What If We Go Back to Old Tax Rates?

Key Points – What If We Go Back to Old Tax Rates?

- Analyzing the Impact of the Tax Cuts and Jobs Act of 2017

- Comparing Current Tax Brackets with 2017/2026 Tax Brackets

- Differences Between CPI and Chained CPI

- Breaking Down Changes in Deductions and Exemptions

- Previewing the end of the TCJA in 2026

- 6 Minutes to Read

What If We Go Back to Old Tax Rates?

Do you remember when the Tax Cuts and Jobs Act of 2017 was signed into law? The law was arguably the most significant change to the tax code in years, as it reduced tax rates and increased the standard deduction, among other things.

Because the legislation was so unpopular with Democrats, the Republican authors of the bill wrote in a sunset provision for most of the changes affecting individuals (the corporate tax law changes were made permanent) to work within budgetary constraints.

Well, the sunsetting is suddenly right around the corner, as it’s scheduled to take place after 2025. That means if there is no additional legislation passed between now and the end of 2025, much of the law will be reversed, and we’ll go back to many of the same tax laws we had prior to 2018. Since we can’t predict what will happen with potential future legislation, let’s take a few minutes to discuss what would happen if the TCJA was allowed to sunset as scheduled.

Tax Rates

One of the most significant changes to individuals was the change in tax brackets and rates on ordinary income. New rates and brackets were introduced in 2018, and those changes will be reversed. The brackets are and have been adjusted for inflation each year. We won’t necessarily have the same brackets we had in 2017, but the rates will be the same.

