Rising Interest Rates and Your Retirement

Key Points – Rising Interest Rates and Your Retirement

- Back to Bear Market Rallies

- An Example of a Building a Comprehensive Plan

- Market Valuations and Interest Rates

- Finding Clarity in Chaotic Conditions

- 21 minutes to read | 38 minutes to listen

The Fed raised interest rates by the most in nearly three decades, a 0.75% rate hike, and is set to do it again in July. Dean Barber and Bud Kasper examine how rising interest rates can impact your retirement.

Show Resources:

Find links to the resources Dean and Bud mentioned on this episode below.

Rising Interest Rates and Your Retirement

Dean Barber: Thank you for joining us here on America’s Wealth Management Show. I’m your host Dean Barber along with Bud Kasper.

The Bear is Back

Last week we acknowledged that the bear is back! We’re officially in bear market territory on the broad market index, the S&P 500. We’ve been in bear market territory on the NASDAQ for some time.

Retirement Planning with Rising Interest Rates

Jerome Powell last week increased the FED Funds Rate by 0.75%. And they are strongly expected to raise that FED Funds Rate by another 0.75% in July.

We need to discuss what this means for people in retirement or nearing retirement. How do we play this? And how long will it take for us to get back to a more normal monetary policy, and what are the economic consequences of bringing us back to that normal monetary policy, Bud?

Bud Kasper: Well, I would say first off, for retirees, you’ve been through this before. There’s no way you’ve been saving, let’s say, for the last 25, 30 years, and you haven’t experienced a bear market of some sort. So, understanding that bear markets are unfortunately a natural part of the evolution of what happens in markets, we have to be prepared for these.

If people aren’t prepared, they probably didn’t do a plan and didn’t stress test their portfolio for the possibility of what we’re experiencing today. And if that’s the case, somebody neglected to do the right thing for you as your representative.

Different Perspectives in Our Later Years

Dean Barber: But I could tell you, Bud, I am 56 years old now, and as I get closer to my sixties, my psyche is different than it was when I was in my thirties. If we were going through a bear market cycle when I was in my thirties, it didn’t matter because I knew that I would continue to invest and buy, and I had a lot of years for this thing to recover.

Bud Kasper: Retirement was far away.

The S&P 500 Shouldn’t Be Your Benchmark

Dean Barber: Right. People come in and want to take advantage of the services that our CERTIFIED FINANCIAL PLANNER™ professionals provide, is that the S&P 500 has become like this. It’s the benchmark that everybody wants to compare their returns against. And because they want to reach their returns against it and the likes of John Bogle at Vanguard of saying, “Just index.”

Bud Kasper: Be the market.

Dean Barber: Be the market and okay, when you’re 30, 35, 40 years old, okay. But when you’re in your mid-fifties, early sixties, mid-sixties into your seventies, no. Especially whenever you’re getting to a point where you’re going to start asking your money to go to work for you.

It’s become so prevalent. I’ve had two couples that I’ve reviewed plans that our CERTIFIED FINANCIAL PLANNER™ professionals are doing, and they have relatively large 401(k) plans, and 100% of their 401(k) is in the S&P 500 Index Fund.

Preserve and Grow

Bud Kasper: Yeah, it’s incredible that people do that. Yeah, I met with a couple the other day and had the same experience. I said, “Well, did you not think this might be a time that you might want to readjust your risk, at least in the next six to 10 months? Well, this is the way it’s worked for all these years, yes. But you’re at a different point in your life where we need to preserve and grow.”

Dean Barber: The only way you can get that done and understand what you should be doing is by having a well-thought-out, complete financial plan. One that looks at every aspect of your financial life and then forecasts it into the future for what you want your future to look like.

