How to Build Generational Wealth

Key Points – How to Build Generational Wealth:

- Have You Heard About the Great Wealth Transfer?

- Looking at Assets by Generations

- Predicting the Future of Wealth Transfer

- Understanding How to Build Generational Wealth

- 9 Minutes to Read

How to Build Generational Wealth

Are you a Baby Boomer (born between 1946 and 1964)? If you are, there’s a good chance that you’ve either retired or at the very least are considering retirement. If you aren’t, you’re likely related to someone who is. Either way, it’s critical to understand how to build generational wealth if leaving a legacy is important to you.

We’re going to highlight some eye-popping statistics to explain why building generational wealth needs to be even more top of mind than it has been in the past. And after we dive into those statistics, we’re going to discuss how to build generational wealth. We have three main goals at Modern Wealth. We’re committed to helping you and your loved ones gain more confidence that you’re doing the right things with your money, freedom from financial stress, and more time to do the things that you love.

Retirement Considerations for the Baby Boomers

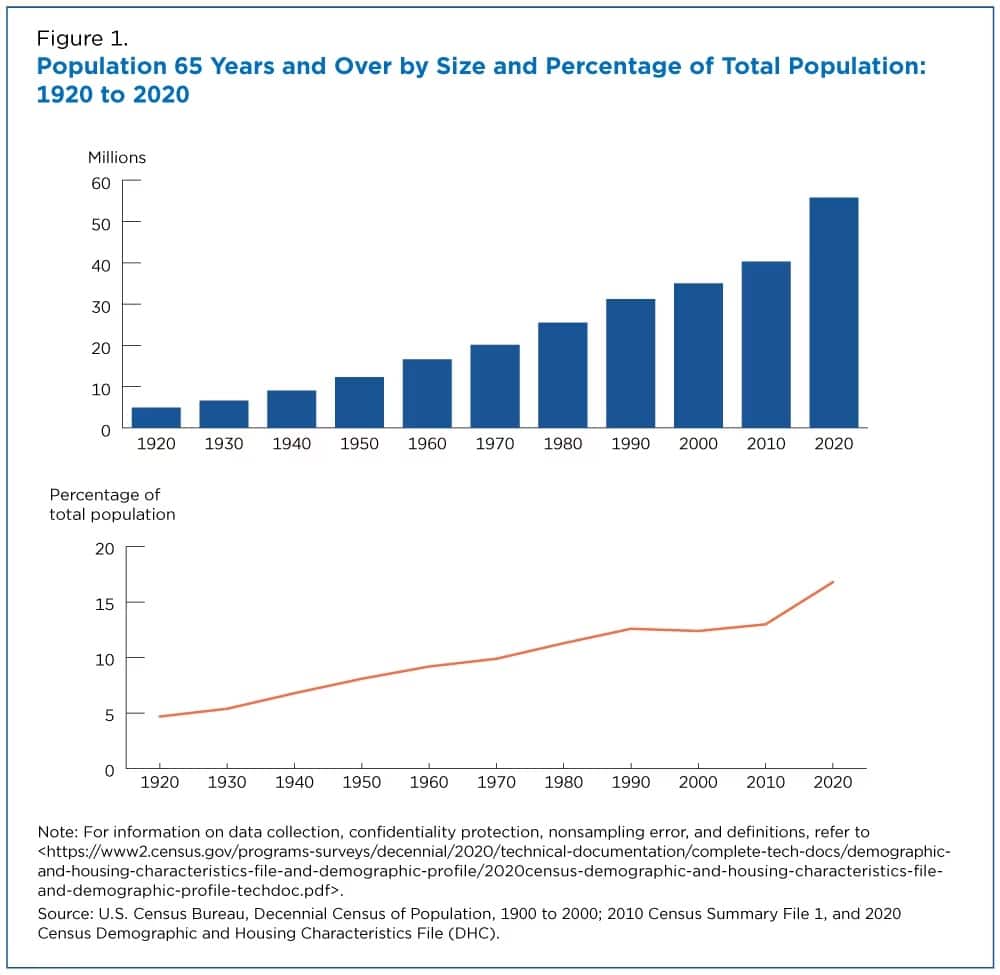

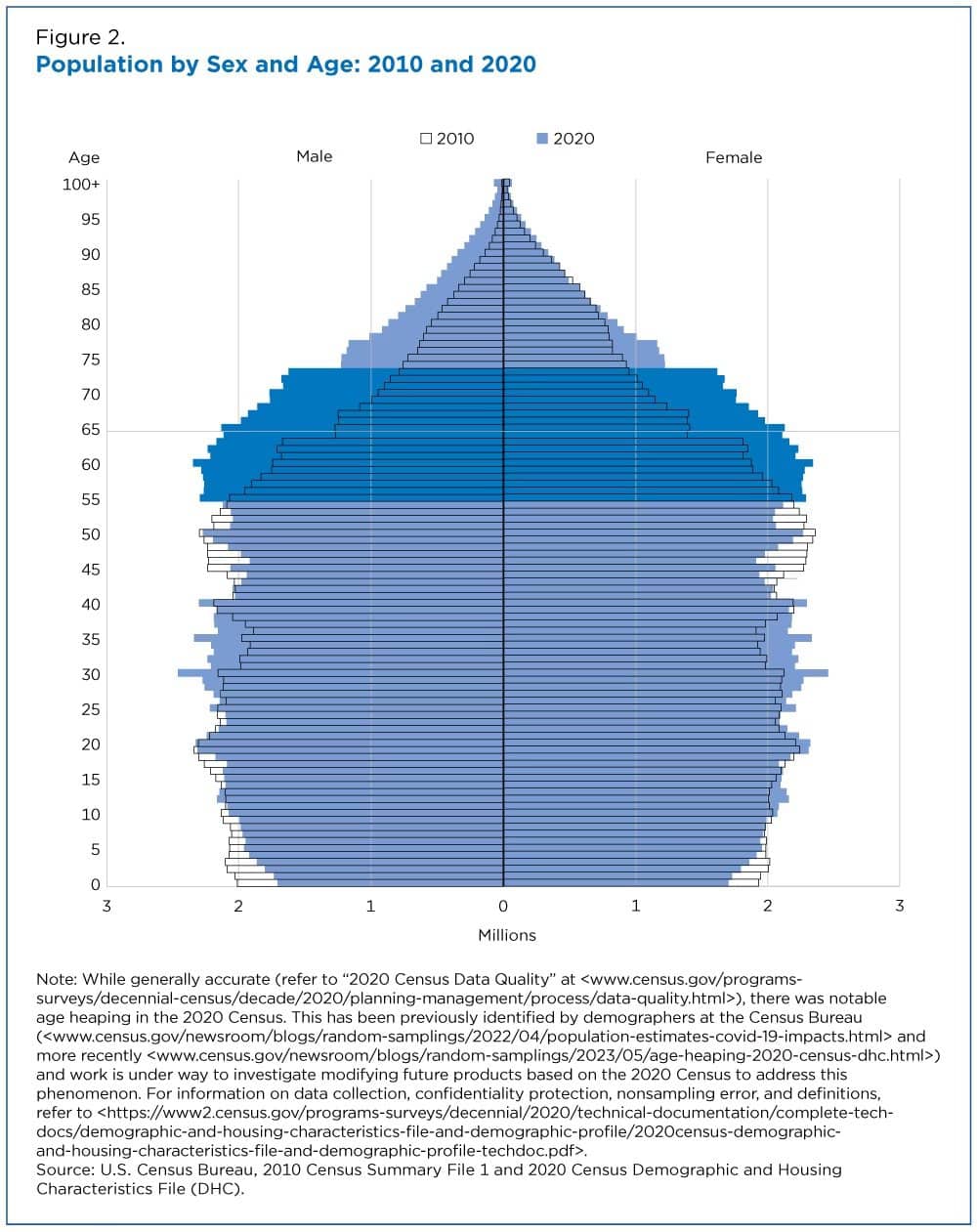

The Baby Boomers have played a huge role in building the American work force, but more and more of them are retiring. Between now and 2030, more than 10,000 Baby Boomers are expected to turn 65 each day. If you think that’s alarming, just look at these statistics from the 2020 census.

- Nearly one in six U.S. citizens were 65 or older in 2020 (it was less than one in 20 in 1920).

- There were 15.5 million more people 65 or older in 2020 than there were in 2010 (that’s the fastest rate of population increase since 1880-1890).

- The older population (65 and older) grew about five times faster than the overall population from 2010-2020.