2017/2026 Tax Rates vs. Current Tax Rates

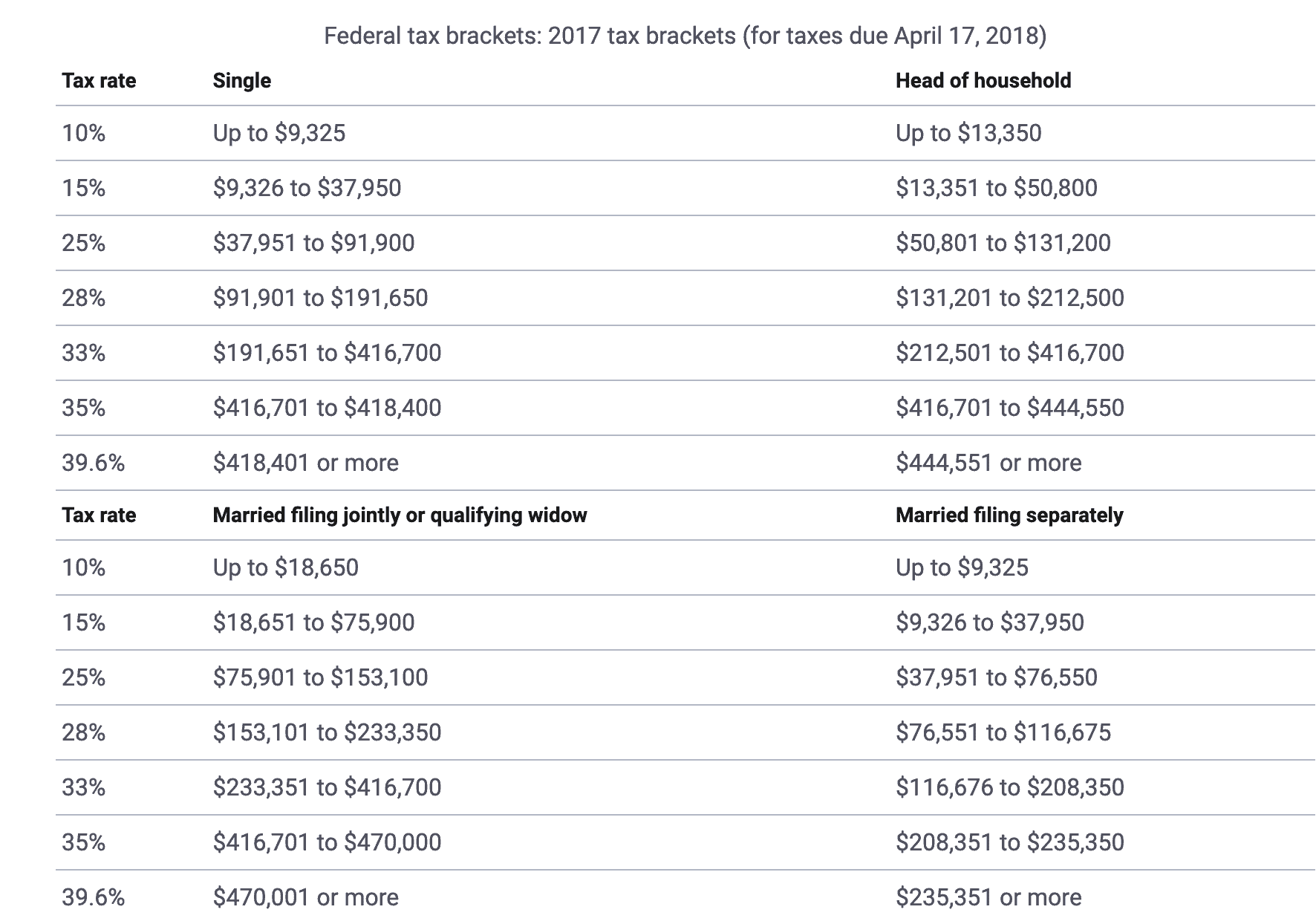

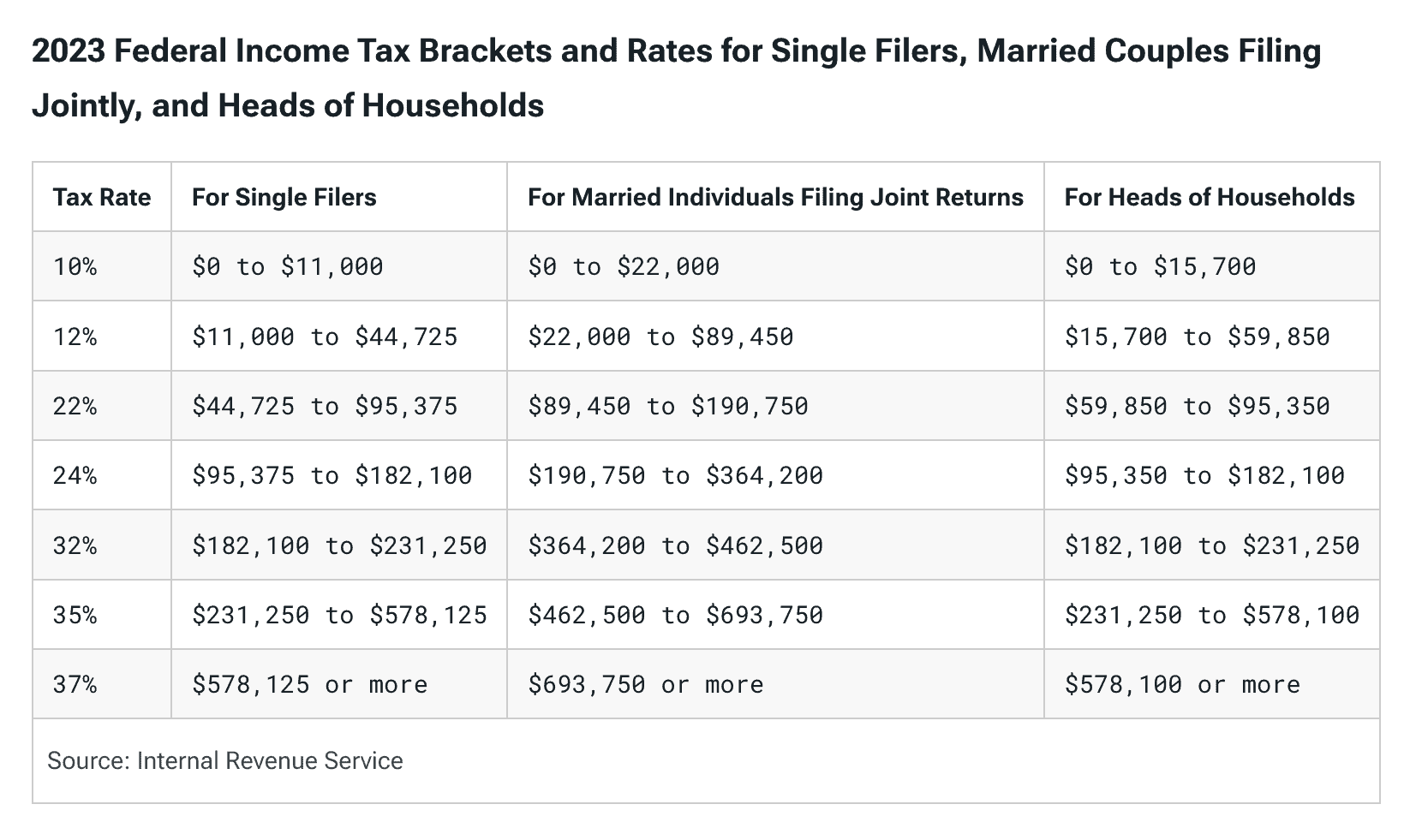

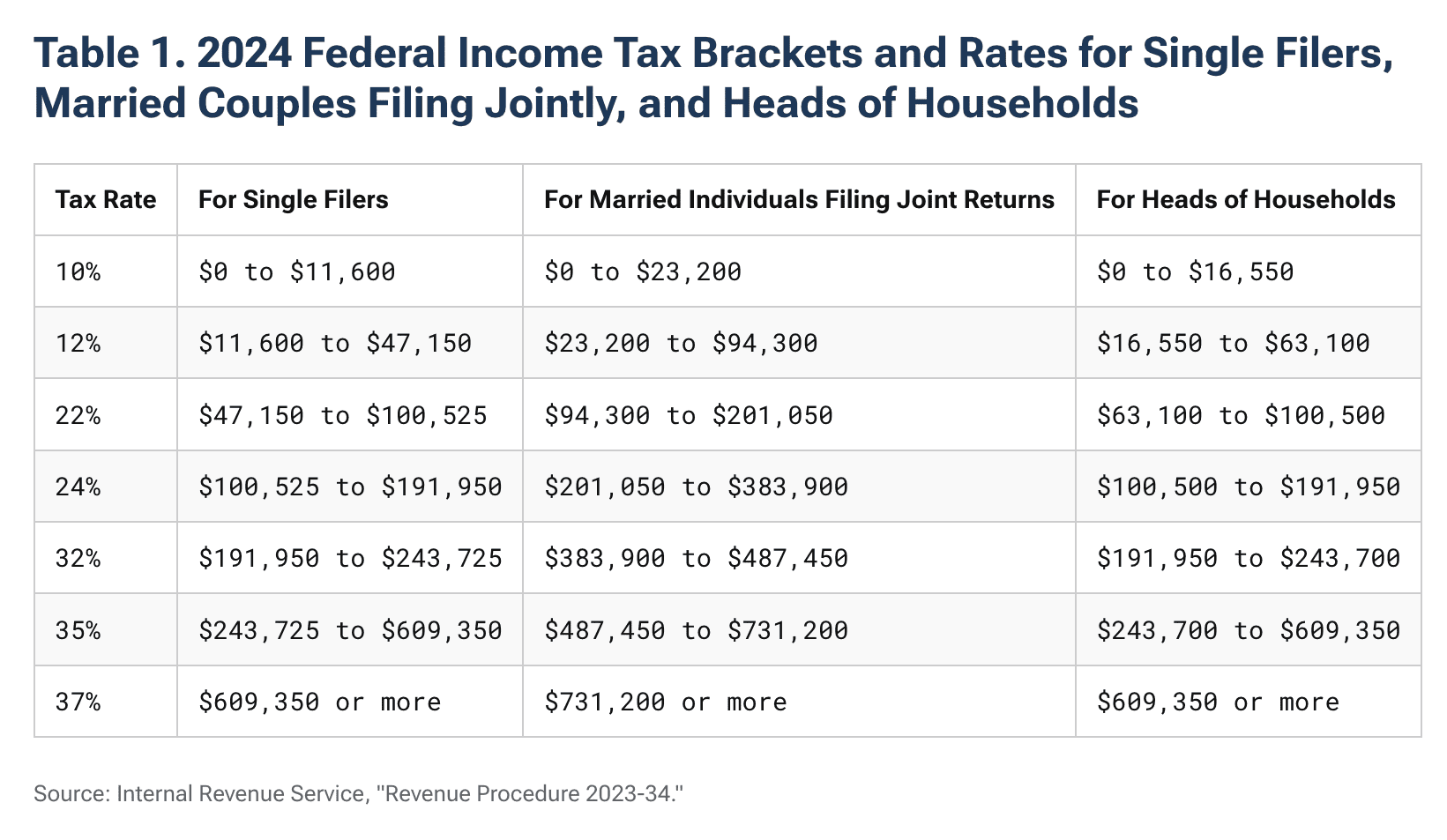

Let’s compare the 2017 (pre-TCJA) brackets with the 2023 and 2024 tax brackets. As you’re filing your taxes for the 2023 tax year, you’ll be using the 2023 tax brackets. The IRS released the 2024 tax brackets in November. Comparing the 2023 and 2024 tax brackets will give you an idea of the inflation adjustments that were made. But first, let’s revisit the 2017 tax brackets.

FIGURE 1 – 2017 Tax Brackets – Bankrate/IRS

Notice that the tax rates from 2017 are 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%. Those will be the tax rates again in 2026 if the TCJA sunsets as scheduled after 2025. Now, let’s see how those tax rates compare to the current tax rates.

FIGURE 2 – 2023 Tax Brackets – Tax Foundation/IRS

FIGURE 3 – 2024 Tax Brackets – Tax Foundation/IRS

While the lowest bracket is at a 10% tax rate for the 2023 and 2024 tax brackets and the 2017/2026 tax brackets, the other tax rates for the 2017/2026 brackets are higher. The current 12% tax rate will become 15% in 2026. And the current 22% tax rate will become 25%. The biggest jump is the 24% tax rate becoming the 28% tax rate.

Going back to higher tax rates won’t be quite as impactful for many higher-income earners. The current 32% tax rate will bump up to 33%, the 35% tax rate will remain 35%, and the 37% tax rate will become 39.6%.

