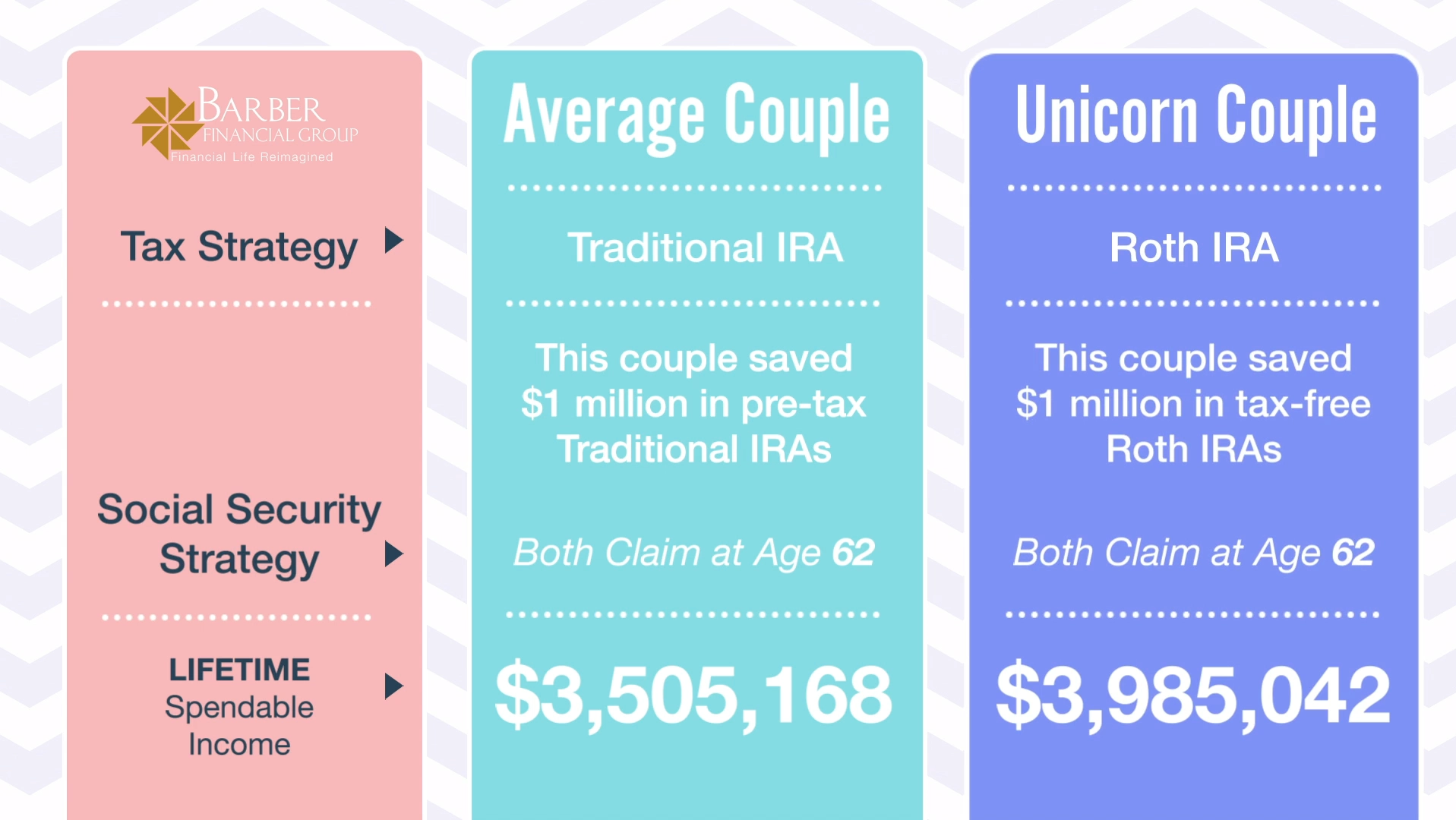

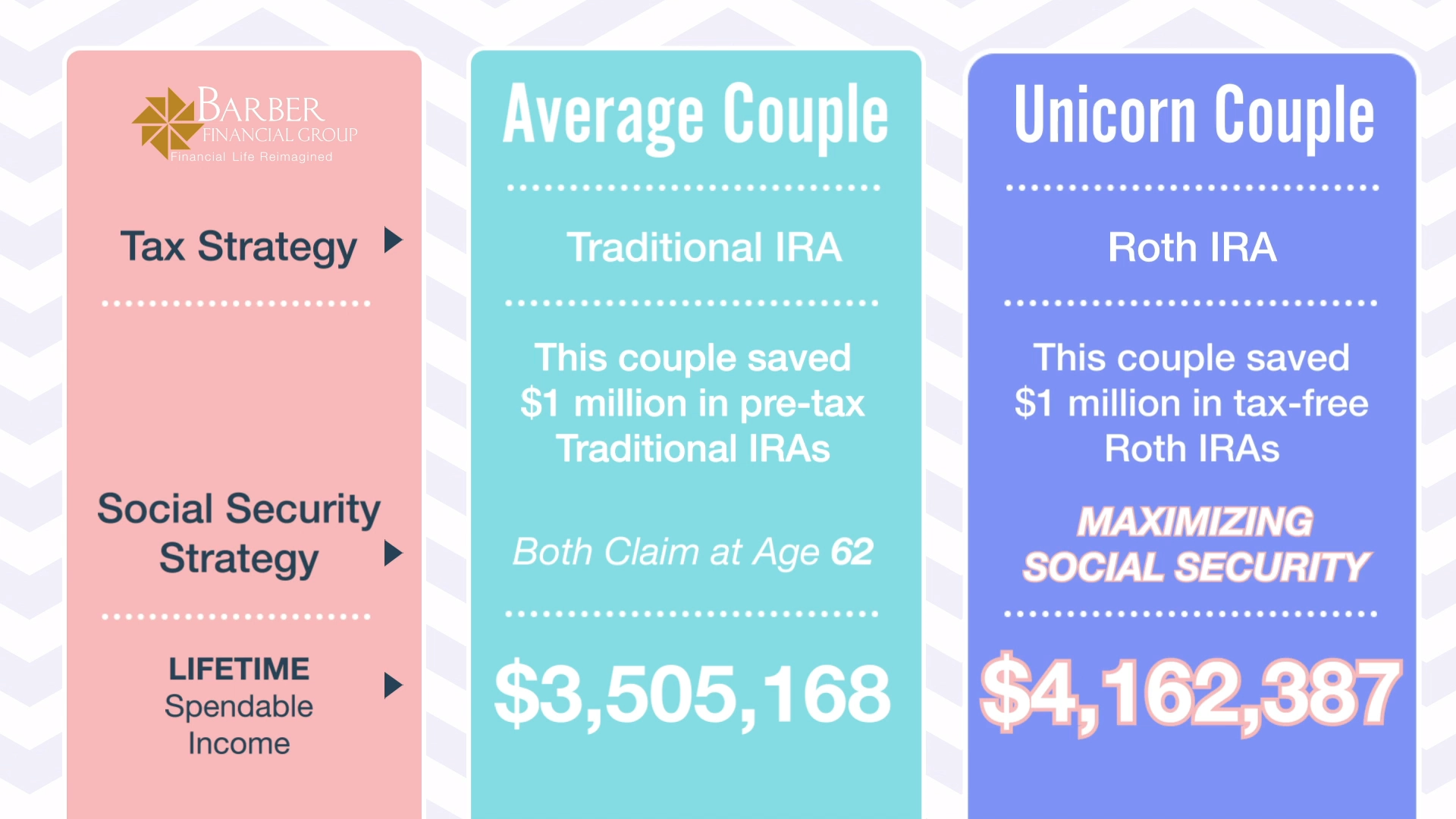

The Unicorn Couple Retiring with $1 Million

GRAPHIC 6

Now, let’s talk about the couple that we never see, the unicorn couple.

Jason Newcomer: You’ve been doing this longer than I have never seen a couple with a 100% of their savings in Roth IRAs in 15 years that I’ve been looking at financial plans here. That’s unless they were maybe just getting started, and their first account was a Roth IRA.

Dean Barber: Just to let everybody know, it’s possible if somebody at the age of 22 started putting $5,000 a year into a Roth and a little over 6.5% per year rate of return. By the time they reached age 62, they’d have $1 million in a Roth IRA. If that’s all they ever did, they will get there. It’s not impossible; we just haven’t seen a couple that has everything in Roth. But look at the power of the Roth.