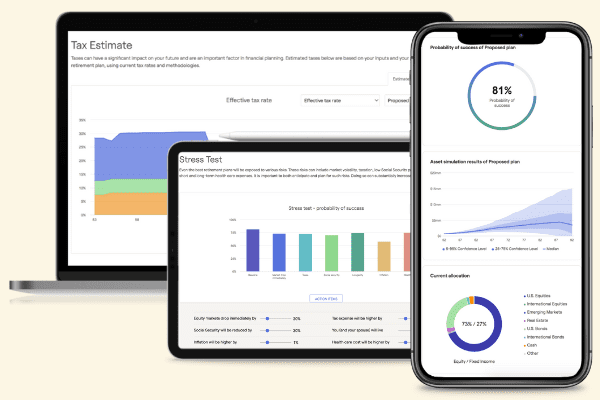

You can get started by using the same financial planning software we use for our clients from the comfort of your own home or your office. Just click here to start planning.

Retirement, Inflation, and Rising Interest Rates

Dean Barber: Bud, let’s get back to the Fed, these rising interest rates, and the inflation situation. The excess stimulus that came out of COVID has caused this rampant inflation. And there are some other issues there too, Bud. But the big deal is the money supply.

Bud Kasper: Yeah. And it’s so simple, isn’t it? They forced interest rates to be so low that the stock market was the only real option for investors.

Stock Market Valuations and Ultra-Low Interest Rates

Dean Barber: Exactly right. The stock market’s valuations were justified because of the ultra-low interest rates. And we did a show here awhile back on the duration of bonds and how bonds react when interest rates are rising.

Bond Bear Market

I’ll give a little bit of a highlight right here, Bud. So, we began the year with a 10-year treasury of around 1.5%. As we speak here, the 10-year treasury is about 3.2% to 3.3%, which has the bond aggregate down on the year by 12.39%.

Bud Kasper: Hard to believe, is it?

Dean Barber: The bond aggregate is negative 12.39% year to date, with a yield of 1.98%. That’s not good, Bud. We’ve got the S&P 500 down over 20% year to date.

Bud Kasper: Officially, in a bear market.

Dean Barber: Officially, in a bear market. So, if you had a 60/40 portfolio, 60% in the S&P 500, 40% in the bond ag, you’re down 17.6% year to date. And your portfolio is almost in a bear market. In a typical bear market cycle, Bud, the ones that you and I have lived through, the crash of 1987, we had the Dot-Com Bubble.

Today is Different

We had the 1998 Russian bond crisis. We had the financial crisis, and we had the COVID bear market. All of those bonds did exceptionally well because we were coming out of a normal interest rate environment entering those times.

Bud Kasper: So that’s not what we have today.

Dean Barber: That is not what we have today. Why would anybody want to go out and buy the bond aggregate today at 1.98% when you can go out and buy a one-year treasury for approximately 2.8%?

Bud Kasper: Yeah, you wouldn’t.

401(k) Investment Options & Tartget-Date Funds

Dean Barber: You wouldn’t. But here’s another issue, Bud. You look at the 401(k) plan, investment options that most people have today. They’ve got an S&P 500 fund.

They’ve got an international fund, a large-cap growth fund, a large-cap value fund, and a small-cap, midcap, et cetera. They have the bond aggregate. And sometimes they might have a short-term treasury, or you got to go to a money market.

Bud Kasper: Well, and the other prevailing one is the target-date fund.

Dean Barber: The target-date funds, which own a little bit of them.

Bud Kasper: And they’re getting hit hard.

Perma-Bull, Brian Wesbury

Dean Barber: Yes, they are. So, our friend, Brian Wesbury from First Trust, and you’ve probably seen Brian Wesbury on CNBC or Bloomberg or any of the major stock market outlets. Fox Business, you’ll see him on there.

He has been referred to as the perma-bull. He is always finding a reason to say, “No, don’t be worried right now. You should be thinking longer-term, and things are good.”

Well, in late 2021, they were predicting the S&P 500 to be at 5,250 by the end of 2022, and the Dow would be at 40,000.

We’re nowhere near those numbers today, and he’s since changed his tune. And he’s changed his tune because of how aggressive Jerome Powell and the rest of the federal reserve governors are in increasing interest rates.

Bud Kasper: Yeah. And so, the title of this article is, Respect the Bear.

