Social Security Cost-of-Living Adjustment Set for 5.9% Increase in 2022

Key Points – Social Security Cost-of-Living Adjustment Set for 5.9% Increase in 2022

- Social Security Cost-of-Living Adjustment Will Be the Highest Increase in 40 Years.

- The Increase Will Be 5.9% in 2022, Compared to Just 1.3% in 2021.

- 2 minutes to read.

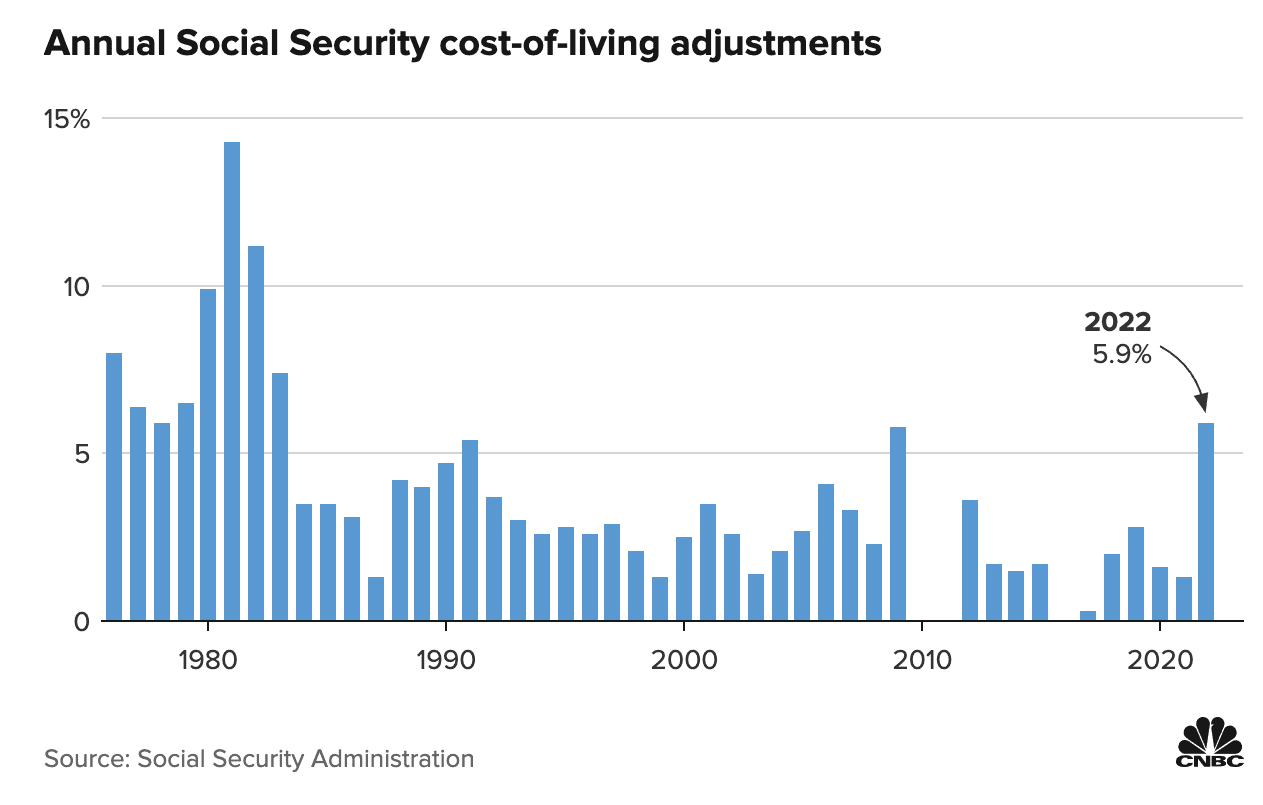

The Social Security Administration announced last week that the Social Security cost-of-living adjustment will increase 5.9% in 2022, which marks the biggest annual uptick in 40 years.

Annual Social Security COLA increases had been below 5% every except one since 1992. The lone exception was a 5.8% increase in 2009. Last year, Social Security beneficiaries saw a 1.3% increase.

“(Wednesday’s) announcement of a 5.9% COLA increase, the largest increase in four decades, is crucial for Social Security beneficiaries and their families as they try to keep up with rising costs,” AARP CEO Jo Ann Jenkins said in a statement.