FIGURE 2 – Population by Sex and Age: 2010 and 2020 – U.S. Census Bureau

The Great Wealth Transfer

There are so many things that can be taken away from these statistics. Some people are worried about a “gray tsunami”—referring to the potential stress that the rapidly increasing older population could be putting on the Medicare system. There are also concerns about the Baby Boomers potentially bankrupting Social Security. Those are two examples of things that are out of your control, but you can plan for them. Those specific concerns aren’t going to be the focus of this article, though. Rather than looking at this period as a “gray tsunami,” we’re looking at it as the Great Wealth Transfer.

What Is the Great Wealth Transfer?

If you haven’t heard about the Great Wealth Transfer, it’s exactly what it sounds like. Most of the Baby Boomers participated in an unprecedented economic surge—accruing financial wealth via the markets, real estate, etc. Well, now that the Baby Boomers are retiring, they’re not only living off their hard-earned wealth, but they’re looking into passing it down to the next generation. Let’s look at a few more statistics from the past 40 years to get a better idea of how big this Great Wealth Transfer could end up being.

- Home values increased 500% from 1983-2023.

- In 1989, household wealth was at $38 trillion. In 2022, it came in at $140 trillion per the Federal Reserve.

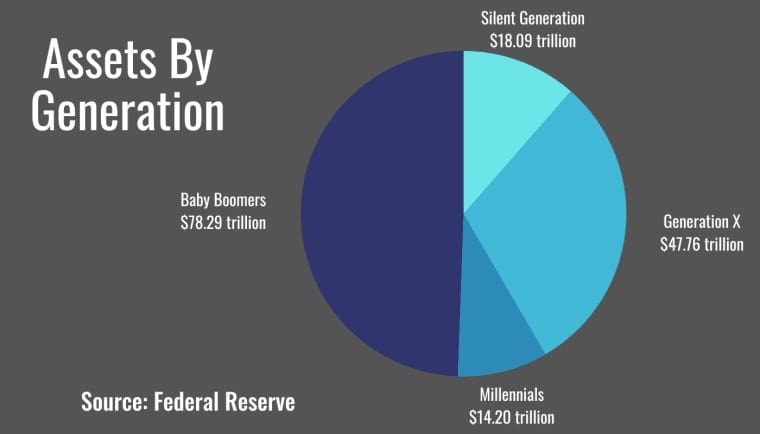

- Baby Boomers currently hold about $78 trillion in assets in 2023. See Figure 3 below to see how that compares to other generations.

FIGURE 3 – Assets by Generation – Federal Reserve

The Future of Generational Wealth

Can you start to see why it’s so important to understand how to build generational wealth? We’ve shared several statistics that illustrate how we’ve gotten to this point, but let’s look at the potential future of generational wealth too. A 2022 study from Cerulli Associates estimates that $84.4 trillion in assets will be transferred through 2045. Of that $84.4 trillion, $72.6 trillion will be passed down to heirs and the other $11.9 trillion will go to charity.

Understanding How to Build Generational Wealth

Passing down that much wealth from generation to generation is a good problem to have. But trust us that wealth transfer isn’t as simple as it might seem. We want to make sure that you’re passing down or inheriting as much as possible without too much of it going to Uncle Sam.

Remember that if you’ve saved $1 million for retirement (just as an example), all that $1 million isn’t actually yours because taxes haven’t been factored in yet. It’s not about how much goes into your retirement savings accounts that matters most; it’s how much comes out net after taxes.

When most people meet with us for the first time, they tend to have most of their assets in a traditional 401(k) or IRA. When you save to a traditional 401(k), that money goes in tax-deferred. You get a tax deduction when you make the contribution, but once you get to the distribution phase of life, it becomes taxable.

The Retirement Savings Time Bomb Highlights the Importance of How to Build Generational Wealth

So, if you’re planning to pass down a traditional IRA to the next generation or expecting to inherit one, can you see where this becomes problematic? Our good friend Ed Slott, who is America’s IRA Expert, refers to the traditional IRA as the retirement savings time bomb. As the Great Wealth Transfer takes place, more and more people will be inheriting assets during their peak earning years—making that retirement savings time bomb bigger and bigger.