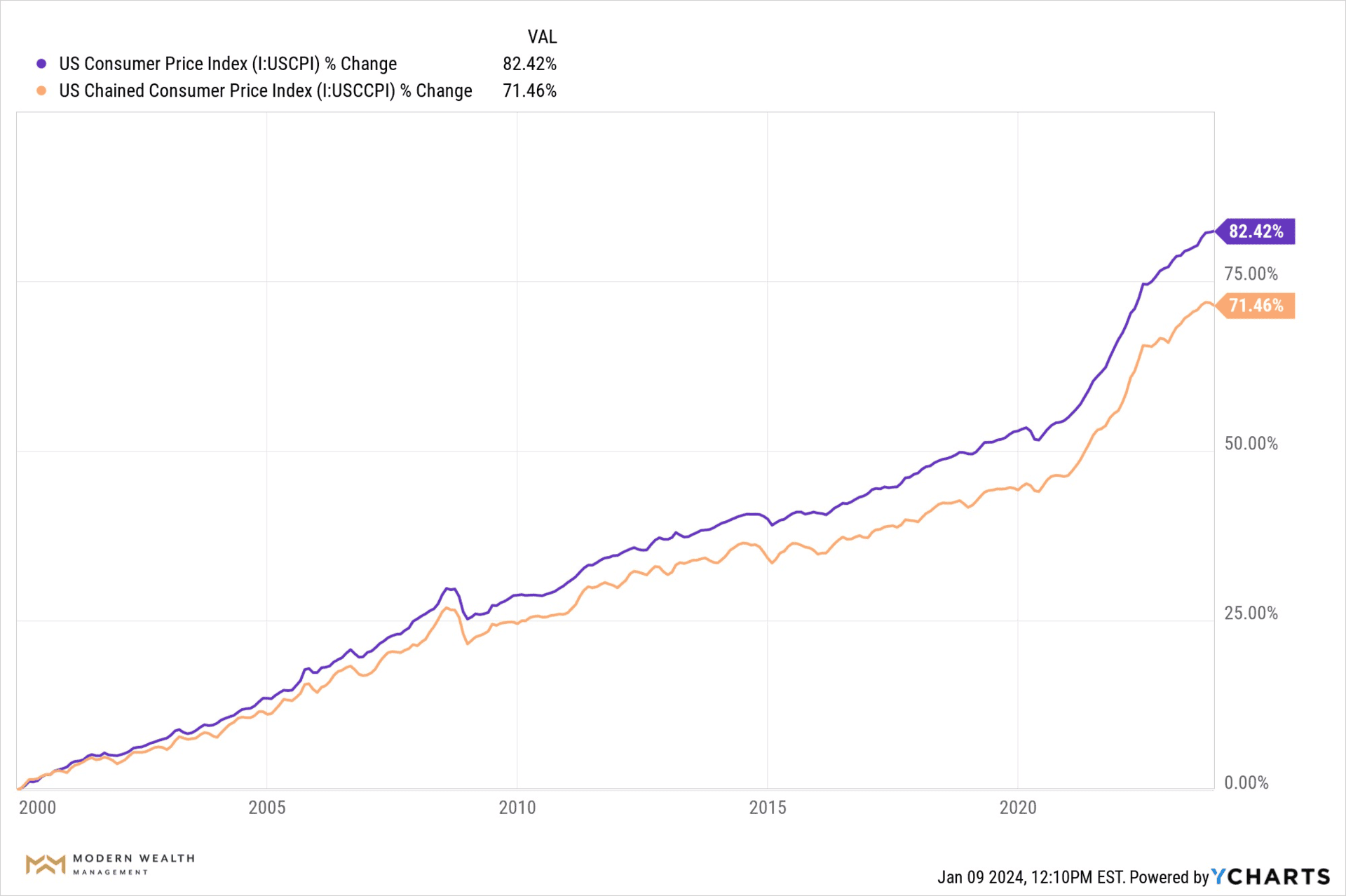

Differences Between CPI and Chained CPI

The TCJA also included a major change to how inflation will adjust the tax brackets year by year. In the 1980s, the tax brackets were made to adjust annually by the consumer price index (CPI), an index tracked by the Bureau of Labor Statistics that is designed to measure the change in prices of consumer goods and services.

The TCJA made it so the tax brackets will adjust by Chained CPI instead of CPI. The Bureau of Labor Statistics has a good video on their YouTube channel explaining the difference between traditional CPI and Chained CPI if you want to have a good understanding for how tethering the tax brackets to Chained CPI will impact you.

FIGURE 4 – CPI vs. Chained CPI — YCharts

An article from the Congressional Budget Office spoke to the impact by saying, “The chained CPI-U results in lower estimates of inflation than the traditional CPI does. CBO expects that annual inflation as measured by the chained CPI-U will be about 0.25 percentage points lower, on average, than annual inflation as measured by the traditional CPI.”

Translated to English – the tax brackets will not grow as “fast” in the future. Therefore, someone who was near to going into the next tax bracket and receiving regular increases to their income may wind up in the next higher tax bracket sooner. Of note, the tethering of the tax brackets to Chained CPI is a change that will not sunset after 2025.