TABLE 1 | Source: Social Security Administration

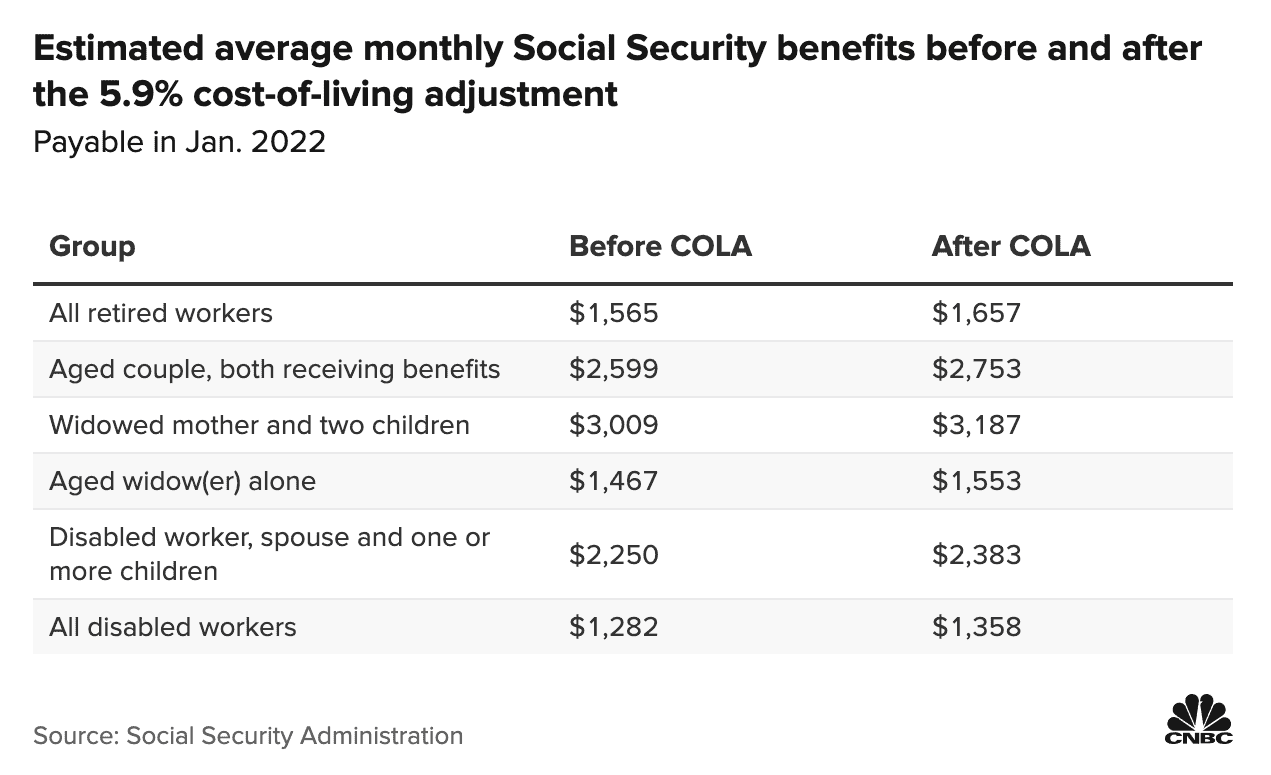

According to CNBC, more than 64 million Social Security beneficiaries will see the increase in their monthly checks beginning in January. The increase will be effective on December 30 for the roughly 8 million Supplemental Security Income beneficiaries.

Social Security Cost-of-Living Adjustment Inside the Numbers

TABLE 2 | Source: Social Security Administration

It was also announced on Wednesday that consumer prices experienced a bigger bump in September than expected.

The National Committee to Preserve Social Security and Medicare had a few thoughts to share about the 5.9% COLA increase for next year. While the NCPSSM believes the big increase is certainly encouraging news for seniors in the effort to combat rising costs of living, they argue that changes still need to be made for configuring annual adjustments. The NCPSSM claims that the Consumer Price Index for the Elderly (CPI-E) would more effectively calculate the costs for seniors. They also say it’s hard to ignore that the COLA adjustment was zero in 2010, 2011, and 2016.

“The fact that this is the highest increase since 1982 does not speak well for Social Security’s ability to keep pace with those expenses,” NCPSSM President and CEO Max Richtman said in a statement.

Who Supports the CPI-E and Who Doesn’t?

The NCPSSM’s recommended change to tracking annual COLA data via the CPI-E has been backed by President Joe Biden and in various Democratic congressional bills. Others argue, though, that the CPI-E remains as an experimental tool, and that there are more efficient ways to document COLA data.

Urban Institute Principal Policy Associate Chantel Boyens expressed her concerns about the CPI-E during the Bipartisan Policy Center’s webinar on Wednesday. She claimed that the CPI-E doesn’t directly correlate with the Social Security beneficiary population.

“If you care a lot about reducing poverty among the oldest beneficiaries and those that are receiving benefits the longest—a lot of disabled beneficiaries—then providing a one-time benefit boost is actually a better option then adopting, for instance, the CPI-E,” Boyens said. “A boost for long-term beneficiaries is both more effective at reducing poverty and it costs less. In fact, it provides more protection against poverty at about half of the price tag.”

Other Social Security Administration Announcements

Last, but not least, the SSA announced that maximum earnings subject to Social Security taxes will increase next year. That mark will be $147,000 in 2022, compared to $142,800 in 2021.

Get Assistance with Claiming Your Social Security

Please don’t hesitate to reach out to us with Social Security-related questions. Our financial advisors are advisors are happy to answer any questions about benefits that you may have in a complimentary consultation. Give us a call at (913) 393-1000 or schedule a complimentary consultation below.

Schedule Complimentary Consultation

Select the office you would like to meet with. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Lenexa Office Lee’s Summit Office North Kansas City Office

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.