What Is Tax Diversification?

Key Points – What Is Tax Diversification?

- The Three Tax Buckets

- Considerations for How to Create Tax Diversification

- Thinking About Your Current and Future Tax Rate

- Tax Diversification as You Approach Retirement

- 11-Minute Read | 20-Minute Watch

Should You Put All Your Eggs in One Basket?

To set the stage for defining tax diversification and why it’s important, let’s do a quick refresher on investment diversification. Have you heard the investment diversification analogy about not putting all your eggs in one basket? Our Director of Investments Stephen Tuckwood, CFA, talks all the time about how having a diversified asset allocation is one of the key components of proper portfolio construction. Your tolerance for risk and your goals are going to be two primary factors for what your diversified portfolio looks like.

Diversification shouldn’t just be limited to investing in small, mid, and large-cap companies, different sectors of the market, or determining how heavily you should tilt your portfolio toward equities or fixed income. Taxation needs to be considered as well—hence why we’re having Martin James, CPA, PFS and Dean Barber help explain tax diversification in this article.

Schedule a MeetingSubscribe to the Modern Wealth Management YouTube Channel

The Three Tax Buckets

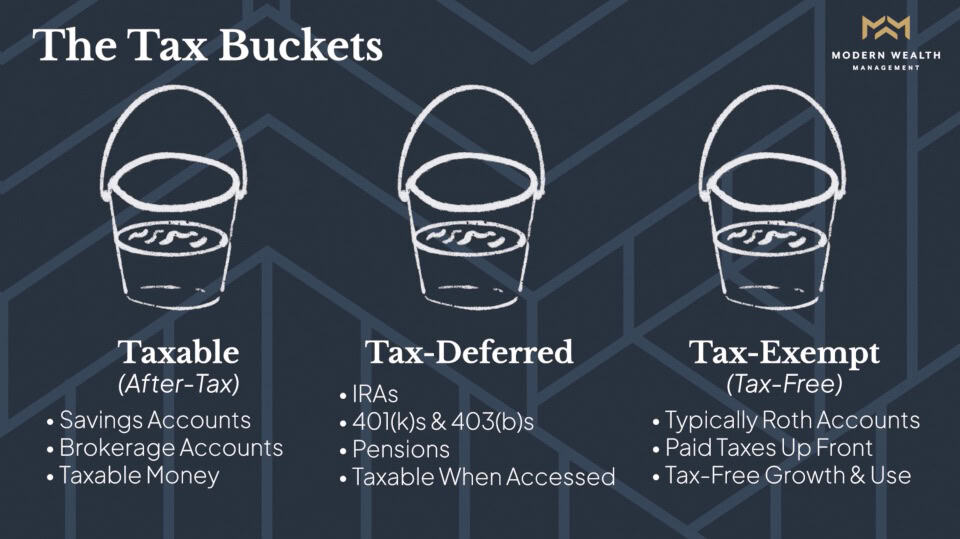

There are three different buckets that we look at for tax diversification. Those buckets are non-qualified (taxable) money, tax-deferred, and tax-exempt (tax-free).

FIGURE 1 – The Three Tax Buckets

Tax-Deferred

Let’s give a quick overview of each tax bucket, starting with the tax-deferred bucket. Many people tend to have most of their retirement savings in this bucket. It’s great that those people have prioritized saving for retirement by saving to a 401(k), 403(b), pension, or IRAs, but here’s the kicker. If you have $X amount of money saved in those accounts, it’s critical to remember that all that money isn’t technically yours. That’s because that money won’t be taxed until you access it.

“That account is infested with taxes that are going to come due at some point in the future.” – Dean Barber

Tax-Deferred and Tax Deductible Don’t Mean the Same Thing

One thing that Marty has witnessed people get confused by is the term tax-deductible. Let’s say that Marty fills out his tax return and makes a tax-deductible charitable contribution. That’s a tax deduction because that is never going to come back and bite him.

But what if Marty put money into a tax-deferred 401(k) on a pre-tax basis or an IRA? That’s a different story.

“That’s tax-deferred and eventually it’s going to come back and bite me somehow because I’m going to have to pay taxes on it or somebody is going to have to pay taxes on it.” – Martin James, CPA

Tax-Exempt (Tax-Free)

Let’s shift gears now to Martin’s favorite bucket: tax-free. This is your Roth money. You’ve delayed the benefit of that and paid taxes on the front end. But once you access that money, it’s all tax-free.

