Should I Buy Gold?

Key Points – Should I Buy Gold?:

- Fear, Greed, and Gold

- Fear Assets and COVID

- Old Gold Adages

- The Value of Gold

- Negatives and Positives to Buying Gold

- 7 minute read

Should I Buy Gold?

“Should I buy gold?” I hear this question daily, multiple times, and it’s not surprising. You can’t turn on your radio, television, or open your email or social media accounts without being bombarded by gold commercials. They’re everywhere.

The commercials and digital ads all do their best to convince you that the dollar will become worthless, inflation will be rampant, and the only thing you can do to protect yourself is to buy gold NOW.

The messaging is pervasive, if not persuasive, and is sure to get people looking gold up on the internet. To see what a Google search would turn up, I typed “buying gold” into the search bar. Google brought up 3,650,000,000 results in 1.22 seconds! Pretty incredible. So today, I want to talk about the realities of gold versus the hype about gold to bring some much-needed perspective in these unprecedented times.

Fear, Greed, and Gold

“Be fearful when others are greedy, and greedy when others are fearful. “

– Warren Buffet

The Oracle of Omaha, Warren Buffet, has been an incredibly successful investor for a very long time. He has maintained for years that gold is not necessarily a good investment. And if history is our guide, he’s not wrong.

That’s not to say you can’t make money in gold at some point or that it doesn’t have value. But long term, it has not lived up to the hype surrounding it. The reason, I believe, is that gold tends to be a fear asset more than anything else. And fear is one of the most destructive emotions to have when it comes to investment decisions.

Greed is the other emotion that can be equally as destructive if left unchecked. When acting on fear or greed, we are acting on emotion. And when we make decisions emotionally, we can’t let go of them because we’re emotionally attached to them. Consequently, a fear asset like gold will break a lot of hearts because the emotion of fear causes otherwise intelligent people to make the wrong decision at the wrong time.

Fear Assets and COVID

“Gold is a way of going long on fear, and it has been a pretty good way of going long on fear from time to time. But you really have to hope people become more afraid in a year or two years than they are now. And if they become more afraid you make money, if they become less afraid you lose money, but the gold itself doesn’t produce anything. “

– Warren Buffet

The panic over COVID is a perfect example of what Mr. Buffet is talking about here. Based on the early predictions of the potential loss of life (which thankfully turned out to be apocalyptic compared to what happened) and the global responses based on them, the economy and life as we knew it ground to a screeching halt beginning in March of last year.

I’m not telling you anything you don’t know because you all lived through it too. What you may not know is that the federal stimulus payments that would ensue to mitigate the economic damage of lockdowns, stay at home orders that were widespread and continue to this day, caused a predictable (if irrational) fear of runaway inflation and the collapse of the US dollar due to the amount of money that the Federal Government was spending.

Gold Prices Increased Based on Fear

Consequently, the fear asset and perceived inflation hedge, gold, saw a huge increase in its price per ounce. The price of gold peaked in August of last year at $2081 an ounce. By early March of this year, gold had fallen to $1681 an ounce, almost exactly where it was before the pandemic.

For those of you doing the math in your head right now, that’s a 24% drop in value in 7 short months if you were the person who bought gold at the peak of the fear rally. What about the longer term, though?

Old Gold Adages

You’ve undoubtedly heard the old adages that “Gold is a constant store of value,” and “Gold has never been worth zero,” right?

Gold Has Never Been Worth Zero

Well, let’s start with the easy one. Gold has never been worth zero. That’s absolutely correct, but it got REAL close for a long time when FDR outlawed private ownership of gold in 1933. The government forced everyone to surrender their gold and paid them $20.67 an ounce for it.

The punishment for failure to comply by May 1st of that year was a $10,000 fine ($167,700 inflation-adjusted to 2010 dollars) and/or up to ten years in prison.

Then, eight months later, they fixed the price of gold at $35 per ounce. Did you catch that? They “paid” the people they forced to surrender it $20 an ounce, and then once they controlled it, they proclaimed that it was worth $35 an ounce. Might they try that again? I wouldn’t be surprised. It took 41 years for the right to private ownership of gold to be restored by Gerald Ford in December of 1974.