Jason Newcomer: Almost another $1,000 per month, every single year, over their retirement because they’ve saved entirely to Roth IRAs.

Dean Barber: That’s huge.

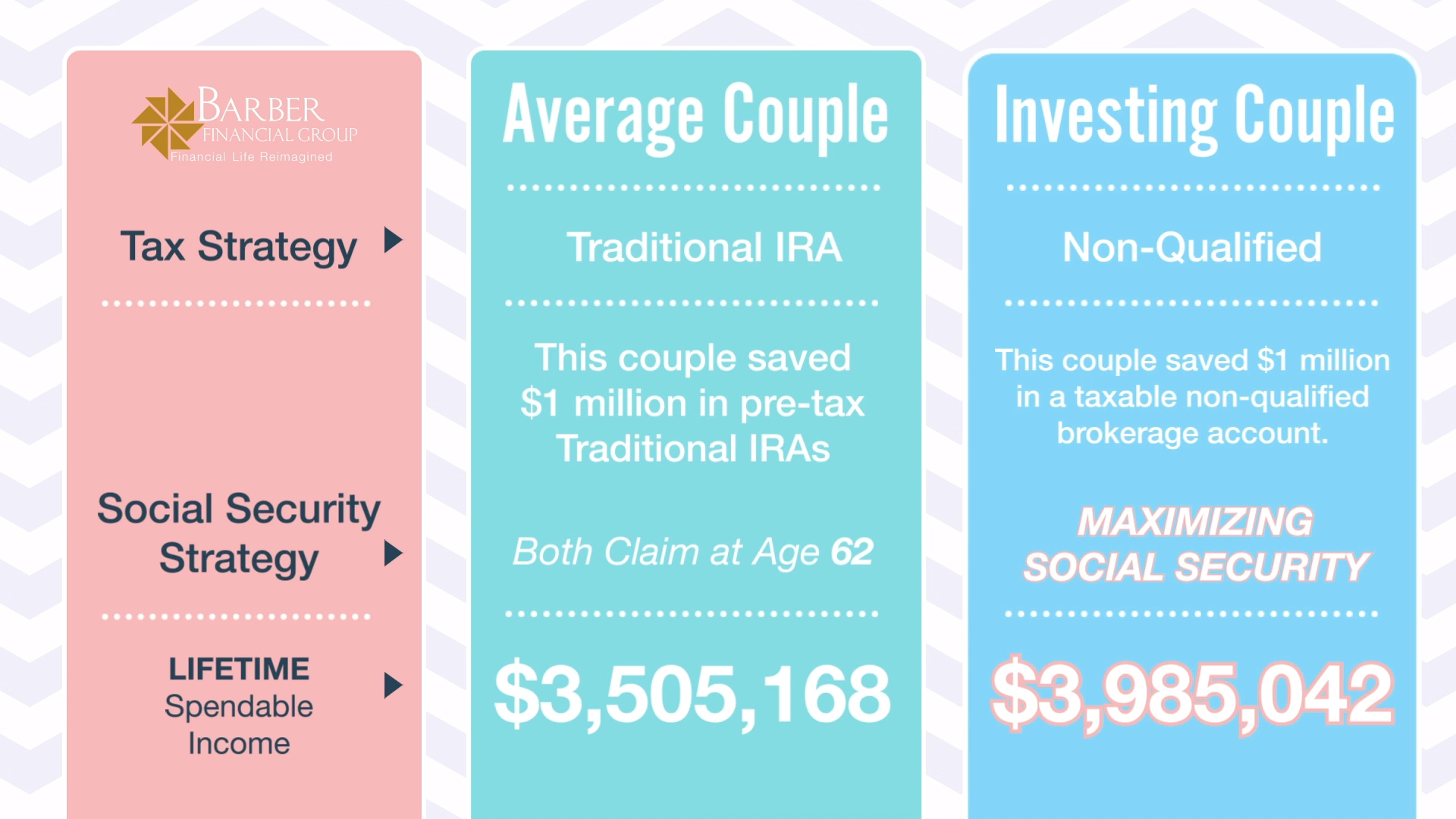

Layering in the Social Security Strategy

Matt, we know that most people decide that they will claim their Social Security at 62. That’s just because they’ve heard Social Security is going broke. They think, “I want to get as much money out of the system as fast as I can cause I put a lot of money into that thing.” However, we know that the average couple will have over 600 different ways to claim Social Security. Learn more about maximizing your Social Security in our Social Security Decisions Guide.