“If you could be all tax-free, that’d just be wonderful. But that’s not always the easiest thing to accomplish.” – Martin James, CPA, PFS

Non-Qualified (Taxable)

Your non-qualified money is money that has already been taxed. This includes savings accounts, brokerage accounts, and taxable money. Martin has witnessed some put a substantial amount of money into an index mutual fund, thinking they’re going to use it early in retirement. However, they oftentimes haven’t managed the unrealized gains. There are strategies, such as direct indexing, to mitigate that problem.

“Let’s say that they reinvest their dividends and capital gains and put $100,000 in. Over time, it’s worth $150,000 as far as cost basis, but the account is now at $300,000. They need to unwind that in retirement. Actively managing that cost basis, whether you’re harvesting losses or gains along the way depending on your tax bracket, can help that a lot.” – Martin James, CPA, PFS

Creating Tax Diversification

When creating tax diversification, the goal is to have an even spread between those three buckets. That’s going to create a lot of flexibility when it comes to tax planning and distribution planning.

“When we look at the taxable, tax-deferred, and tax-free, that’s a high-level type thing. The devil is in the details when we really look in each one of these accounts.” – Martin James, CPA, PFS

Don’t Let the Government Dictate Your Retirement

Let’s say that someone puts $10,000 into their 401(k) and they’re in the 22% tax bracket. Their actual take-home income won’t be reduced by $10,000. It’ll only be reduced by $7,800 because they’re in the 22% bracket. It’s going in on a pre-tax basis. Even though that $10,000 was deductible in that year, it’s just tax-deferred because when that money comes out, you’re going to pay taxes on it at whatever rate you’re at.

“When you’re putting the money in on that tax-deferred basis, you’re inviting the government into your retirement plan, and they make the rules.” – Martin James, CPA, PFS

Defusing the Retirement Savings Timebomb

Dean and Martin remember back in the late 1970s and early 1980s when the 401(k) was introduced.1 Back then, many people were focused on getting as much money into their 401(k) as possible because they figured that would put them in a lower tax bracket in retirement.

A lot of people still have that mindset today with going all in on the tax-deferred bucket to pay the least amount of tax today. But will that approach result in paying the least amount of tax over a lifetime? Martin and Dean have seen time and time again that that’s typically not the case.

The light bulb came on for Dean when he and Martin started studying with Ed Slott, CPA, 20 years ago. Ed has written a few books about how the tax-deferred bucket can become a retirement savings time bomb.

“To defuse that time bomb, that’s where the tax diversification comes in. A lot of people pile most of their wealth into their 401(k), 403(b), and IRAs, and paint themselves into the proverbial tax corner. This is why we want to talk about tax diversification. Don’t put your money into something until you know what the rules are when it comes to getting the money out.” – Dean Barber

Were You Auto Enrolled in Your 401(k)?

One factor that Dean says is contributing to more people having most of their money in the tax-deferred bucket is 401(k) auto enrollment. When someone gets auto enrolled into their company’s 401(k) plan, they get enrolled into the traditional side of the 401(k) rather than the Roth.

The decision of whether to contribute to Roth or traditional is going to depend throughout your career, but Dean and Marty want people who are in the early stages of their career to be aware of the opportunity they have to get more money into the tax-free bucket while they’re in a lower tax bracket.

“If you’re going to be in a profession where you’re going to continue to grow that income over time, get that money into that Roth IRA when you’re in a low tax bracket. Conversely, when you’re in your late 50s and in your peak earning years, maybe you want to take a deduction and get the money into the traditional and then think about a conversion strategy after you retire and no longer have any income so you get to the Roth at a lower tax bracket.” – Dean Barber

Creating Tax Diversification via Roth Conversions

Do you have most (or all) of your retirement savings in the tax-deferred bucket? Let’s dive a little bit deeper into the Roth conversion strategy that Dean just alluded to and illustrate how it can help create tax diversification. With a Roth conversion, you’re converting funds from a traditional IRA to a Roth IRA. While you must pay tax on the conversion, the Roth IRA earnings and withdrawals can be tax-free and penalty-free if you follow certain IRS rules.

However, it’s not as simple as converting all of a traditional IRA to a Roth IRA. It’s important to consider your current AND future tax bracket when determining whether to do a Roth conversion. Consider doing methodical Roth conversions over time as you attempt to max out your tax bracket.

“We do a long-term tax projection looking out several years, realizing it’s not going to be 100% correct. But at least we get a good picture of what their Social Security claiming strategy, cost-of-living increases, and Required Minimum Distributions (RMDs) might look like. Once we get that picture, here’s how we want to attack this.” – Martin James, CPA, PFS

Reasons NOT to Convert to a Roth IRA

Roth conversions aren’t for everyone, though. There are unintended consequences of Roth conversions as well, such as potentially being pushed into a higher Medicare IRMAA bracket. Also, if you’re charitably inclined and 70½ or older, you may want to consider leaving enough money in the tax-deferred bucket to make Qualified Charitable Distributions, which involve donating to a qualified charity directly from an IRA. Up to $105,000 can be donated to charity each year through QCDs.