Respect the Bear

Dean Barber: Respect the Bear. So, he said that the valuations of the mark were highly justified when the 10-year treasury was at 1.5%. The Fed has been much more aggressive than anybody anticipated and has sent the markets into a tailspin. You’re 3.2% to 3.3% on the 10-year treasury versus 1.5% on the 10-year treasury, which devalues what the stock market should be doing.

Bud Kasper: Yeah. To use an old saying, you’re not going to get any gain until you have the pain, and that is what we got. I mean, we cycle through these things from time to time. And I think I was sharing with you earlier that my wife and I went to a program created that was the temptations. What a group, I mean, that’s right out of my generation.

You know all the songs and everything. Well, one of the songs is Getting Ready. And dawned on me, are people getting ready for what we will experience with these continual increases? How should you adjust your portfolio, or do you need to adjust your portfolio? You need to know what your options are.

No Expectations for a New All-Time Highs

Dean Barber: You definitely do, Bud. Back to our friend, Brian Wesbury from First Trust. Brian says, “Hey, we don’t expect the S&P 500 to hit a new all-time high, above the old high of 4,797, anytime soon.

Instead, until one of our two scenarios plays out, a recession or the realization that the Fed has pulled off to soft landing. US equities are like to be in a trading range with potential bear market rallies that come and go.”

What he’s saying is that as the 10-year yield continues to rise, it will continue to put pressure on the S&P 500. It’s going to continue to put pressure on the bond aggregate.

The Fed’s target now is to be around 3.5% on the fed fund’s rate by the end of the year. And that’s higher than what the 10-year treasury is today, Bud. So, it’s very likely that the 10-year treasury continues to rise. We’ve got mortgage rates now at 6%, and we expect that to be 6.75% by the end of the year.

Bud Kasper: Yeah, we do. I think that for most people, the realization of the impact that it has on your savings needs to be understood. And that’s why you have to have a plan.

Patience and Opportunity

Dean Barber: Absolutely. So, here’s the thing: this is not all gloom and doom because an opportunity will arise out of every chaotic time or difficult time. There is opportunity today in areas that are not necessarily what people would consider to be the normal 60/40 type of portfolio. You have to get outside that box a little bit. And for some time, you’ll want to own things that can give you some protection and provide liquidity for those opportunities.

A History of Recessions

Dean Barber: I want to quote my good friend Bud Kasper because he always says, “History doesn’t necessarily repeat itself, but it often rhymes.” And, of course, he picked that up from Mark Twain.

So you have to ask yourself the question. If you were going to take what’s happening in today’s stock market and bond market and inflationary environment and economic environment, when would be the last time from a historical perspective that we saw a stock market struggling? A bond market struggling? High inflation and rising interest rates? When was the last time that that happened, Bud?

Bud Kasper: You know, I’m going back to my mind and saying the Great Recession in 2008, but that wasn’t the case.

Dean Barber: No, it’s not. It was before either one of us entered the business. It was the late ’70s and early ’80s.

Bud Kasper: And I should remember that.

Dean Barber: Yeah, it was the late ’70s and early ’80s. So if you own stocks and bonds today, I suggest that you go back and start in about 1975 and start running a scenario of a 60/40 portfolio, taking withdrawals out of it in retirement, and see how that fared from about 1975 to about 1983.

Bud Kasper: Yeah. By the way, that’s what’s great about planning, folks. We can do this.

Dean Barber: We must do it because that’s where we are. Over 80% of economists today are now predicting stagflation. The stagflation term was coined in the late ’70s.

Bud Kasper: That’s right.

The Impact of The Federal Reserve’s Decisions

Dean Barber: And early ’80s. We had a stagnating economy. Runaway inflation and Paul Volcker came in and just shocked the entire system by jacking the rates up through the roof in a very short period.

Bud Kasper: And by the way, they didn’t do it on the meeting date of the FOMC. He just said, “We got to raise rates.”

Dean Barber: Yeah, we got to do it.