Let’s look at what proper Social Security claiming strategies can do here.

Matt Kasper: When you think about that 62, in this case especially, we’re saying retirement at 62, a lot of folks will want to continue receiving some sort of check. However, we all know there are many challenges and mistakes that can be made when you’re electing at these earlier ages. That’s especially true when we’re using the example of 62; that’s the earliest. What does the earliest tell us? That means we’re getting about a 30% penalty reduction inside of our benefit rather than taking at our full retirement age.

Dean Barber: Those are the numbers that Jason went through. If all the couples all decided to claim at 62, when we just had a tax strategy, that’s what it is. Still, go through the numbers on using Social Security maximization.

I’ll set the stage for you here, Matt, because this goes back to 2008, when I wrote a Social Security book. The theory behind that book was that the average couple aged 62 has more than 600 different iterations on how they claim their Social Security. The difference between the best and worst strategy in many cases was winding up, showing an additional $100,000 of income over a lifetime. Let’s take a look and see what we got here.

Maximizing Social Security for the Investing Couple Retiring with $1 Million

GRAPHIC 7

Matt Kasper: Yeah. When we’re looking at the investing couple, it might surprise a lot of our audience that essentially just by optimizing your Social Security, maximizing that benefit in the investing couple, that added another $11,500 above what that average more traditional couple will define inside of their retirement.

Maximizing Social Security for the Ideal Couple Retiring with $1 Million

GRAPHIC 8

We will take it to the next step further, and we go to the ideal couple. You’re going to see that it now goes up to $12,500.

Maximizing Social Security for the Unicorn Couple Retiring with $1 Million

GRAPHIC 9

Of course, we love the unicorn; we love the Roth. When the unicorn couple maximizes Social Security, it adds another $15,750 above and beyond what that average couple can spend each year in retirement.

Dean Barber: This isn’t a surprise for you, Jason. Matt, it’s not a surprise for you. It’s not a surprise for me. We know the power of financial planning. We wanted to build a straightforward scenario to illustrate briefly how the power of financial planning can impact your retirement. All we’ve done here is look at two strategies out of many that we typically employ and look at for each individual, depending upon their situation.

The cool thing is that if you pay attention and get the financial planning done, you can have an entirely different retirement lifestyle than somebody who does no planning and sticks everything into a 401(k).