“In a lot of cases where people are charitably inclined, you never want to convert all that IRA money because you want to use that IRA money to go directly to charity without it ever hitting your tax return. That’s ultimately the most efficient.” – Dean Barber

To learn more about what to consider prior to doing Roth conversions, download our Roth Conversion Case Studies and Tax Reduction Strategies white papers.

Will Tax Rates Be Going Up in 2026?

We encourage you to keep tax diversification top of mind, especially leading up to 2026. As it currently stands, the tax rates within the Tax Cuts and Jobs Act are scheduled to sunset after December 31, 2025.2 If Congress does nothing between now and 2026, tax rates will revert to the rates from 2017, which are higher than today’s rates. That would potentially set the stage for taxpayers to accelerate through the tax brackets faster at higher rates.

“2025 is going to be a pivotal moment for people once we know what’s going on. Hopefully we’ll have some time to make the adjustments, but Congress tends to do things in late December. We’re kind of planning on that sunset right now, but we’re trying to do it in such a way that maybe we don’t have to pay the taxes at such a high rate today if we can get it accomplished over time.” – Martin James, CPA, PFS

Considering Municipal Bonds

Along with keeping a close eye on what will happen with tax rates going forward, we’ve been monitoring interest rates very closely. Dean shares that for the first time in a long time, the tax-free municipal bond market is worth considering again.

“Interest rates have done us a favor and allowed us to look at the tax-free bond market in a very different way than we’ve looked at it for almost two decades. You can make money now in tax-free bonds and it’s super attractive. That’s another way that you can position those taxable assets in a very tax-efficient way.” – Dean Barber

The interest on municipal bonds is taxable, but there is an opportunity for long-term capital gains considering where interest rates are today if they continue to fall. Long-term capital gains are taxed much more favorably than ordinary income.

The Role of an HSA from a Tax Diversification Perspective

One type of account that wasn’t included in Figure 1 that we still want to discuss are Health Savings Accounts and how they fit into the tax diversification picture. With HSAs, you can get a true tax deduction when the money goes in and then the money comes out tax-free when it’s used for qualified medical expenses.

Many people utilize their HSAs by putting their money in and paying off current medical expenses. However, there are some tax advantages of HSAs that you may want to consider as well. Rather than taking distributions from your HSA, think about investing it just like you would with other retirement accounts and keep a record of all your out-of-pocket medical expenses. You can reimburse yourself several years later from your HSA for all the expenses you incurred. Again, those reimbursements will come out tax-free.

ACA Tax Credits

Speaking of medical expenses, Martin and Dean have met with many people who haven’t felt comfortable about retiring until they’re eligible for Medicare. If having employer-sponsored health insurance is the only thing keeping you from retirement, don’t forget about the Affordable Care Act tax credits, which are based on your income.

The Marketplace can be expensive with high deductibles and such, but many people aren’t aware of the ACA tax credits. The lower your income, the more ACA tax credits you’re eligible for.

“Instead of paying $20,000 for a couple, it’s possible that they’re paying like $900, $600, or even $300 for the premiums because of these tax credits.” – Martin James, CPA, PFS

In-Plan Roth Conversions

If most of your money is in pre-tax account as you’re heading into retirement, keep in mind that you’ll be increasing your income and your Medicare premiums and disqualify yourself from getting the ACA credits. This is where in-plan Roth conversions could be a potential strategy to consider.

“The idea is before you retire and before you’re on the ACA plans, you can consider doing a large conversion if you haven’t already started planning for it by funding Roth deferrals. You’re creating this pool of money that for those next few years to bridge to Medicare that you’ll spend down. Sometimes, it makes sense to cross over to that higher tax bracket because that premium cost is so high. You could still be saving money tax wise.” – Martin James, CPA, PFS

Don’t Forget About the Taxable Bucket

It can be easy for people to focus primarily on the pros and cons of the tax-deferred and tax-free buckets. To have true tax diversification, it’s critical to also have money in taxable accounts. If you have money in the taxable bucket in the early years of retirement, you can live on that money and begin doing Roth conversions to fund the rest of your retirement in a tax-efficient manner. Let’s review a quick example of that.

For this example, let’s say that you’re over 59½ and want to do a $100,000 Roth conversion. If you decide to withhold taxes on it, you will get $75,000 into the Roth bucket. But what if you had $100,000 in a taxable account?