Bud Kasper: What do you mean he just raised by three-quarters of a point?

Dean Barber: And what did he do? He sent the economy into a recession. But when the economy came out of that recession, Bud, we went into an era of expansion in the mid to late ’80s into the ’90s that was unprecedented.

Bud Kasper: If we could ever get the government to quit spending so much money and show some fiscal responsibility, the market would eat that up. Finally, we’re coming down, dropping the $33 trillion worth of debt and nibbling that, and by the way, the Federal Reserve’s objective is to help in that regard because they stop their bond-buying program.

Follow the Money Supply

Dean Barber: Well, which brings us to M2. Not MI2, not Mission Impossible, M2, the money supply, and if you look at the money supply, it’s as big as it’s ever been. When you look at money supply, and when you look at money velocity, traditionally, it has taken money velocity to start to cause inflation; still, in this particular instance where we saw such a rapid increase in the money supply that it caused the inflation.

So on June 28th, next week, the Fed is going to release its report on M2 or the money supply for May, and so we need the Fed to shrink the money supply and raise interest rates if there’s any hope of fighting off this inflation. With a stagnating economy and roaring inflation, the most likely outcome is that the Fed overshoots, and we go into a mild recession. And recessions are not necessarily the end of the world. It’s a reset.

Bud Kasper: It’s a cleansing.

Dean Barber: It is a cleansing. The question is, are you just going to sit there and do nothing with your portfolio and follow Wall Street’s mantra that you must wait. Just hold on.

Bud Kasper: You have to live through the trouble to get the reward.

Dean Barber: There are things that people can be doing today to reduce the drawdown in their portfolios, to reduce the risk in the portfolios remaining a hundred percent liquid and waiting for what could be the buying opportunity of a lifetime, Bud.

A Lack of Stock and Bond Options for Portfolios

Bud Kasper: You know, when we’re talking about the market, anytime we reference something called the 60/40. 60% stocks, 40% bonds, and in looking at that, generally, over time, has provided a pretty decent return over more extended periods.

Dean Barber: Absolutely, it has Bud. The problem is, again, you got to go back to the late ’70s and early ’80s and run a 60/40 portfolio because the bonds were not bullying up the stocks. They were a drag.

Bud Kasper: And we don’t have the stock or bond option this time.

Dean Barber: That’s right. Same as then.

Bud Kasper: And for those who weren’t alive or don’t remember, in the early 1970s, say 72, 73, 4, 5, it was another oil situation. I shared the story with you that the way you got gasoline was based upon your driver, your license plate. Why was that? Because if it ended with an even number, you could get your gas on Monday, Wednesday, and Friday. If it was odd, then you go Tuesday, Thursday, Saturday, and God knows what Sunday is, hopefully, a day of rest, right? But that’s how it was, is that crazy?

Dean Barber: Yeah.

Bud Kasper: I mean, I remember I couldn’t go home because I couldn’t get enough gas in the car to make it, and we’re not that bad at this point, but we still have similarities in terms of the pain at the pump.

Dean Barber: Was that when you started hitchhiking?

Bud Kasper: I have hitchhiked in my earlier days.

What Does It Mean for You?

Dean Barber: I think the big thing that people need to be asking themselves today, Bud, is what does all this mean to my ability to do what I want to do for the rest of my life. You and I were talking before the show started today, and you were asking the question, do you believe people are wondering whether they should cut back on their spending?

And there’s no doubt that inflation is putting pressure on every single American today. Just the everyday things, the food, the energy, the gasoline, the usual stuff you do daily are costing so much. People could be stepping back and saying, you know what, those discretionary things, the trips, the gifts for the kids or the grandkids, or whatever it is that are those discretionary expenses.

We are giving you free access to the same financial planning software that we use for our clients. You can use it from the comfort of your own home, office, or wherever you want to do it, and you can start to build that plan.