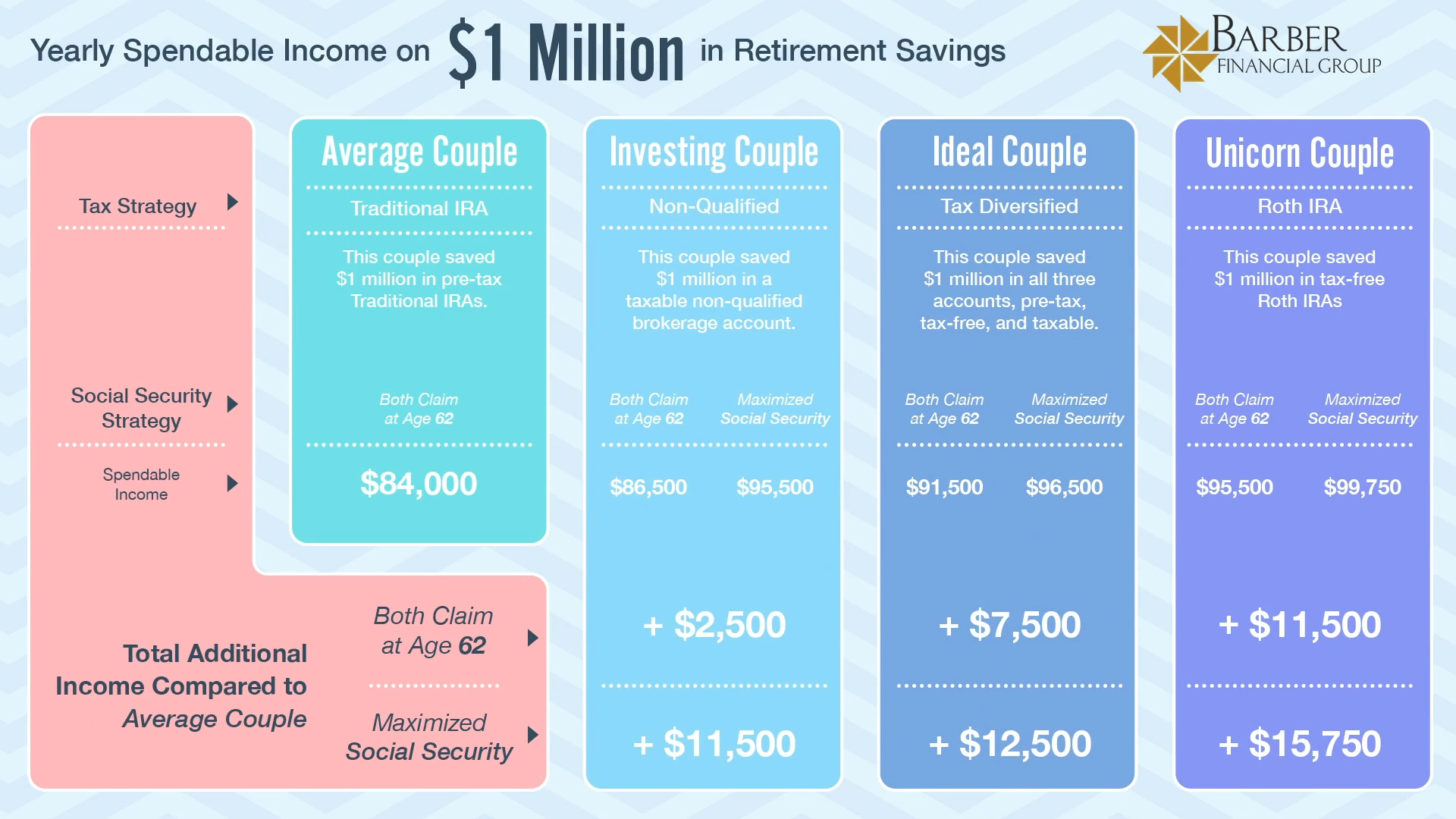

Yearly Income by Couple When Retiring with $1 Million

GRAPHIC 10

Dean Barber: Just so everybody knows what we did here, when we say that $84,000 for the average couple and the increases for the investing couple, the ideal couple, and the unicorn couple, those numbers are net of taxes, that’s their spendable income. Also, those numbers will keep up with inflation.

Lifetime Income When Retiring with $1 Million

Jason Newcomer: Things get interesting when we take this beyond the annual spend and look at the difference in spending over someone’s lifetime.

Dean Barber: That’s huge. Let’s now look at the additional lifetime income for just applying these two strategies.

Lifetime Income with Different Tax Strategies When Retiring with $1 Million

Matt Kasper: Absolutely. When we look at these, the lifetime benefit, what might surprise even with making what happens to be many cases, wrong decision claiming at 62, not universally, by the way, sometimes that can make sense.

Lifetime Income for the Investing Couple Retiring with $1 Million

GRAPHIC 11

When we look at the investing couple filing at 62, they’re aware they accumulated their assets throughout retirement and captured another $104,321 of spendable income throughout the retirement.

Lifetime Income for the Ideal Couple Retiring with $1 Million

GRAPHIC 12

When you look at the ideal couple, this is where it just becomes more and more shocking. The ideal couple ended with $312,962 more in spendable income over a lifetime.

Lifetime Income for Unicorn Couple Retiring with $1 Million

GRAPHIC 13

Of course, the unicorn couple added $479,874 to their lifetime spendable income compared to the average couple. I think we could all say we would have a more meaningful retirement if we had another $500,000 of discretionary spending on things.

Dean Barber: There’s no question about it.

Lifetime Income with Different Tax Strategies and Maximized Social Security When Retiring with $1 Million

Now, we apply the Social Security maximization strategies. Let’s take a look at the numbers.

Jason Newcomer: It’s taking things to the next level when you incorporate planning when you’re going to take your Social Security benefit on top of how you’ve saved for retirement.

Lifetime Income when Maximizing Social Security for Investing Couple Retiring with $1 Million

GRAPHIC 14

In the investing couple, by maximizing their Social Security benefit, not taking it at face value, and taking it as soon as you can at 62, they maximize that benefit. It adds $408,000 of spendable income to that couple’s lifetime spending in retirement.