It wasn’t that long ago that the IRA was still a reasonable option for wealth transfer, but that changed in December 2019 when the SECURE Act was passed. Simply put, IRAs are a bad wealth transfer vehicle. Prior to the SECURE Act, designated beneficiaries of IRAs could utilize a Stretch IRA. That allowed them to take their own Required Minimum Distributions from IRA depending on their life expectancy. The SECURE Act eliminated the Stretch IRA, though. Now, beneficiaries are required to empty the IRA within 10 years.

Building Generational Wealth on

America’s Wealth Management Show

How to Build Generational Wealth with Roth IRAs

While the SECURE Act wasn’t welcomed news for how to build generational wealth, the creation of the Roth IRA certainly was. The Roth IRA was introduced by former senator William Roth in 1997. With the Roth, you pay the tax up front and then all the earnings and growth come out tax-free.

Now, think about that when it comes to wealth transfer. There isn’t the tax timebomb that you have with the traditional IRA because the tax has already been paid. The 10-year rule still applies with the Roth IRA, but there are no RMDs in the first nine years. There are RMDs each year with the traditional IRA. That’s a huge factor with how to build generational wealth.

Also, keep in mind that tax rates are scheduled to go up in 2026 because the Tax Cuts and Jobs Act will be sunsetting on December 31, 2025. That means that will revert to the higher tax rates from 2017. That has led many people to do Roth conversions—converting their traditional IRAs to Roth IRAs. Those people are paying the tax now while rates are lower and then the distributions will come out tax-free. Again, that’s wonderful news for the beneficiaries of those Roth accounts.

529 Rollovers to Roth IRAs

Let’s stay on the subject of Roth IRAs. When SECURE 2.0 became law on January 1, 2023, one of the provisions that was included was that starting in 2024, a 529 plan could be rolled over to a Roth IRA under certain conditions. For those unfamiliar with 529 plans, they are investment accounts that offer tax benefits when used to pay for qualified education expenses for designated beneficiaries. They’ve become very popular for grandparents who want to help pay for their grandchildren’s education. Everyone wins.

However, one issue that has come up with 529s is that the funds can become obsolete if the 529 beneficiary drops out of school or doesn’t need them to complete their education. With the SECURE 2.0 provision, those funds can be rolled over to Roth IRAs so the beneficiaries can take advantage of tax-free assets as they begin their careers. That’s how to build generational wealth 101.

Making Sure Your Loved Ones Understand the Importance of Saving

It can sometimes feel like a blur when you’re watching your child or grandchild grow up. One minute you’re taking them home from the hospital shortly after they’re born. Suddenly, they become parents themselves. Somewhere in that blur, it’s important to teach them the basics of saving.

Bucketing Strategies

Do you and your loved ones understand the difference between saving to the traditional side of a 401(k) compared to the Roth side? While we’ve given a few reasons to save to the Roth, there are cases to be made for saving to the traditional as well. Obviously, the main benefit is getting the tax break up front.

There are three tax buckets that you can save to: taxable, tax-deferred accounts, and tax-free accounts. Spreading your money across all three buckets (AKA: tax diversification) is critical for getting yourself to and through retirement and figuring out how to build generational wealth.

The tax buckets aren’t the only buckets that are prevalent in this discussion. You have your short-term, mid-term, and long-term investing buckets as well. Obviously, the long-term bucket is key in terms of how to build generational wealth. Check out what Lisa Featherngill, the national director of wealth planning at Comerica Bank, has to say about thinking long-term.

“With long-term money that has a multigenerational focus, you’re not as concerned about liquidity, because you don’t need to access it for spending. You can take more risks with the potential for higher returns because you have a longer time frame.” – Lisa Featherngill, National Director of Wealth Planning at Comerica Bank

How to Build Generational Wealth via Tax Planning

Again, the goal with how to build generational wealth is determining how to pass as much money to the next generation as possible in the most tax-efficient way possible. What tax planning strategies that we’ve discussed could be beneficial to you and your loved ones? Take some time to review our Tax Reduction Strategies guide to see what all you and family need to consider from a tax perspective with how to build generational wealth. Download your copy below!

Download: Tax Reduction Strategies Guide

While the tax planning strategies mentioned in our Tax Reduction Strategies guide can have a profound impact on your plan’s probability of success, we strongly encourage you to consult a tax professional who understands what tax planning is all about before making a financial decision that could be fueled by fear or greed. This is why we have CPAs in house that work side by side with our CFP® Professionals to review financial plans from a tax perspective.

