What Is a Monte Carlo Simulation?

Key Points – What Is a Monte Carlo Simulation?

- What Is Your Probability of Success for Retirement and How Is It Determined?

- There Random Variables that Factor into Your Probability of Success

- Using Monte Carlo Simulations Before and After Retirement

- 5 Minutes to Read

Doing a Monte Carlo Simulation on Your Financial Plan

When I say “Monte Carlo,” what’s the first thing that comes to your mind? Did you have (or still have) a Chevrolet Monte Carlo that means a lot to you? Have you been to the beautiful Monte-Carlo resort of Monaco? Or maybe the movie, Monte Carlo, happens to be one of your favorite flicks.

If I polled members of our Modern Wealth Management team, I think those Monte Carlos might interest some of them. However, most of them likely have different answer to that first question. Our financial advisors regularly use something called a Monte Carlo simulation when creating or reviewing a financial plan.

Getting You to and Through Retirement

When we’re building a financial plan, the whole idea is to not only get you to retirement, but through retirement. That’s what our Guided Retirement System is all about. We’re focused on helping you accomplish your personal retirement goals. To do that, we need to know what your goals are, and how you think and feel about money to set up a spending plan for your retirement.

Keep in mind that your spending is going to be much different between your working years and in retirement. It will change throughout retirement as well, just as your goals will continue to change. That’s one of the reasons why we have review meetings with our clients to make sure their plan is current.

Knowing how you think and feel about money will allow us to determine how much risk you’re comfortable with taking. This is where the Monte Carlo simulations come into play, as they help determine how much you should be spending.

Defining a Monte Carlo Simulation

Before we outline how Monte Carlo simulations are specifically used in the financial planning world, let’s define them at a high level. A Monte Carlo simulation models the probability of different results in a way that can’t simply be projected because of the intervening of random variables.

Now, let’s define that to put it in terms of your retirement. For retirement planning, Monte Carlo simulations run thousands of different iterations and situations against your retirement plan to show you that probability of success. We’ll dig into some of those many variables/situations here in a second. But first, let’s focus what we mean by “probability of success of your retirement.”

What’s Your Ideal Probability of Success?

If your probability of success is X%, what exactly does that mean? That means that from a historical perspective, you can do everything you want to do X% of the time, and never need to adjust your spending. As Drew Jones recently explained during our Modern Wealth Management Educational Series webinar, Retiring During a Recession, your ideal probability of success is between 75% and 90%.

You might be wondering why wouldn’t you want your probability of success to be 100%. Well, that means that you’re either A, saving more than you need to; B, not spending as much as you could; or C, taking on more risk than necessary. If your probability of success is 100% or anything that’s starting to get into the mid to upper 90s, you’re assuming that the markets will be in bad shape for several years.

While the markets obviously haven’t looked great this year and the outlook isn’t the best right now for 2023, it’s highly unlikely that this market downturn will continue for several years. Remember, markets are cyclical. This financial uncertainty that we’re going through right now is uncomfortable, but not uncommon.

Let’s Do a Quick Monte Carlo Simulation

Considering that people planning to retire in the coming weeks or months could be retiring during a recession, let’s go back to one of the examples that Drew used during the educational series event. Here are some important details for the sample couple that he used in this Monte Carlo simulation:

- 60-year-old wife and 63-year-old husband

- Most of the $1.2 million they’ve saved is in their 401(k)s

- Their goal is to spend $5,000 a month in retirement and they haven’t done any Roth conversions yet

- An initial 60/40 asset allocation (60% stocks/40% bonds)