Deductions and Exemptions

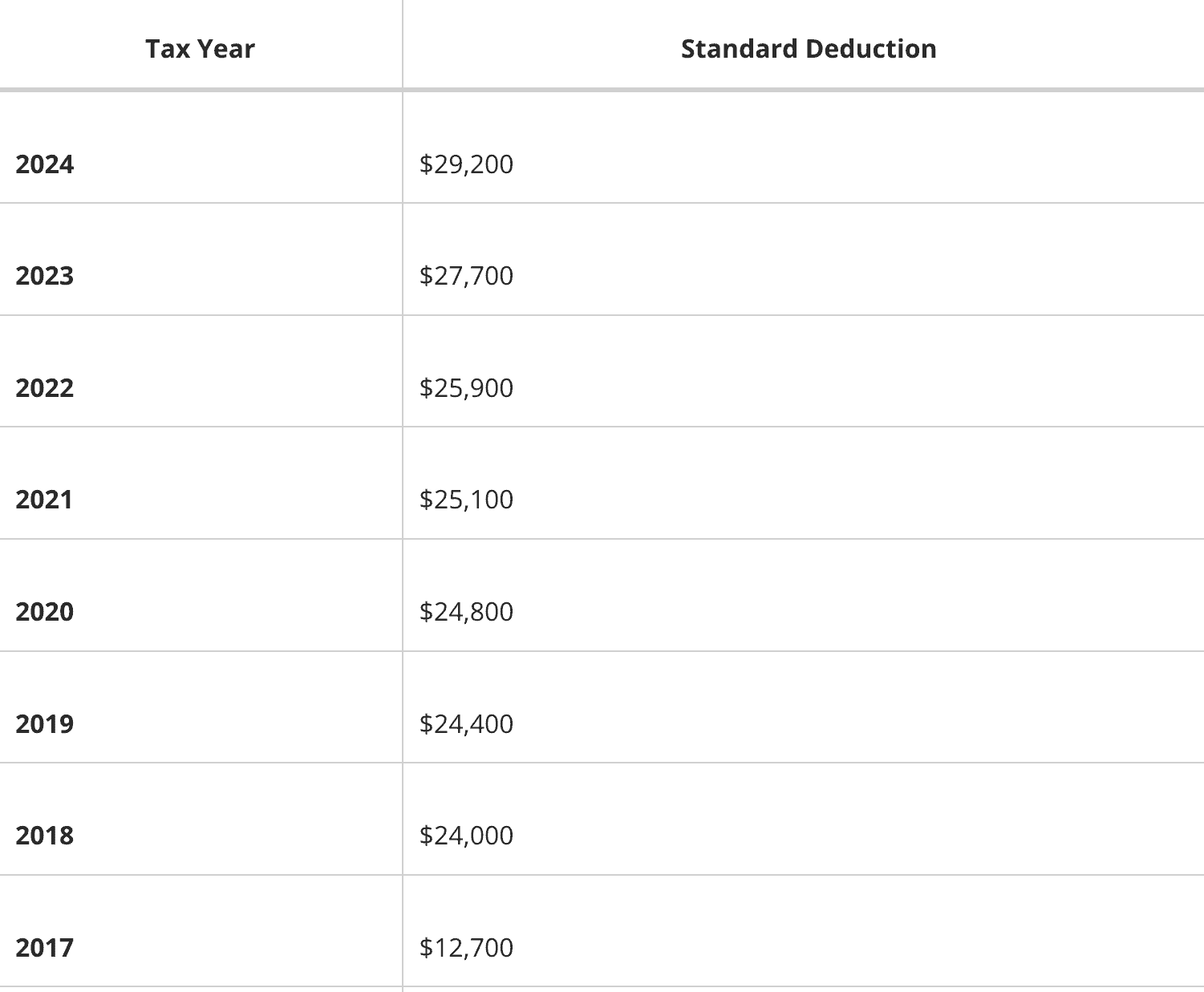

There was also a major change to deductions. Pre-TCJA, the standard deduction for a single tax filer was $6,350 ($12,700 for married filing jointly). The TCJA greatly increased the standard deduction. For the 2023 tax year, the deduction is $13,850 for a single tax filer and $27,700 for married filing jointly.

Inflation adjustments increased the standard deductions for the 2024 tax year to $14,600 for single filers and $29,200 for married filing jointly. So, if the TCJA does sunset, the standard deduction will be about half of what it is today come 2026.