What Does Your Estate Plan Look Like?

And since we’re talking about how to build generational wealth, we’d be remiss if we didn’t mention that we also have estate planning specialists on staff. Estate planning is one of the most important pillars of a financial plan. Consider these crucial questions as your building out and reviewing your estate plan.

- Will your spouse be OK financially if you spouse away (or vice versa)?

- Where do you and your spouse want your money to go once both of you are gone?

- Is a will going to be enough or do you need a trust?

- What factors go into probate?

- Are your beneficiaries up to date?

Don’t just ask yourself those questions. While end-of-life conversations obviously aren’t fun to have with your family, they’re essential to have so that everyone is on the same page. And as you’re building out or reviewing your estate plan, don’t forgot to download our Retirement Plan Checklist. It includes 30 yes-or-no questions—some of which pertain to estate planning—as well as a timeline of things to consider as you’re approaching and going through retirement. Download your copy below!

Life Insurance as an Estate Planning Vehicle

Having the peace of mind that your loved ones will be OK once you’re gone means so much to so many people. That leads us right into discussing the importance of insurance and its role in how to build generational wealth. And yes, we have insurance specialists on staff at Modern Wealth too that play a key cog in our financial planning approach.

We could talk all day about the various types of insurance coverages, but we’re going to focus on life insurance. Does it make sense for you to carry life insurance into retirement? There are several reasons why it makes sense to have it while you’re still working, but believe it or not, there are reasons to carry it into retirement as well. Life insurance can be used as a pension maximization tool or to help with covering long-term care costs.

And let’s circle back to Roth IRAs for a second. You can use life insurance to convert from a traditional IRA to a Roth IRA. For example, what if you pass away and your spouse gets forced into a higher tax bracket? Well, if you and your spouse carry life insurance policies on each other, that could help your spouse pay or completely cover the taxes to convert the traditional IRA to a Roth IRA when you die. And once again, once that Roth IRA is passed down to the next generation, it goes to them tax-free. It’s yet another effective way for how to build generational wealth.

Do You Have Any Questions?

We’ve covered a lot of ground with the many ways of how to build generational wealth. We’re also well aware that there’s much more detail that we can get into on this important topic. If you have questions about how to build generational wealth, we have a wide range of professionals on our team that can help you depending on your questions. You can ask those questions during a 20-minute “ask anything” session or a complimentary consultation by clicking here.

Depending on what works best for you, we can meet with you in person, virtually, or by phone. No matter the setting, we’re excited to talk with you about how to build generational wealth.

Resources Mentioned in This Article

Articles

- Family Financial Planning with Matt Kasper

- ABCs of Medicare

- Revisiting Roth vs. Traditional with Bud Kasper and Corey Hulstein, CPA

- Retiring with $1 Million

- What Is Tax Diversification?

- Ed Slott – In Studio!

- What Is the SECURE Act?

- Tax Rates Sunset in 2026 and Why That Matters

- Roth Conversion Decisions for 2023

- Understanding the SECURE Act 2.0 with Ed Slott

- 529 Rollover to a Roth IRA

- Tax Planning for Individuals: 5 Tips to Save

- What Are the Tax Buckets?

- Tax-Efficient Investing with Stephen Tuckwood

- Tax Planning Strategies with Marty James

- What Is a Monte Carlo Simulation?

- Components of a Complete Financial Plan with Logan DeGraeve

- What Is Probate and Why Should I Avoid It?

- How to Be the CEO of Your Retirement

- Investment Risk in 2023 with Garrett Waters

- What Are Tax Brackets?

Past Episodes of America’s Wealth Management Show

- Getting Ready for Retirement: Don’t Retire without Doing These Things First

- Meet Modern Wealth Management

- 4 Retirement Risks That Are Out of Your Control

- What Is Wealth? 4 Types of Wealth

- Transferring Wealth: IRAs Are a Bad Option

- How to Reduce RMDs with 5 Strategies

- Converting to a Roth IRA: What Are the Pros and Cons?

- How Does a Roth IRA Grow?

- What Is Tax Planning?

- Couples Retirement Planning: What You Need to Know?

- Life Insurance in Retirement: Do I Still Need It?

- Pension Plans: Defined Benefit Plans vs. Defined Contribution Plans

Downloads

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.