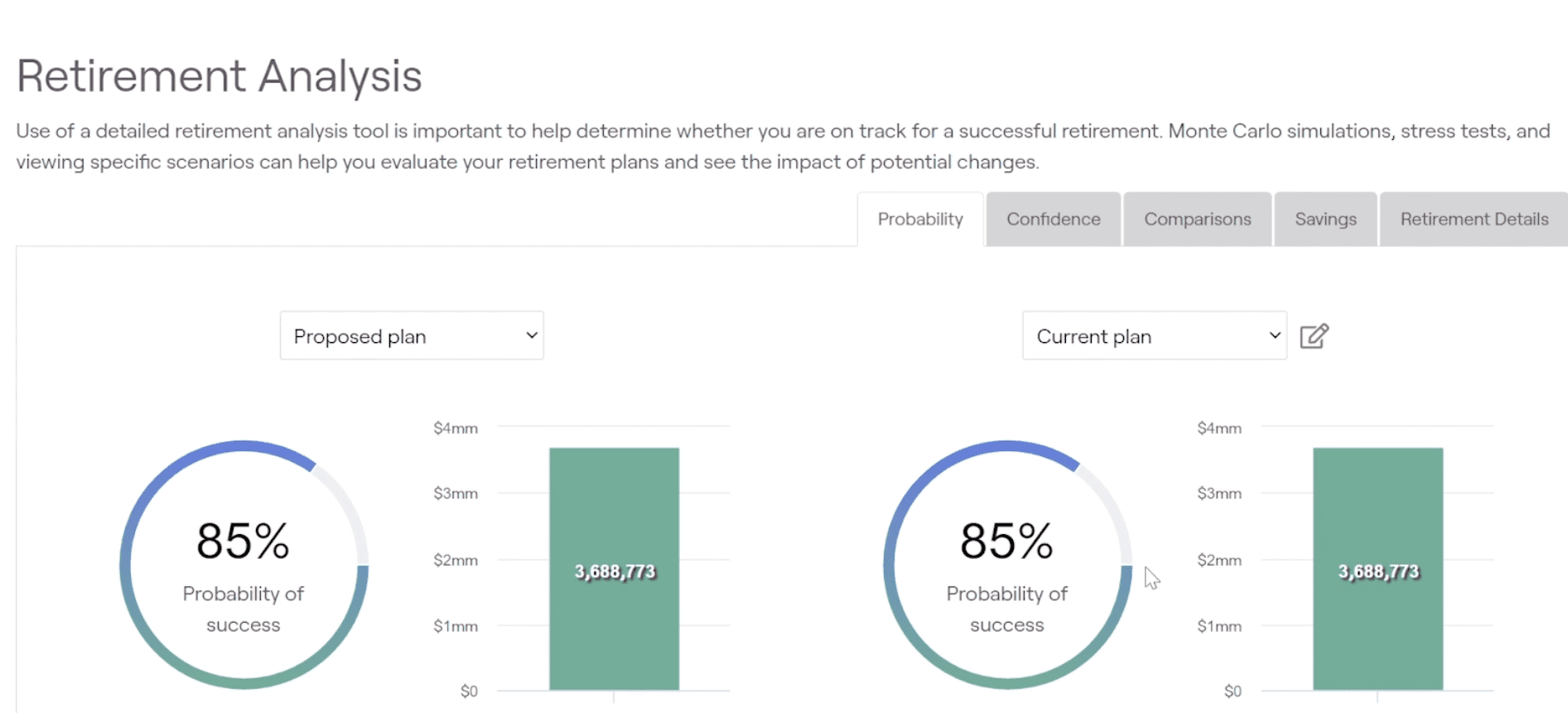

Given the information above, their probability of success with this Monte Carlo simulation would be 85%, as shown below.

FIGURE 1 – Probability of Success

Again, this means that 85% of the time, you can accomplish your retirement goals without having to adjust your spending. But what about that other 15%? Well, don’t fret. Even if that 15% comes into play, it means you might need to briefly adjust your spending at some level. You might need to consider some trade-offs in that scenario.

It All Goes Back to the Plan

This is another reason why we want to review your plan at least once, if not twice a year. Without a financial plan in place that goes through these Monte Carlo simulations and is stress tested through various economic conditions, you’re just doing guess work. Guess work and your retirement isn’t an ideal combination. The key to living your one best financial life is by building a financial plan that gives you clarity, confidence, and control leading up to and through your retirement.

Bringing the Other Monte Carlos Back into the Picture

As we bring this article full circle, we have a fun Monte Carlo fact to share. Do you know why a Monte Carlo simulation is called a Monte Carlo simulation? Well, it has to do with the Casino de Monte Carlo that’s in the Monaco resort that we mentioned in the opening paragraph.

There can be many random variables that can suddenly change how you go about life in retirement. On the bright side, you could become a grandparent and want to help pay for your grandchildren to go to college. Or maybe you want to go on a dream trip to a place like Monaco and make a big purchase (like a Monte Carlo at a car show).

And on the flip side, there are things like a long-term care stay or an early death of a spouse that can completely change the direction of your retirement. You’re factoring in different variables like that and many more to determine your probability of success. Games like roulette, dice games, and slot machines that you can find at the Casino de Monte Carlo also have quite a few random factors—all which go into determining your probability of success in each game.

We Can Help You with Determining Your Probability of Success

We hope that this article has given you a better perspective on what a Monte Carlo simulation is and how it can relate to your retirement. Once again, you can try some Monte Carlo simulations out for yourself with our industry-leading financial planning tool. Just click the “Start Planning” button below to begin building your plan and see what your probability of success for retirement will be, whether that’s in the next couple of years or 10 to 15 years down the road.

As you’re using our financial planning tool, please keep in mind that it’s intended to be used by professionals. That being said, we are here to lend a hand if you have any questions that come up while getting started. Our team of CFP® Professionals is ready to help answer whatever questions you may have about building your retirement plan. To schedule a 20-minute “ask anything” session or complimentary with one of our CFP® Professionals, click here. They will then screen share with you while using our tool to answer your questions. It’s our No. 1 goal to enhance your probability of success in retirement.

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.