If you pay $25,000 in taxes from the conversion with that taxable money and put $25,000 more from your taxable account into the Roth, you can get the full $100,000 in the Roth and accomplish a couple of other things. One, you would have more tax-free growth going on in the Roth bucket. And two, you would reduce the amount of taxable income that that taxable account is producing.

“Over time, if you can make a Roth contribution or do a backdoor Roth IRA, you should shift money from that taxable account into that strategy and ultimately get it to where it’s in a very protected tax and asset protection state.” – Martin James, CPA, PFS

Do You Have Questions About Creating Tax Diversification?

As Dean and Martin have pointed out, there is a lot to think about as you try to create tax diversification. Remember that you have more control over your taxes in retirement than you do at any other time of your life.

“If you create good tax diversification, you have money in taxable, tax-deferred, and tax-free accounts. It’s how and when you spend money out of these different accounts and how you pair them together that really will dictate the amount of taxes you’ll pay on a year over year basis.” – Dean Barber

Working with a Team of Professionals to Create Tax Diversification

When you’re planning to get to and through retirement, understand that taxes are going to be one of the largest wealth-eroding factors in retirement. The goal is to pay less taxes over your lifetime rather than on a year-to-year basis, and tax diversification can help with that.

As you’re determining how to create tax diversification based on your unique situation, make sure you’re working with a team of professionals that includes a CFP® Professional and CPA that collaborate on your behalf. What tax bucket should you be funding and how much should you have in each bucket? Start a conversation with our team today to begin addressing those key questions.

Resources Mentioned in This Article

Other Modern Wealth Management Educational Series Videos

- 2024 Year-End Tax Planning

- Maximizing Social Security Benefits

- Roth Conversion Decisions for 2024

- Roth Conversions Before and After Retirement

America’s Wealth Management Show Episodes

- Understanding Retirement Asset Allocation

- What Is Market Risk?

- Short-Term, Mid-Term, and Long-Term Financial Goals

- 2025 401(k) and IRA Contribution Limits

- Taxes on Retirement Income

- How Does a Roth IRA Grow?

- 7 Benefits of a Roth IRA

- How Do Capital Gains Taxes Work?

- 2025 Tax Brackets: IRS Makes Inflation Adjustments

- Charitable Giving in Retirement

- Taxes on Roth IRAs

- 5 Reasons NOT to Convert to a Roth IRA

- Mega Backdoor Roth Before Retirement

- 6 Wealth Destroying Factors

- 5 New Important Things to Plan for from Ed Slott, CPA

- The Retirement Savings Time Bomb Ticks LOUDER with Ed Slott, CPA

- 5 Long-Term Strategies for a Better Retirement

- How Do I Pay Less Taxes?

- Taxation on My Investments

- Examining Municipal Bonds in 2024

- RMD Strategies for Before and After Retirement

- What Is a QCD? Qualified Charitable Distribution

- Health Care Costs During Retirement

- How to Maximize In-Plan Roth Conversions in 401(k) Plans

The Guided Retirement Show Episodes

- Strategic Investing Through Retirement with Stephen Tuckwood, CFA

- Proper Portfolio Construction with Stephen Tuckwood, CFA

- How Does a 401(k) Work with Michelle Cannan, CPFA™, QKA®, QKC

- Tax Planning Tips with Corey Hulstein, CPA and Martin James, CPA, PFS

- The CFP® Professional and CPA Relationship with Logan DeGraeve, CFP®, AIF® and Corey Hulstein, CPA

- Why You Need a Financial Planning Team with Jason Gordo

- Revisiting Roth vs. Traditional with Bud Kasper, CFP®, AIF® and Corey Hulstein, CPA

- Affordable Care Act Subsidies — How to Qualify for Them with Martin James, CPA, PFS

- Tax Advantages of HSAs with Martin James, CPA, PFS

- Tax-Efficient Investing with Stephen Tuckwood, CFA

Additional Blog Posts

- How to Calculate Your Pension in 3 Steps

- Understanding Cost Basis

- 5 Tax Planning Examples

- What Is IRMAA? Medicare Income-Related Monthly Adjustment Amount

- Social Security Administration Announces 2.5% COLA Increase for 2025

- Tax Rates Sunset in 2026 and Why That Matters

- What If We Go Back to Old Tax Rates?

- Is Medicare Free?

Downloads

Other Sources

[1] https://www.investopedia.com/ask/answers/100314/why-were-401k-plans-created.asp

[2] https://taxfoundation.org/blog/tcja-expiring-means-for-you/

Investment advisory services offered through Modern Wealth Management, Inc., a Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management a Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.