FIGURE 5 – Standard Deductions – Tax Notes/IRS

For example, state and local taxes (SALT) capped at $10,000. For taxpayers in states with high tax rates, this change greatly reduced the income deduction they could claim on their tax return. The TCJA also reduced the amount of mortgage interest that could be deducted by only allowing the interest on the first $750,000 of mortgage debt to be deducted, reduced from a limit of $1 million prior to TCJA.

The TCJA also eliminated personal exemptions, which is a deduction taken by the taxpayer, his or her spouse, and their dependents. In 2017, the personal exemption amount was $4,050. Here are a few other key items to keep in mind if the TCJA sunsets as scheduled at the end of 2025. We can expect a reduction in the standard deduction, return of the Alternative Minimum Tax with the elimination of the SALT provisions, addition of miscellaneous itemized deductions subject to 2% of adjusted gross income, and the return of the personal exemptions.

Gift and Estate Tax

The TCJA effectively doubled the amount of the lifetime exemption of assets that passed on tax-free. That means the amount of lifetime gifts you can give while avoiding the gift tax is $12.92 million for the 2023 tax year and increases to $13.61 million for the 2024 tax year. Keep in mind that those totals are just for one donor, so you can effectively double them if you’re married.

We’ve been accustomed to the lifetime exemption going up each year. But if/when the TCJA sunsets after 2025, it will be reduced to about $6 million ($12 million for married couples). You can bet that families with assets that total several million or that are on track to leave behind significant wealth to their beneficiaries will use estate planning techniques that have been out of fashion in recent years. Such strategies include using certain types of irrevocable trusts to avoid estate tax.

Planning for These Potential Changes

These changes may have positive, negative, or mixed impacts on your personal financial plans. Fortunately, we have an idea of what changes are coming and can plan for them. It does, however, require some effort to run these projections in your personalized financial plan.

Our team of financial professionals at Modern Wealth includes CFP® Professionals that will build you a financial plan that’s based on your vision for retirement. They’ll work with you to help understand how you want your life to unfold.

But there’s so much more forward-looking planning that needs to be done besides outlining your needs, wants, and wishes. This article is meant to shed light on how critical it is to have a forward-looking tax plan that is geared to get to pay as little tax as possible over your lifetime.

Working with a Team of Professionals to Understand the Impact of Reverting to Old Tax Rates

That’s why we have CPAs in-house that work alongside our CFP® Professionals to review financial plans for potential tax planning opportunities. From Roth conversions to gifting strategies, our Tax Reduction Strategies guide includes examples of tax planning strategies that could result in substantial tax savings. Download your copy of our Tax Reduction Strategies guide below.

Tax Reduction Strategies Guide

We also have estate planning specialists on our team that work with our tax team and CFP® Professionals to help ensure that you’re understanding the various complexities with estate planning. Given the impact that the sunsetting of the TCJA has on future taxation and estate planning needs for our clients and prospective clients, these changes have our team’s full attention.

If you want to learn more about how the sunsetting of the TCJA could impact you and your family, start a conversation with our team below.

Taxes are a main source of financial stress for so many people, as they are only of the biggest wealth-eroding factors for retirees. Planning for events like the TCJA sunsetting can go a long way toward alleviating that financial stress. We’re ready to build you a financial plan that includes a forward-looking tax plan so that you have confidence that you’re doing the right things with your money as you approach and go through retirement.

Resources Mentioned in This Article

- Tax Rates Sunset in 2026 and Why That Matters

- 2024 Tax Brackets: IRS Makes Inflation Adjustments

- What Are Tax Brackets?

- 10 Ways to Fight Inflation in Retirement

- How to Build Generational Wealth

- Family Financial Planning with Matt Kasper

- Components of a Complete Financial Plan with Logan DeGraeve

- Why You Need a Financial Planning Team

- The CPA and CFP® Professional Relationship with Logan DeGraeve, CFP® and Corey Hulstein, CPA

- Roth Conversion Rules

- Tax Planning Strategies with Marty James

- Charitable Giving in Retirement

- Financial Stress: How Do You Deal with It?

- 7 Wealth Protection Tactics

Downloads

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.