If you’re already retired and wondering, do I need to cut back? Well, don’t wonder. Know. I’ve had so many conversations with people, and they’re like, well, should I forgo this trip? Or should I not do that? And we put it in the plan. I’m like, “No, you’re still fine. Keep doing what you’re doing. Live your life.” You only have one time to live every day, and you should be doing it to the best of your ability with the confidence that you can continue to do what you want to do in the future.

Finding the Right Relationship for Your Financial Future

Bud Kasper: And the vast majority of people representing people are investment advisors, not planners. And that creates a significant problem in genuinely understanding your performance based upon income streams, growth factors, and Medicare and Social Security. All the applications for a comprehensive financial plan are, in my opinion, the only way to have the assurance that you’re on the right track or that you might need to make a course correction.

Dean Barber: Yeah. So get access to the financial planning software that Bud and I keep mentioning. Here’s what we use for our clients every single day. But remember, a financial plan is only as good as the data you enter, so if you don’t document every single piece, then you’re not going to get the correct answer coming back out the other side of it.

If you have questions as you build out that plan, you can set up a time to visit with one of our certified financial planners. We’ll get a CFP® on the line with you and give you the assistance that you need.

Monetary Policy and The Global Economy

Bud Kasper: I’m looking at this article, and it says fed officials have admitted that they were too slow to tighten and are now trying to front-load rate increases in a more aggressive policy than they’ve seen in decades. Well, 1994 was the last time we had that three-quarter of a percent move.

Dean Barber: Yep. You know what, Bud? They’ve got a long way to go here, I believe. Like we talked about before, they’re going to have to attack the M2, the money supply while raising rates. They can’t just raise rates and assume that that will fix the issue here. They’ve got to tighten the money supply, as well.

Bud Kasper: I agree. And if for some reason, or somehow, they were able to reduce our country’s debt load. But look at what we’re doing. I’m pleased that the government is helping Ukraine but think of the billions of dollars that America’s putting forward to help the people. I could say, well, thank goodness we can do that. But at some point, we may not have the ability. If we keep throwing money at this and fabricating money, it will weaken the dollar.

Dean Barber: Can you imagine Bud, if the additional three-plus trillion or almost $5 trillion, worth of additional stimulus that the Democrats in the House and Senate and Joe Biden wanted to put into place early last year, can you imagine if that would’ve gone through?

Dean Barber: It was already apparent that people and businesses were back on their feet, and the economy was getting back to where it needed to be. They didn’t need additional stimulus, yet plenty was done, coming off the heels of COVID. But I think it is irresponsible.

Bud Kasper: I agree.

Utilizing an Educated Planning Perspective for Your Portfolio

Dean Barber: And yet, people want to point their finger at somebody else. It was their fault. It was Putin’s fault.

Bud Kasper: We know where that money came from, Congress. And we also knew who was leading that charge.

Dean Barber: Nancy and Chuck.

Bud Kasper: That’s right.

Dean Barber: Anyway, enough of politics. You, as an individual, have two choices at a time like this. Either you go on the offensive, build your plan, get educated, and understand what you must do to not just survive through these times but to thrive.

Option two is you put your head between your knees, wait, and hide out; don’t open your statements. That’s the craziest thing I’ve ever heard. You don’t bury your head in the sand in a time like this; you need to look for other opportunities, and there are opportunities today. You have to look somewhere besides the bond aggregate and the S&P 500.

Bud Kasper: With our over 70 years of experience, you and I combined, we’ve lived through these before. I don’t get excited, but I have to admit, I get pretty worried about things because I share the responsibility of ensuring we’ve done all we can for our clients. First off, from a planning perspective, that should always be number one. Secondly, possible portfolio adjustments need to be made to mitigate some of the volatility we’re experiencing at this time.

And that’s why I see flaws in too many relationships where people are only dealing with investment advisors because that’s how they want to fix everything. But the reality is, that many other events come into life’s plan. If you don’t recognize how to maximize those results, you’re probably missing out on serious opportunities to have the type of retirement you love.

Finding Confidence in Controlling What You Can Control

Dean Barber: Right. So, we talked about this a couple of weeks ago, you got to control what you can control. And the things that are out of your control, you can’t spend time worrying about.