Gold is a Constant Store of Value

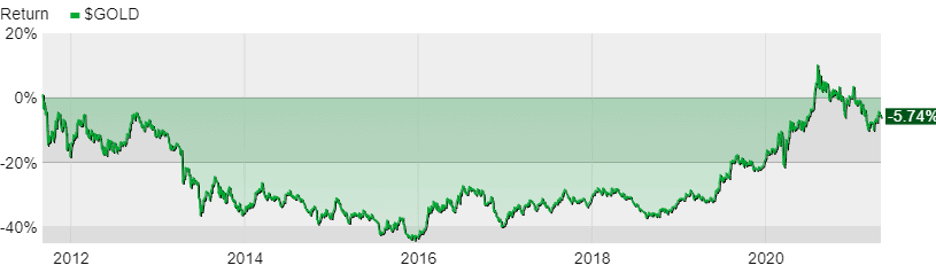

But what about the other adage? “Gold is a constant store of value.” Well, let’s look at gold’s most recent lost decade to see if that’s true. The chart below illustrates the gain/loss in the spot price of gold from September 11, 2011, the last high following the great recession, to today, May 3, 2021.

If you bought amid the panic buying spurred by the quantitative easing that followed the great recession, your loss today after holding your gold for ten years would still be almost -6%. But would you have held it? If you bought it in September of 2011, by the end of December 2015, your gold would have been worth 43.47% less than what you paid for it. I don’t know many people who would stay the course in the face of those kinds of losses.

Gold Can Be Good

To be fair, just the opposite can be true since two things can be true simultaneously.

If you bought gold in December of 2015, you’re pretty darn happy right now because you are up by 63%. For how long no one knows. The point is, gold is no more stable than any other equity investment you can name, except maybe cryptocurrencies, which is a whole different discussion.

If you are going to buy gold, and I’m not saying you should or shouldn’t, you need to be aware of the amount of volatility that this “constant store of value” can be subject to. Don’t buy the hype. Know the facts.

Where is the Value in Gold?

Aside from its natural beauty, making it ideal for decorative jewelry and the limited industrial demand for gold in specific applications, it truly has no utility. It especially has no utility in the way that the gold peddlers want you to think it has. Want proof? Name one place you conduct everyday consumer transactions today that you could use gold as your payment method. I’ll wait.

You can’t name any because gold is not accepted as currency. Though it has monetary value, you can’t trade it for goods and services in a retail store. And, if you could, what are you going to do?

Take your gold bar into the grocery store and shave off the proper amount onto a scale based on the current (ever-changing) value of an ounce of gold? That’s what you’d have to do if you could do it. But you can’t. Why? Not a single retail outlet in the country is set up to accommodate your desire to pay with gold. Not one.

Using Gold for Commerce

In order to use your gold for commerce, you have to convert it to dollars. That’s right, dollars. The same currency that the gold sellers want you to believe will become worthless so that you’ll buy gold from them. But let’s take that a little further.

Gold has Fees

Like Warren Buffet said, you have to pay people to guard your gold. They don’t do that for free. You also have to pay a commission to buy your gold, and you have to pay a commission to SELL your gold and convert it to useable currency.

Here’s a question to consider. Do the guys selling you gold, and buying your gold back from you, take their commission payments in gold? What do you think? If they believed their own hype, you would think they would be more than happy to, but they don’t. You have to pay them in, wait for it, US. dollars! Why? Because they can’t pay their mortgage and their utility bills with gold any more than you can.

There are Negatives and Positives to Buying Gold

The reality is that there are as many negatives to gold as there are positives, just like any other investment you might make. But that doesn’t mean it’s not smart to own some gold at some point.

Gold tends to increase in value during times of higher than normal inflation and can help offset some losses in other assets you own that may tend to lose value in those inflationary times. That is a good thing and a valid reason to own some gold for a period.

If you’re buying gold as a hedge, you have to know when to sell it, and you can’t be emotionally attached to the gold or to the idea of owning gold.

I know that this article may come across as biased against gold ownership, but that is not the intent. For any of you considering buying gold, you must understand WHAT you are buying and WHY you are buying it.

Gold is a Complex Investment

The reality of gold is not what you hear or read in the commercials and ads I mentioned at the beginning of this discussion. It’s a complex investment that carries a high potential for gain AND loss. The commercials never tell you about the loss potential, though.

You must do your due diligence and make your own decisions based on that work. Buy gold, like any other investment, with your eyes open and your mind informed. That way, you won’t be so hard on yourself when the outcome of the purchase is something less than ideal, and you can congratulate yourself for being so wise when things go better than expected.

Shane Barber

Partner

Schedule Complimentary Consultation

Select the office you would like to meet with. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Lenexa Office Lee’s Summit Office North Kansas City Office

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.

Historical IRA Contribution Limits