Dean Barber: That’s almost half as much as what they accumulated to get the return.

Jason Newcomer: It is. It’s incredible.

Lifetime Income when Maximizing Social Security for Ideal Couple Retiring with $1 Million

GRAPHIC 15

Let’s look at the next couple here, the ideal couple. This couple saved to the three different categories of tax accounts. They added $521,000 of additional spendable income over their lifetime in retirement.

Lifetime Income when Maximizing Social Security for Unicorn Couple Retiring with $1 Million

GRAPHIC 16

Then Matt’s favorite couple is the unicorn couple, that saved entirely to Roth IRAs. It’s still worthwhile maximizing Social Security, even though you’re coming out so far ahead of the king, by having all of your assets and Roth. They added $657,000 of additional spendable income over the average couple by maximizing Social Security benefits.

The Big Picture – Retiring with $1 Million Can Be Different, Planning is Key

GRAPHIC 17 – Download the Full Graphic Here

Dean Barber: These numbers are astounding. If people who view this video do nothing else, they can glimpse some simple strategies to improve their ability to retire successfully.

What I want you to take away here is that if you have $1 million saved and your neighbor has $1 million saved, and you both had the same Social Security earnings, don’t expect that you’re both going to have the same lifestyle.

You really should be asking yourself at this point: where do you line up here? Which one of these couples are you? Whether you have exactly $1 million for retirement, $750,000, $2 million, or $10 million, the same techniques and the same strategies apply across the board.

This does not discriminate in terms of how much money you have saved. The impact of proper financial planning can make an enormous difference on your ability, not just to reach retirement but to get through retirement in a much more meaningful way. Planning can allow you to do all the things you want with clarity, confidence, and control. Would you guys agree with that?

Jason Newcomer: I would agree. I would just add one other thing. If you’re looking at this Graphic 17 above, which you can download for print here, and you’re someone who’s in your 30s and 40s thinking, “Well, I don’t need to worry about this retirement stuff.”

Dean Barber: No, you need to start now.

Jason Newcomer: This is when you need to be implementing these things.

Know the Tax Implications, and Understand Your Social Security Situation

Dean Barber: Yeah, you have to start now. Again, go back to what we said at the beginning. Don’t put your money into anything until you know what the rules will be to get it out.

The only way you’re going to know the rules is to sit down with great CERTIFIED FINANCIAL PLANNER™ Professionals like yourselves and the other CERTIFIED FINANCIAL PLANNER™ Professionals here at Modern Wealth Management.

We can help you construct this plan, regardless of the phase of life that you’re in, to put you in a position where you can maximize every dollar that you earn over your lifetime and get more income in retirement. In my opinion, that’s the name of the game.

Building the Financial Foundation

Matt Kasper: Absolutely. Essentially when you’re looking at all these different scenarios, it’s truly about building that financial foundation that you’re trying to build for your family. It doesn’t start 10 or 20 years down the road. Planning is critical when it comes to making these types of decisions. Of course, starting today is all the more beneficial.

What if You Saved $750,000 for Retirement and Planned?

Dean Barber: Here’s what we want you to take away here. We did one other thing. What would happen if somebody saves $750,000? They did all the right things. They were the ideal couple, maximized their Social Security, and had solid tax diversification. Guess what? Their numbers were identical to the average couple with a quarter of a million dollars, less saved. Check out that comparison here.

Start the Conversation

You have an opportunity right now to schedule a complimentary consultation with one of our CERTIFIED FINANCIAL PLANNER™ professionals. We can visit with you by phone. We can do a virtual meeting, or we’re happy to meet you in our offices. We’ve got offices in Lenexa, Lee’s Summit, and North Kansas City. We’ll sit down, give you a complimentary consultation, and we’ll dig in and let you see what you can do.

Continue Learning

If you haven’t already done so, subscribe to the Modern Wealth Management YouTube channel. Get out to your favorite podcast app and subscribe to The Guided Retirement Show™, as well as America’s Wealth Management Show, so that you can continue to get sound financial education. Thanks for joining us.

Schedule Complimentary Consultation

Select the office you would like to meet with. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Lenexa Office Lee’s Summit Office North Kansas City Office

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.