Well, you can control your asset allocation. You can control when you claim your Social Security. You can control how much you pay in taxes to a large degree, especially after you’re retired. And you can control a lot of different things, but you can’t control what the Fed’s going to do, and you cannot control what the stock market’s going to do.

So, when we can build out that financial plan and see with a hundred percent clarity and confidence that somebody, we test it through bear markets, and somebody, yeah, you’re still okay. You can go through these timeframes, and your probability of success is still well above where it needs for us to have a high degree of confidence.

That gives us confidence as the financial planners, Bud, and it can help the individual’s psyche, but it still doesn’t remove the human emotion. So, this is almost like you have to double-check here. You’ve got to check the plan and make sure that it’s right and that you can continue the lifestyle you want to live, but you also have to check your emotions.

Bud Kasper: Right.

Dean Barber: And you have to check whether or not it feels okay, and from a psychological standpoint, can you continue to do the things that you want to do, or is the psychological part of it too significant? So, even though we know the plan works, we need to make some adjustments.

Find Clarity to Validate Your Financial Plan

Bud Kasper: Yeah. A lot of people over panic, and they’re on the ledge if you will. They’re trying to say, “well, I don’t know what to do. I can’t handle all this. It’s just driving me crazy and I’m ruining my retirement,” whatever the case.

Well, more than likely, not, but you don’t have validation that you can do that through all the various resources you have.

But that’s not going to be just building a portfolio or changing your allocation from 60% bonds to 20% bonds and cash is going back up to 30 and so forth, you know what I’m driving towards.

Dean Barber: Well, you hear us talking about the plan on America’s Wealth Management Show all the time. And so we’ve decided to do something that I find very exciting and many of our listeners, since we started this last week, also find it very exciting.

We’re giving you access to the exact same financial planning software, that we use for our own clients, here in our office. And you can access this software and start building out your own plan, with the same software we use. All you have to do is enter in all of your biographical and geographical data. You enter your assets, liabilities, current spending, spending goals into the future, your estimated Social Security, et cetera.

It will calculate what your tax rate’s going to look like and how much taxes you’ll pay over your lifetime. It’ll optimize when you should claim your Social Security, and it’ll allow you to see what’s the optimum asset allocation for you.

So, take advantage and start building your plan from the comfort of your own home, using the same financial planning software that we use for our clients.

Now is the Time To Get Your Questions Answered

Bud Kasper: And we’ve only had that for what, two weeks, three weeks?

Dean Barber: It’s a little over a week.

Bud Kasper: And it’s incredible, the number of people that have shown an interest.

Dean Barber: Well, and the thing is that people want clarity.

Bud Kasper: Sure they do.

Dean Barber: They want to know where are they? And can I keep doing what I’m doing? Am I saving enough? Do I have enough?

Bud Kasper: And they know there’s an answer beyond a 60-40 portfolio.

Dean Barber: And they know there’s an answer, beyond own your age in bonds. Can you imagine if you’re 75 years old and, you say, own your age in bonds and just lost 13% on 75% of your portfolio?

Bud Kasper: Yeah, you’re right with that. So, this is a wonderful opportunity, folks, and it’s so unique, and I know it’s going to be very popular because there are people that want to do the right thing for themselves and their money.

Dean Barber: Remember, to get a good result and a fair result of one that is reality, it’s all about the data input. It’s all about the accuracy of the data that you input.

And if you have questions while you’re trying to put that data in, you can reach out to us, and we can help you through a Zoom call or a phone call or something like that, walk you through it with one of our CERTIFIED FINANCIAL PLANNER professionals.

We appreciate you being with us here on America’s Wealth Management Show. I’m Dean Barber, along with Bud Kasper. Everybody stay healthy, stay safe. We’ll be back with you next week, same time, same place.

Schedule Complimentary Consultation

Click below and select the office you would like to meet with. Then it’s just two simple steps to schedule your complimentary consultation. We can meet in-person, by virtual meeting, or by phone.

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.